The information technology sector has been rallying in last one year, it has seen steep upward movement which helped to erase some of the weakness / slowdown seen in 2016-17.

The S&P BSE IT index has gained 28.25% so far this year and 58.45% in last one year. This recovery has helped erase some of the pronounced weakness it saw earlier.

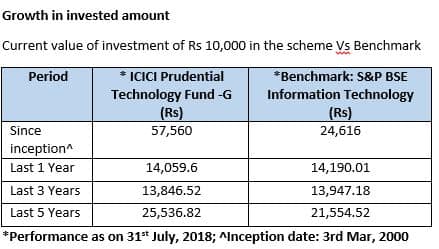

ICICI Prudential Technology Fund is one of the thematic fund which seems well-poised to gain from recovery in the sector. This scheme was launched on March, 3, 2000. The AUM of the scheme as on July 31, 2018 is Rs 422.29 crores.

The investment objective of the scheme is to invest in equity and equity-related securities in the information technology sector. The scheme is best fit for investors searching for good investment avenues in technology sector for a longer investment horizon.

The general thought process about the fund is that if there is an overvaluation of the broader market, this sector will be able to generate good value buys.

Fund Manager

Ashwin Jain is managing this fund since October 2016 and Sankaran Naren since July 2017. Together they even manage ICICI Prudential Exports and Services Fund and ICICI Prudential Growth Fund - Series 3.

Ashwin Jain and Sankaran Naren have over 9 years and 26 years of experience respectively in equity research and fund management.

Portfolio composition

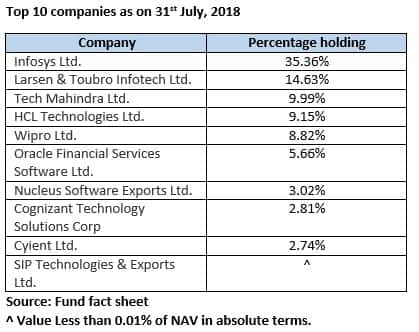

Majority share of the assets are invested in software, technology and related stocks in the portfolio. The fund also carefully invests in companies outside the ones listed on the S&P BSE Information Technology Index (benchmark) when it senses an opportunity of growth and stocks available at attractive valuations.

The fund is allocating 93.75% of the total corpus to largecap, 2.97% to midcap and 3.28% to smallcap as on 31st July, 2018.

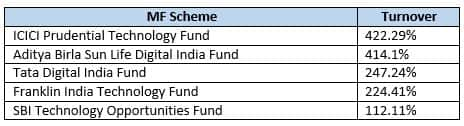

High portfolio turnover ratio compare to peers

A higher portfolio turnover ratio suggests fund manager did quite a bit of buying and selling of stocks in the portfolio compare to peers in last one year.

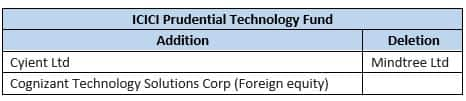

New entrants and exits from the portfolio Details on the stocks entered and exited during Feb 1, 2018 to July 31, 2018.

Caution: Investing in information technology thematic funds could turn bad decision

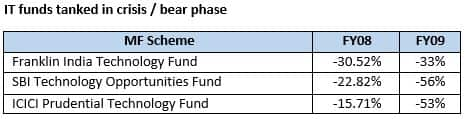

During bull phase, thematic funds will perform well and gives strong returns. However, when markets enter into bear phase and things turn bad, these funds register heavy losses. For instance, during sub-prime crisis i.e. FY08 and FY09 thematic funds in technology sector suffered heavy losses.

Should you invest now?

Vijay Kuppa, CBO and COO, Orowealth said, “The information technology sector is projected to have a strong growth over the next couple of years. There is sharp spike in the digital usage coupled with new technological advancements such as Blockchain and AI which are expected to propel the IT sector. The allocation of Rs 3,073 crore for Digital India Program and INR 10,000 Cr for new telecom infrastructure is expected to create huge opportunities in the sector. In addition to this, increasing exposure of DIIs is critical for the growth of the industry.”

The rupee has fallen more than 12 percent year-to-date and it hit a record low of 72.45 against USD (on 10th Sep, 2018). Analysts on Dalal Street believes IT sector will benefit from a weaker currency so it’s good time to invest.

Expert takeaway

Kuppa said, “The broad indices are reaching its all-time high and creating new records. So, market capitalisation is now stretched in terms of valuation and thus the fund managers are now inclined towards buying IT sector stocks in the dip.”

He added, “The above factors makes this scheme an ideal investment for investors with a moderate to high risk profile. However, the investment horizon needs to be long-term in order to enjoy full benefits of the scheme. There are some good value buys by the fund managers of this scheme.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.