In July, you will have to file your income tax returns to avoid a penalty. Also, you will need to know the implications of not linking your PAN with your Aadhaar before June 30. Then, if you are their customer, you will need to be aware of the impact of the HDFC Bank and HDFC amalgamation on depositors and borrowers.

Let’s look at each of these in a little more detail.

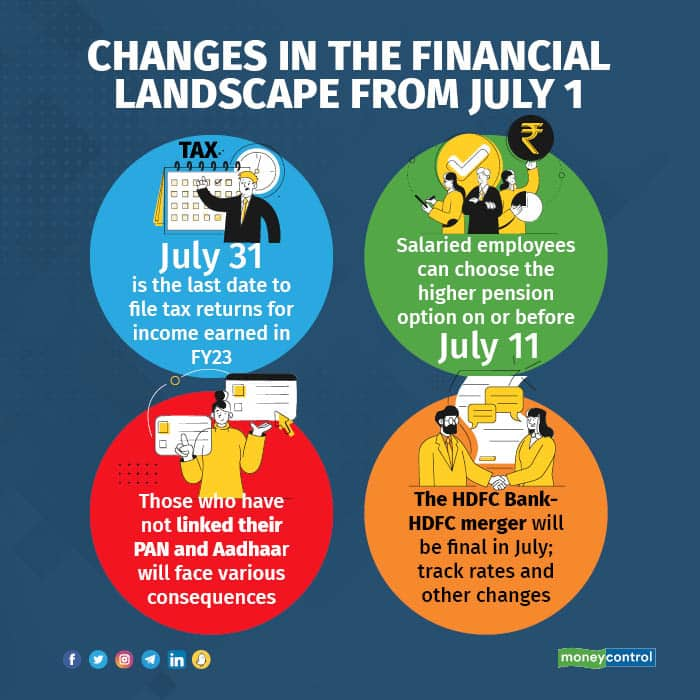

File your tax returns nowThe due date for filing income tax returns for financial year 2022-23 (assessment year 2023-24) is July 31. Get started with the exercise right away instead of waiting until the last minute.

If you miss the due date but complete the process by December 31, you will have to shell out a penalty of Rs 5,000. However, if your income is less than Rs 5 lakh, the late filing fee will be restricted to Rs 1,000.

Also read | ITR filing: Annual Information Statement gets bigger, but crucial omissions give taxpayers a headacheApply for higher pension on actual salary by July 11The Employees' Provident Fund Organisation (EPFO) has extended its June 26 deadline for choosing the higher pension option to July 11.

Employees who were members of the EPFO and EPS, prior to September 1, 2014, and who continue to be in service but missed availing of the higher pension option earlier, are eligible to apply for this facility. Those who retired before this date and had signed up for the higher pension option will have to validate the information.

You will have to take a call on whether you want to file a joint application — with your employer — to claim higher pension on your actual salary or not. You will have to complete this process by June 26 through the online facility provided on the EPFO’s member portal.

Currently, your employer deducts 12 percent of your basic salary towards your employees’ provident fund (EPF) contribution. The organisation also contributes an equal amount to create your retirement kitty. A part of the employer’s contribution (8.33 percent) goes to the employees’ pension scheme (EPS), while the balance flows into your provident fund. However, this contribution is calculated on the statutory wage ceiling of Rs 15,000. So, currently, out of your employer’s contribution, Rs 1,250 (8.33 percent of Rs 15,000) goes towards EPS. This amount joins the pool created under EPS to pay regular pension income to member-employees with at least ten years’ service and their dependent family members.

You can, however, now choose to direct 8.33 percent of your actual salary towards the pension pool, translating potentially into a higher pension post-retirement, thanks to a Supreme Court verdict in November 2022. Additionally, 1.16 percent from your employer’s contribution will also be funneled into the EPS, with the balance 2.51 percent flowing into your EPF.

You will have to exercise this choice by July 11. If you spot errors in your application, you can delete the application and file it again. However, you cannot do so if your employer has already validated the application. Next, EPFO officers will evaluate and approve your application for a higher pension.

However, several grey areas around the process and final pension formula persist, making it difficult for employees to exercise their choice.

The deadline to seed your PAN with your Aadhaar is June 30, 2023. If you have not taken action on time, your 10-digit PAN will become inoperative from July 1.

Moreover, there will be other repercussions, too. If the tax department owes you a refund for excess taxes paid, the refunds will not be issued, and if any interest is due on such an amount, it will not be paid for the period during which the PAN remains inoperative.

Also, tax deducted at source (TDS) and tax collected at source (TCS) will attract higher rates.

An inoperative PAN will mean that you will not be able to file your income tax returns. The linkage is also required as per the Securities and Exchange Board of India (SEBI) rules to invest in mutual funds and stocks. No financial and service requests will be processed for a PAN that is not linked with Aadhaar.

IDCW (Income Distribution cum Capital Withdrawal) will continue to be paid, but at a higher tax of 20 percent instead of 10 percent for Resident Indians who have ‘not linked’ their PAN and Aadhaar.

Also read | PAN-Aadhaar linking: Link your PAN and Aadhaar by June 30 to avoid PAN deactivationHDFC Bank and HDFC merger effective from July 1The amalgamation of the country's largest private sector bank, HDFC Bank, and mortgage lender, Housing Development Finance Corporation, is effective from July 1.

After amalgamation, account holders and borrowers need to keep track of home loan rates, deposit rates and operational changes post-merger. Also, you need to know whether existing HDFC Ltd branches in your vicinity will be converted to full-service bank branches or closed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.