Among the many tax proposals in this year’s Budget impacting investment securities widely used by the rich is a proposal to tax a hitherto tax-free proportion of income distributed by Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs).

The finance minister has proposed taxing, at one’s marginal rate of income tax, any repayment of capital arising from distribution by business trusts like REITs and InvITs with effect from April 1, 2023.

The total income arising from such trusts is usually distributed as interest, dividend, rental income or repayment of debt. While income received under the first three categories is taxed in the hands of the investor or unit holder, income received under the category of repayment of debt was not being taxed. The latest proposal will tax this income in the hands of the investor, under the head, ‘income from other sources’.

The genesis of this is a loophole in the structure itself. Any REIT or InvIT has three stakeholders; unit holders or investors, the trust and special purpose vehicles or SPVs through which investments are made.

Investors buy units of the trust, which invests that money through SPVs by lending (in most cases). Income earned from the underlying SPVs is transferred to the trust either as dividends or interest. Since the trust gives the funds to the SPV as a loan, there is also a component of loan or debt repayment. The trust is liable to distribute 90 percent of the income earned and does so to its unit holders keeping the nature of the income the same. For unit holders, the portion that came in as capital or debt repayment was so far not taxable, only capital gains on the final sale were being taxed under equity taxation.

Some experts suggest that debt capital taxed as equity seems misaligned and the only other alternative (other than taxing it as the Budget 2023 has proposed) could have been to allow for a reduction of this value from the original cost of units as repayments happened.

As far as the proposed tax change is concerned, for investors in REITs and InvITs, this means a higher tax outgo and potentially lower yield on investment. A potential additional tax may be seen as a disruption of the long-term return expected from such investments.

