The Finance Minister has postponed the deadline for filing income tax returns (ITR) for the previous financial year, to November 30, 2020 from July 31 earlier.

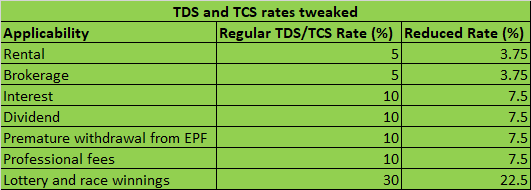

The government has also reduced the tax deduction at source (TDS) and tax collection at source (TCS) rates, so that taxpayers have more funds at their disposal. The rates for non-salaried payments to residents have been reduced by 1.25-7.5 percentage points depending on the category of deduction.

“The reduction in TDS and TCS rates for non-salaried payments and reduction in EPF contribution rates will further increase cash in hand for taxpayers, leading to a consequent boost in demand, setting the economy rolling,” says Archit Gupta, Founder, and CEO, ClearTax.

Dr Suresh Surana, founder of tax consultancy RSM India, says, “The reduction in TDS and TCS rates would affect payment to contractors (1-2 per cent), rents (10-15 per cent), brokerage, dividends too (as they are tax deductible starting this year) and interest payment.”

The government has said that this overall relief of Rs 50,000 crores of liquidity through TDS/TCS rate reduction would be applicable from May 14, 2020 up to March 31, 2021.

“However, the government has only offered a deferment in tax liability by reducing the TDS and TCS rates. TDS is not the final tax liability. The total tax liability will in no way come down and hence this is a cashflow benefit and not absolute money in the pocket,” Surana points out.

So, for example, you would have to declare the entire interest income earned on your FDs in your returns and pay tax on that at your slab, even though TDS rates may be lower.

So, remember that a lower TDS rate would be collected while making payments to you, but the tax would have to be borne while filing returns. So, you merely get a leeway of time.

Assessment dates postponedThe date of assessments, which were getting barred on September 30, 2020, would now get barred on December 31, 2020 and similarly the ones expiring on March 31, 2020 would get barred on September 30, 2020. So, those tax returns which could come under scrutiny have been extended as per the dates mentioned. So, make sure you preserve your tax proofs and donation receipts for the additional period.

An extension has been granted for making payment under the Vivad se Vishwas scheme, without the additional penalty amount. One can pay the taxes under dispute at various levels in this settlement window up to December 31, 2020.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.