Those with pre-existing diseases and senior citizens have been among the most vulnerable to COVID-19. Therefore, it comes as a relief to them that two coronavirus standard health insurance policies, Corona Kavach (reimbursement) and Corona Rakshak (fixed benefit) have been rolled out by insurance companies. Thanks to an IRDAI ruling, these will cover co-morbidities – or pre-existing illnesses – as a part of the treatment under standard COVID-19 policies.

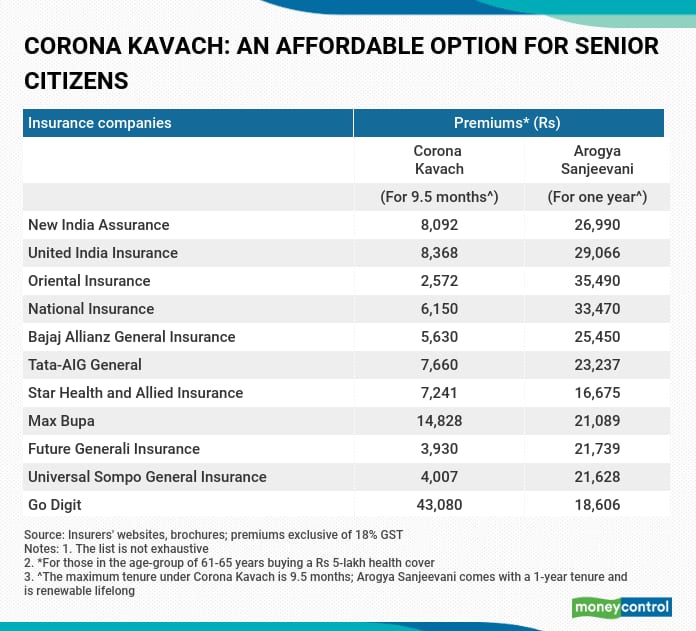

Coverage of co-morbidities along with COVID-19 treatment under COVID-19 policies will be allowed after the initial 15-day waiting period. This is far better than regular health policies, where despite the policy cover kicking in after an initial 30-day waiting period, the pre-existing diseases are covered only after a waiting period of up to four years. Also, Corona Kavach policies do not come with any room rent sub-limits. On the face of it, for such senior citizens policyholders, the standard COVID-19 covers hold an edge over regular policies if they get hospitalised due to the pandemic. Besides, most insurers are charging substantially lower premiums for standard COVID-19 policies.

Corona-specific policies: Not open for all?However, co-morbidity coverage does not mean individuals will manage to obtain these new policies easily. Underwriting – your health risk assessment – and pricing will be decided by insurers, which means that they may choose not to entertain such ‘high-risk’ groups. Insurers have already indicated that their underwriting – health risk assessment before issuing policies – will be more stringent. Underwriting means that the insurance company will assess your health and then decide whether or not it can issue you the policy, and if so what should be the suitable premium.

Some companies have put out their health-risk scrutiny approach on their websites. For example, New India requires insurance buyers to specify whether they are suffering from co-morbidities such as diabetes, hypertension, heart-related ailments and respiratory diseases. If they do, they have to pay 30 per cent higher premium (loading in insurance parlance).

Similarly, Reliance General Insurance has put out a list of pre-existing conditions, which could lead to a rejection of your proposal. These include certain heart ailments, chronic kidney diseases, pancreatic diseases, Hepatitis B and so on. Other companies, too, are likely to have devised such norms as part of their underwriting strategy, even if not disclosed upfront. “It is unlikely that the vulnerable segment – those who find it difficult to obtain regular health insurance policies due to age and pre-existing conditions –will be issued a COVID-specific policy. This will especially be the case with private insurers,” says Mahavir Chopra, Founder, Beshak.org.

After 60, the chances of suffering from pre-existing illnesses such as diabetes or hypertension are higher. A health insurance policy plays a crucial role in the life of a senior citizen. “If senior citizens can afford comprehensive health policies that cover everything, then they can look at buying a large cover of Rs 10 lakh or more, since hospitalisation bills have touched Rs 12 lakh in some COVID-19 cases. If you cannot afford it, however, Corona Kavach is a good option, as home care expenses and complications arising out of COVID-19 are also covered. While COVID-19 is covered under all health policies, standard policies are highly affordable,” says Amit Chhabra, Health Business Head, Policybazaar.com

Also, since most regular and senior citizen health policies come with waiting periods of up to four years for pre-existing illnesses, sub-limits and co-pay, Corona Kavach or Rakshak policies can be useful alternatives for now.

However, you must still strive to buy an independent cover of at least Rs 10 lakh, if you can afford it and the insurer is willing to issue the policy despite your age and pre-existing ailments. “These new products will certainly be useful for those without cover. However, they should treat these as add-ons and look to buy regular health covers too, along with super top-up plans. Regular policies cover multiple ailments and are renewable lifelong,” explains Puneet Oberoi, financial planner and director, Excellent Investment Advisorz.

Oberoi also brings up an important point that the Standard COVID-19 policies will cease to exist after 9.5 months.

For the long-term, your budget permitting, you can also explore plans from insurers such as Star Health and Religare Health, which offer dedicated policies for those with pre-existing diabetes, hypertension or heart conditions.

Insured, but sub-limits and co-pay clauses play spoilers?Room rent capping and proportionate deduction can reduce your claim payout substantially. If you currently own such policies, you run the risk of partial claim settlement and disputes with insurers. Standard COVID-19 policies have done away with these restrictions, paving the way for smoother claim settlement. “I would recommend COVID-19 policies. Your existing policies are for the long-term, but this is a unique phase which justifies a separate policy. Room rent sub-limits have been taken care of and if you manage to get a policy issued, your pre-existing diseases will be covered during treatment. Moreover, premiums are highly affordable, making the decision easier,” points out Chopra. Although the upper age limit on paper for Corona standard polices is 65, some insurers have specified premiums for policyholders beyond this age too. But issuance or denial of policies will depend on their underwriting.

If senior citizen parents are covered under their children’s employers’ group insurance, they can also look at buying Corona Rakshak policies, which pay out the entire sum insured if the policyholder tests positive and is hospitalised for at least 72 hours. Corporate group policies tend to offer covers of between Rs 3-5 lakh and have room rent sub-limits. Corona Rakshak’s fixed benefit payout can take care of expenses that remain unpaid as a result or other expenses such as food, recovery and loss of income. “If you already have a regular health policy, choose Corona Rakshak. If not, buy Corona Kavach if you cannot afford a regular policy,” says Kapil Mehta, Co-Founder, Securenow.in.

Have a comprehensive health cover, free of restrictions?In such cases, you do not need to buy an additional standard COVID-19 policy. “However, ensure that you have adequate cover, of at least Rs 10-lakh. Then, you need not look for any additional policy,” says Oberoi. You can, however, consider buying super-top-ups for future expenses, given the rising cost of medical procedures and equipment.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.