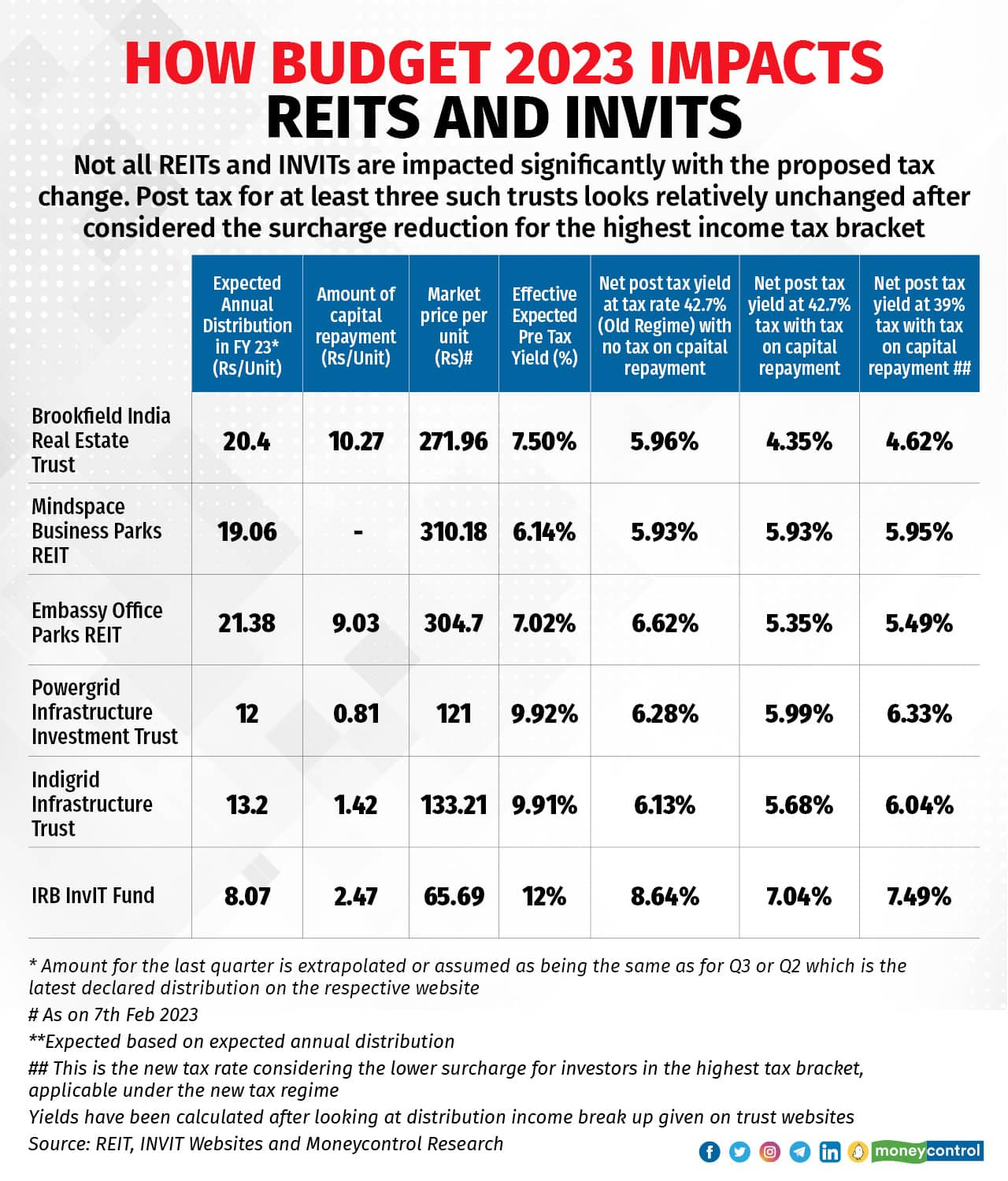

What do the numbers say?Let’s have a look at how the yields for listed REITs and InvITs will get impacted by this change.

Not all listed trusts distribute income under the capital or debt repayment category. A look at the details of distribution shows that among the six listed trusts (REITs and InvITs) only three have a substantial portion as repayment of capital. These three are most impacted in terms of yield change once the proposed additional tax comes into play (see table). For others, since that component was either not part of income distribution or a very small portion, the impact on final yield is not very significant.

REIT INVIT YIELDS

REIT INVIT YIELDSAccording to Nishant Agarwal, Senior Managing Partner & Head – Investment Advisory and Family Office, ASK Wealth Advisors, “Downward revision of surcharge for those in the highest tax bracket means that the net impact gets balanced out.”

For Mindspace Business Parks REIT and Powergrid InvIT, the impact is nil for those taxed in the highest slab who are opting for the new regime and lower surcharge rate.

Also Read: RBI raises repo rate as expected, but does not hint at end to hikesWhat do the experts say?According to Srikanth Bhagavat, Managing Director & Principal Advisor, Hexagon Wealth, “The price correction post the Budget announcement has been sharp and adjusts for the additional tax impact if one were to buy now. Existing investors who invested looking at fundamentals of the asset with a view towards diversification, there is no compelling need to switch. Existing investors can even accumulate at lower prices.”

Also Read: What should debt fund investors do as RBI hikes repo rate?Other than the immediate uncertainty that the announcement in the Budget has caused, price correction for REITs and InvITs must also be seen from a lens of better alternatives in terms of fixed income yield, now that the interest rate cycle has turned upwards. With rates going up, existing bond prices are correcting and prices of REITs and InvITs, which are considered as part of fixed income investments, for their stable and defined income stream, are also witnessing a correction.

Also Read: Increase home loan EMIs or tenure: What should borrowers do?Given this, it is tempting to reconsider the viability of these long-term assets when the interest rate cycle is favouring other debt instruments. There are alternatives available today with similar risk but better payoffs.

Not only have corporate bond yields moved higher but short to medium-term debt funds are also now giving 7 percent-7.5 percent annualised return.

Agarwal does not suggest immediate action for all existing investors, “While the REITs which come with a yield disadvantage post the tax proposal can be switched out of, InvITs where the yield impact is nil can be left as is till the dust settles. For the latter it’s more of a medium-term decision rather than a quick one.” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.