The Central Board of Direct Taxes (CBDT) has quietly slipped in a statement at an obscure place, mandating the Annual Information Statement (AIS) to contain all the information that the Income Tax Department has gained about an individual.

The old Form 26 AS, which used to hold the data regarding fixed deposits (FDs), tax deducted at source (TDS), and tax payments made by a person, has been cleared of many data fields such as advance tax and self-assessment tax.

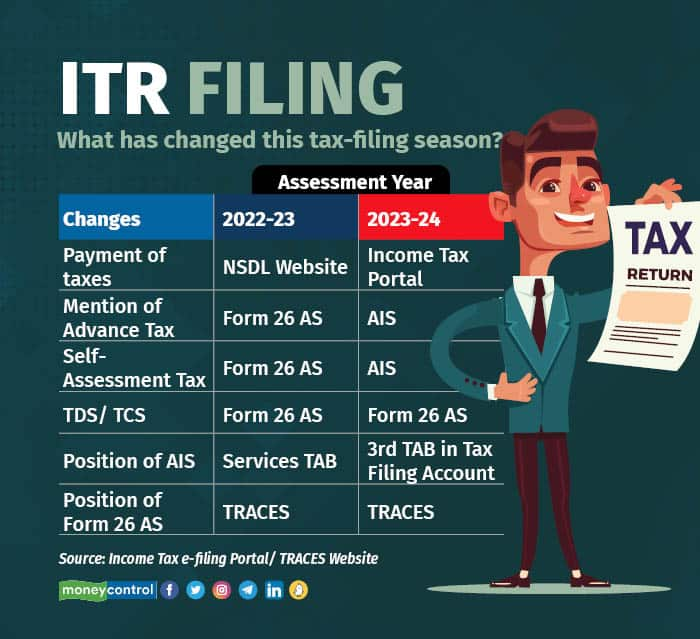

A few days ago, the position of the AIS was shifted from the services tab on the income tax portal. It is now stationed right in the middle as the third bar on the main page when a taxpayer logs into his account.

"From AY (assessment year) 2023-24 onwards, Annual Tax Statement (Form 26 AS) … will display only TDS/TCS-related data. Other details would be available in the AIS (Annual Information Statement) at the e-filing portal," says a two-line note in a normal font where one downloads Form 26 AS.

Also read: What's the difference between Annual Information Statement (AIS) and Form 26AS

A major change like this hasn’t been communicated to chartered accountants (CA) or bodies like the Institute of Chartered Accountants of India (ICAI). When Moneycontrol reached out to some CAs to seek their reaction to these changes, they expressed relief at the consolidation of forms. The AIS was introduced in June 2021. "Why should multiple documents be referred to while filing returns? The move to expand the scope of AIS is good, as it would eradicate multiplicity. AIS contains all the knowledge the Income Tax Department receives from all the entities. Its scope has been expanded, and it is a much-detailed statement," says Paras Savla, Partner at KPB & Associates.

Stretched AIS

But the detailed statement of AIS is what bothers many. AIS contains specified transactions and taxes paid or refunds received. This includes income earned, interest on savings bank and FDs, property sold, stocks sold, and mutual fund units redeemed or purchased, credit card spends above Rs 10 lakh, dividends, interest, rent received, foreign remittances, electricity bills in excess of Rs 1 lakh, hotel bills above Rs 30,000, cash withdrawn above Rs 1 crore, and gold purchases above Rs 2 lakh.

"AIS is a lengthy form, and it is easy to get lost in the details. Often the same information is shared by multiple entities and is hence repetitively mentioned in the AIS. For instance, the mutual fund transactions are notified by the fund house, registrar, and share transfer agents, such as CAMS and KFin Technologies," says Chetan Chandak, Director-TaxBirbal. These double entries and multiple rows of data punched in make it difficult for individuals to go through AIS. However, there is a way out. "There is double, sometimes triple reporting under AIS. But the summary statement of TIS removes the duplication," says Ameet Patel, Partner at Manohar Chowdhry & Associates. In other words, when you open the AIS tab on the tax portal, you can see the summary statement on the side.

Yet details missing

Even though the AIS contains multiple rows of information, you still have to refer to additional documents to pull in additional details that are required to file income tax returns. Even though the TDS and salary payment details are mentioned in the AIS, the detailed Form 16 would be needed as the break-up of salary has to be mentioned in the tax returns.

Similarly, the capital gains captured in the AIS every time you sell equity shares may not paint an accurate picture. "The capital gains number shown in AIS mentions the closing rate for the day you sell the stock but doesn’t take into account the actual purchase date or purchase cost. As a result, the capital gains figures mentioned cannot be used, and you would have to source a statement from the stock broker to actually file your returns," says Chandak of TaxBirbal.

Information mentioned, but not pre-filled

On the other hand, while some information is mentioned in the AIS and you expect it to be mentioned in the pre-filled income tax returns, these basic details aren’t pulled into the tax returns.

Take, for instance, the deduction for savings bank interest, which is captured under the AIS but is not directly pre-filled in the income tax return. So, savings bank interest of up to Rs 10,000 is available for tax deduction under Section 80 TTA, and senior citizens can claim both savings bank and FD interest of up to Rs 50,000 under Section 80 TTB.

"While this data on savings bank and FD interest is captured in AIS, it is not pre-filled (in your income tax return forms). Those who have not filled out this deduction at the relevant place in the tax-filing form have had to pay tax, as interest was added to their income and taxed as per the tax bracket. We have filed revised returns for such individuals," says Sudhir Kaushik, Co-founder of TaxSpanner.com.

Taxes paid missing

Even though the income tax department has moved the advance tax data and the self-assessment tax data to the AIS, moneycontrol.com has met readers who paid the liable taxes as the self-assessment tax on June 14, but until June 22, 2023, it hasn’t been reflected in their AIS.

This could be because the taxes are to be paid using the income tax portal and not the National Securities Depository Limited (NSDL) website, which was used until last year. In other words, for AY 2022-23, if you had to pay taxes, you had to go to the NSDL website. Now, effective AY 2023–24, the tax payment window has shifted to the e-filing portal. <see table>

AIS contains specified transactions and taxes paid or refunds received. This includes income earned, interest on savings bank and FDs, property sold, stocks sold, and mutual fund units redeemed or purchased, credit card spends above Rs 10 lakh, dividends, and so on.

AIS contains specified transactions and taxes paid or refunds received. This includes income earned, interest on savings bank and FDs, property sold, stocks sold, and mutual fund units redeemed or purchased, credit card spends above Rs 10 lakh, dividends, and so on.

One would have to keep the challan identification number safe in case any grievance was to be raised. But since you have more than a month before the tax filing deadline, it would be in your interest to wait to file your returns if the taxes aren’t reflected in your AIS, suggest tax professionals.

Patel says that both advance tax and self-assessment tax have been moved to AIS. "If it isn’t reflected in your AIS, then wait before you submit the tax returns. Last year, many people paid the self-assessment tax on July 30 and filed returns on July 31, but since the self-assessment tax wasn’t being reflected in the tax statements and the returns were processed quickly, they later got notices," says Patel.

Ensure error-free AIS

Ensure that the information in your AIS is correct, as these details will be fed into your pre-filled tax returns. In case of any discrepancies, you need to submit feedback using the option listed in the AIS to get the details corrected. A mismatch of the numbers could lead to a notice.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!