A Securities and Exchange Board of India (SEBI) circular issued on March 10 created a furore among debt funds. According to the circular, the value of all Additional Tier 1 (AT1) and Tier 2 bonds were to be treated as 100-year maturity instruments. Additionally, it put three conditions: A scheme shall not invest more than 5 per cent of its corpus in such securities issued by a single issuer and 10 percent in all such instruments, put together. Additionally, a fund house must not hold more than 10 percent in such securities of a single issuer. On March 11, the finance ministry advised SEBI to roll back the clause in the circular that mandates fund houses to value such bonds as 100-year tenor. But on March 12, the Association of Mutual Funds of India (AMFI) issued a press release saying that it agrees with SEBI’s directives on perpetual bonds. What is the fuss about?

How risky are AT1 and Tier 2 bonds?

SEBI is of the opinion that these securities are risky. And therefore, the net asset values (NAV) of debt funds that invest in them must reflect the risk levels these securities carry.

When debt funds invest in a security, they expect to earn an interest income throughout the instrument’s tenure. The principal amount is paid at maturity. If the organisation goes bankrupt or gets into a financial trouble, the instruments should accord priority to debt funds in paying dues. But not all instruments are at the same priority level when the borrowing firm needs to repay its creditors.

AT1 bonds come last in the queue. Holders of AT1 bonds come last in the queue after bank depositors, general and other creditors in the payment of dues if the firm goes bankrupt. Tier-2 bond holders are better-placed though. They are ahead of AT1 bondholders and equity shareholders in priority.

That’s not the only problem. AT1 bonds do not have a maturity date and are virtually perpetual. But AT1 bonds have a ‘call’ option; this gives the right (but not an obligation) for the issuing bank or non-banking finance company (NBFC) to call back (on a specific date) the bonds and redeem the principal. They do not have a ‘put’ option that gives the right to the bondholder (a mutual fund in this case) to surrender the bond and exit. If your bank decides to rollover the debt, the MF doesn’t have much of a choice. The liquidity in the bond market is also pretty low. T2 bonds, too, don’t have a put option – they just come with a ‘call’ option. Usually, there is a 5-year maturity period. If the issuing bank or NBFC doesn’t exercise the call option, T2 bonds get redeemed.

Banks or NBFCs can skip paying coupons in AT1 bonds if they don’t make profit in a particular year. T2 bonds score cannot skip payments.

AT1 and T2 exposures in mutual funds

According to a Moneycontrol analysis, around Rs 63,700 crore of assets are invested in such AT1 and T2 bonds, across 21 categories – most of them are debt and hybrid funds.

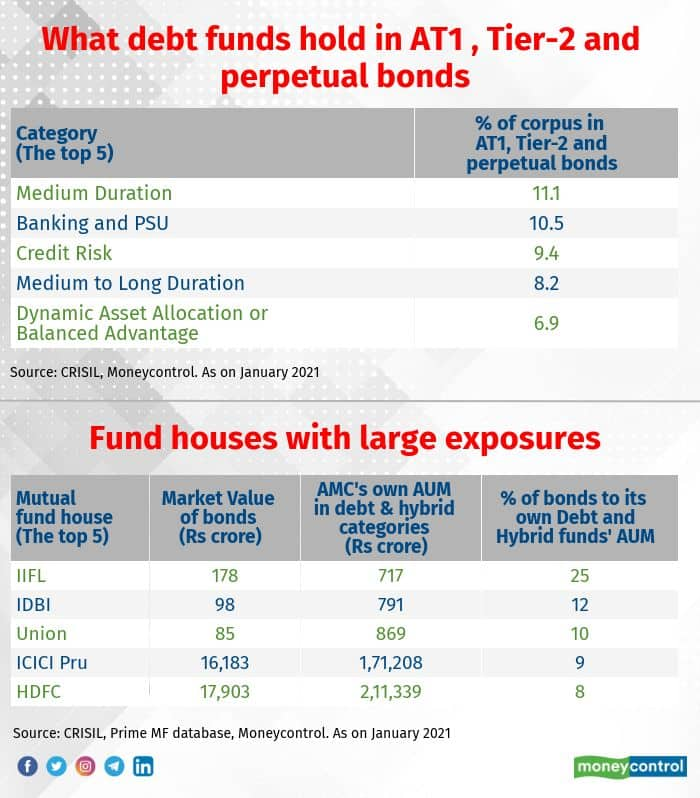

Medium duration (11.1 percent of the category’s total assets lie in AT1 and T2 bonds), Banking & PSU debt (10.5 percent) and credit risk funds (9.4 percent) are the ones that hold these bonds the most.

Nearly 23 fund houses hold these bonds across their schemes. One way to look at it is the sheer quantum of such bonds in your debt fund. A better way, however, is to look at its percentage to the overall assets under management, to understand if your fund is adequately diversified or not. IIFL mutual fund (25 percent), IDBI mutual fund (12 percent) and Union mutual fund (10 percent) have the largest allocation to such bonds relative to their respective sizes. For the overall assets under management, Moneycontrol only looked at the debt (excluding liquid funds) and hybrid funds to understand the real extent of their AT1 and T2 holdings.

SEBI’s 100-year conundrum

Last week, SEBI told MFs to treat the maturity period of all perpetual bonds (T2 bonds are not perpetual) as 100 years. If the maturities are hiked, their durations and yields also shoot up. And since yields and bond prices move in opposite direction, the NAVs of these funds would take an instant hit. While SEBI has grand-fathered the excess holding (over the new SEBI-prescribed limits) that these funds have, it has not grand-fathered the valuations, yet. There is still time for this SEBI ruling to be effective (April 1), but if the rule stays, then debt funds may take a hit on their NAVs.

While AMFI has agreed to abide by SEBI’s norms, the MF industry is divided, in private, about whether these bonds are, in fact, really risky. “Although Yes Bank’s (AT1) and Lakshmi Vilas Bank’s (T2) bonds were written down, not all such securities or banks are as risky. We have been investing in AT1 bonds of large banks such as State Bank of India, ICICI Bank, Canara Bank and so on. We cannot imagine these banks not honouring their payment commitments,” says a senior MF industry official who did not want to be quoted.

Says Raju Sharma, Head Fixed Income and Fund Manager at IDBI mutual fund, “Most banks don’t issue equity, as it is expensive. Instead, they prefer to raise capital by issuing AT1 bonds. These bonds give coupons that are 200 basis points higher than other instruments issued by them. As a fund manager, I can take calls on whether I want to invest in them. So long as they are from good banks, there isn’t an issue.” As per figures provided by CRISIL, IDBI Credit Risk Fund has the highest exposure to AT1 and T2 bonds: 42 percent. IDBI Dynamic Bond Fund has invested 25.7 percent of its corpus (as per January-end portfolio) in such securities.

Vikram Dalal, founder and managing director, Synergee Capital Services says that not a single bank has, to his memory, not exercised the call option. Although that is encouraging, he says, SEBI is right in addressing the risk issue.

Moneycontrol’s take

While fund managers may be well-equipped to assess risks, unexpected shocks – the sort we’ve seen in the past 2-3 years –cannot be ruled out. While SEBI can decide on how much more grandfathering it can allow to existing holdings, it is right in highlighting the risks in such bonds as they are considered risky and treated as semi-equity. After all, if a debt security cannot guarantee interest and principal repayment, then it should logically not be in a debt fund. Alternatively, schemes that take credit risk can be allowed to hold and value them as per existing norms – all other schemes may be kept out of AT1 and T2 bonds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!