The recent signs of slowdown in major global economies has fund managers worried and quite a few of them think that the world is staring at recession.

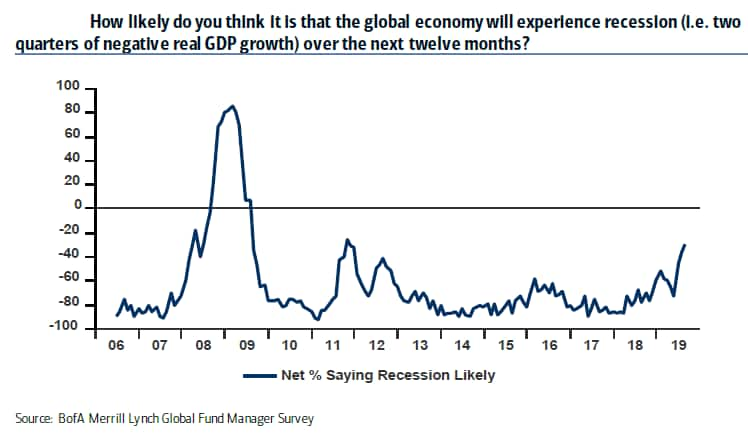

A recent survey of global fund managers by Bank of America Merrill Lynch (BofAML) reveals that a one-third of the fund managers expect a recession in the next 12 months.

Among the 224 panelists, with $553 billion of assets under management, who participated in the survey from August 2-8, a significant "34 percent think a recession is likely in the next 12 months against 64 percent who think it’s unlikely, the highest recession probability since October 2011", an August 13 note from BofAML says.

As per the report, 5 percent of them expect value to underperform growth over the next 12 months, which is the lowest since the global financial crisis, reflecting extremely bearish inflation and growth expectations.

While the picture looks gloomy, with global policy stimuli at a 2.5-year low, the onus is on major central banks, including US’ Federal Reserve, European Central Bank and People’s Bank of China, to restore animal spirits.

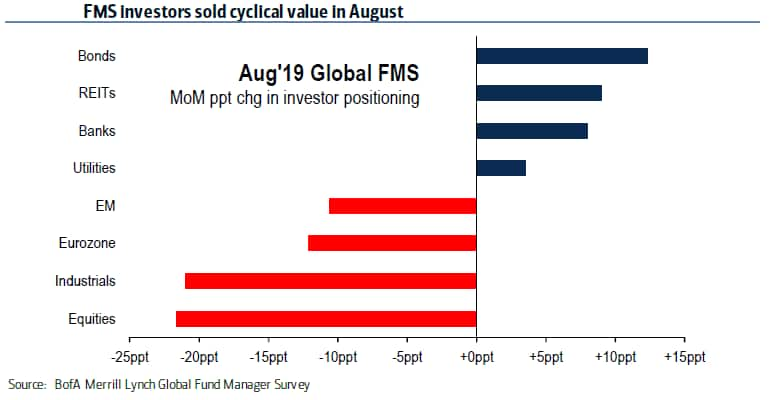

"A 43 percent FMS (fund manager survey) investors expect lower short-term rates and only 9 percent expect higher long-term rates over the next 12 months. Cumulatively, this is the most bullish FMS view on bonds since November 2008," the report says.

The shaken faith in equities has forced investors to slash exposure to cyclicals to buy US treasuries and US growth stocks, the survey reveals.

Concerns over the credit cycle have heightened, the survey shows.

"A record 50 percent of FMS investors say corporates are overleveraged, with 46 percent saying they want corporates to use cash flow to improve balance sheets, against the 36 percent who want an increase in capex and 13 percent who seek cash-return to shareholders via dividends or buybacks," it says.

Global corporate earnings expectations have slumped. As per the report, 84 percent of FMS investors expect less than 10 percent earnings per share (EPS) growth over the next 12 months. Consensus global EPS estimates are 8 percent for the next 12 months and 10.5 percent for 2020.

As per the survey note, a 33 percent investors think corporate bonds are the biggest central bank-induced bubble risk, followed by government bonds (30 percent), US equities (26 percent) and gold (8 percent).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!