There is bloodbath on the mutual funds street. A day after the RBI took control of Yes Bank and capped the amount that depositors can withdraw (Rs 50,000), it put out a reconstruction scheme. The proposal, which is a draft, stated that although all liabilities of Yes Bank would continue as before, the additional tier 1 (AT1) capital bonds that the bank had issued, shall be written down permanently. This announcement has caught the Rs 28 trillion Indian mutual funds (MF) industry by surprise.

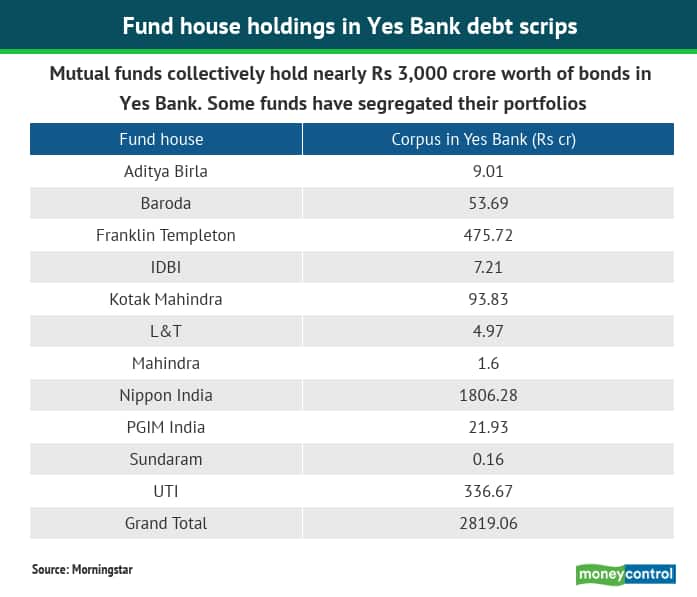

Eleven fund houses hold a total of nearly Rs 3,000 crore of papers issued by Yes Bank and a majority of these are AT1 bonds issued under the Basel III guidelines, according to data from Morningstar India. Rating agency ICRA downgraded Yes Bank’s bonds to ‘D’ – the lowest credit rating that indicates a default. Thus, fund houses are mandated to completely write down the value of such instruments in their portfolio, which all fund houses holding these bonds did. This resulted in a fall of debt funds’ net asset values (NAV). For the week-ended March 6, Nippon India Strategic Debt’ fund’s NAV nose-dived 25 per cent. Nippon India Credit Risk’s value fell by nearly 12 per cent, while that of Baroda Treasury Advantage declined by nine per cent. IDBI Credit Risk Fund’s value decreased by almost 3.5 per cent. In all, 14 debt funds’ NAVs fell last week.

So, as a debt fund investor, what do you do now?

The carnageFor a while, Yes Bank’s financial situation has weak. Observing its continuously deteriorating financial situation, the RBI finally stepped in last week and took control of the bank. State Bank of India (SBI) will also acquire a large stake in the bank. In short, Yes Bank will not sink, but till such time as SBI takes charge of Yes Bank and things get back to normal, RBI has put a moratorium for a period of 30 days. It means that while the bank will not be functional in the sense of ‘business as usual,’ depositors can withdraw up to Rs 50,000 in this period from all their accounts put together.

A loss-making and a badly-managed firm such as Yes Bank will take time to put its house in order. This means recognizing its losses and paying off its creditors and depositors first and then getting its books in shape. In such a scenario, it will line up all its creditors in the order in which it owes them, depending on the nature of the borrowing. AT1 bonds, by way of regulation, rank low in terms of how soon its holders (the investors in these bonds) can get their dues from the issuer – Yes Bank in this case. And that is why there is heartburn for MF industry stakeholders, the advisory and distribution communities and investors.

Can mutual funds recover investors’ money?That’s hard to tell right now, but chances are slim. All debt funds value their portfolios on a daily basis. These valuations norms went through a major change last year, amidst the credit crisis. When the rating agencies reduce the rating of an underlying instrument to below ‘BBB’ (investment grade), fund houses have the option to segregate these assets. This means the infected portion of the portfolio is cast aside and quarantined. Later, if and when the MF recovers its dues, it gives the amount back to investors.

Meanwhile, life continues for the unaffected part of the portfolio – investors are free to buy and sell these units. By Saturday, at least five fund houses – Nippon India, Franklin Templeton, Bank of Baroda MF, PGIM and UTI – have segregated their portfolios. The idea is that even though the RBI has said that AT1 bonds would be written off, fund houses have found it wise to segregate them.

In fact the Securities and Exchange Board of India (SEBI) mutual funds guidelines state that schemes have to segregate their portfolios on the day of the credit event (March 6 in this case) after getting trustees’ approval within one business day from the day of the event. Since Saturday is a non-business day, fund houses have time till Monday to get their trustees’ approval for portfolio segregation, although the separation would have to be effected from Friday, March 6. Once the 24-hour window goes, fund houses cannot, at a later date, segregate their portfolio. The idea is that although RBI’s proposal to restructure Yes Bank is a draft one, the final plan that will be unveiled shortly, may grant a leeway for AT1 bonds. Here again, chances are slim and the MF industry as well other lenders (investors) in Yes Bank AT1 bonds (Rs 52,612 crore worth of bonds in all issued by Yes Bank, according to ICRA) will contemplate what to do next, perhaps even consider going to courts to recover their dues.

However, according to RBI’s circular July 2015, instruments that qualify for inclusion in a bank’s tier 1 capital (such as AT1 bonds) would be just above equity shares, but lower than all other creditors, when it comes to claiming in case the bank (borrower) gets into financial trouble. This is what has caused heartburn to mutual fund managers.

Can I sell my units and get my amount back?Investors can exit their mutual funds that had Yes Bank bonds, but they may have to do so at a loss. Depending on your fund’s holding in Yes Bank bonds, your loss would vary.

For investors in those fund houses where assets of schemes have been segregated, it’s a bit safer to withdraw. This is because your fund house has already quarantined the bad bonds. Now, if your fund house were to get any amount back in the future, the money will belong to the investors who are a part of segregated portfolio. If your fund house does not segregate the portfolio and you withdraw, chances are that new investors who enter such funds will also get to have a share in that pie, if and when the recovery happens. Of course, the proportion that fund houses may recover is highly questionable, given the nature of AT1 bonds and their repayment capabilities depending on the borrower’s (Yes Bank’s) financial health.

That said, the worst for Yes bank is over. And all fund houses have completely marked down the value of these bonds to zero. So, investors have already suffered the loss. Exiting now will not minimise the loss.

The best thing to do in these times is to ascertain how much risk you can digest. Go for mid-term, long-term and credit risk funds only if you can stomach credit risks. Else, stick to low-risk PSU and Banking debt and corporate bond funds, where the assets are of a higher quality. Also, it’s high time investors and their financial advisors and distributors take a good, hard re-look at what credit risk entails. Given the spate of debt market accidents that have happened in the past 12-16 months, it has gotten tougher to understand credit risk.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!