The biggest startup fundraises this year to date have been Dailyhunt’s $805-million round, a $665-million round by Byju’s, and a $255-million tranche raised by ShareChat as a part of a $520-million round that started in December last year.

The six months up to June (H1) have seen a few big bang private equity deals as well. Bodhi Tree, an alternative investments platform backed by Qatar Investment Authority, has led a $1.78-billion funding round for Viacom18 and a $600-million round for educational services company Allen.A $700-million fundraise by telecom major Airtel from Google was another large PE deal struck in H1.“There is generally a one quarter lag between when a large PE deal starts taking shape and it being finalised. There’s no doubt about the fact that most large deals have been paused until there is more clarity on how inflation pans out in the US and the impact of Fed action,” said a PE investor who did not want to be named.

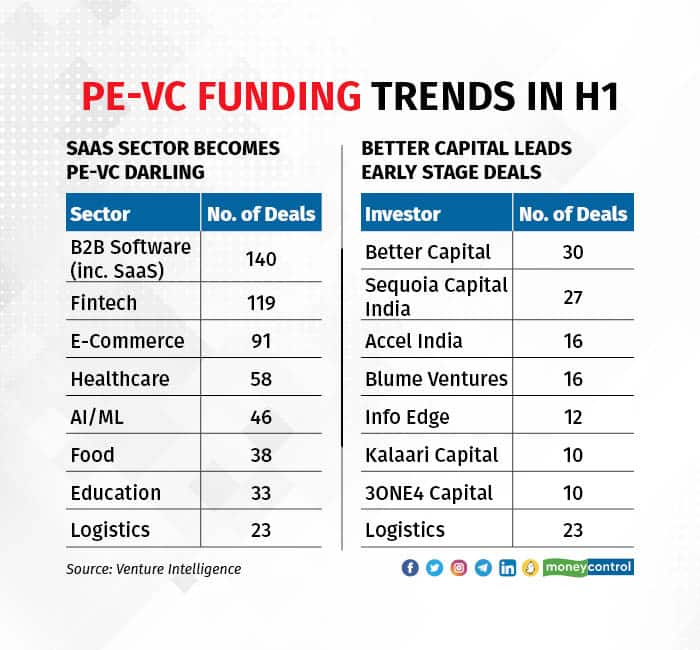

H1 saw 349 early stage deals with a cumulative value of $1.6 billion, according to data from Venture Intelligence. Interestingly, a few challenger funds have emerged in early stage this year as the largest dealmakers of last year have taken a breather in H1.

While Better Capital, an investor in startups like Slice, Open, Bijak and Teachmint led by solo general partner Vaibhav Domkundwar, led the early stage pack with 30 deals, InfoEdge was the other surprise entry into the top five with 12 deals in H1.

“Vaibhav is a rare investor on many counts. For one, he has been an entrepreneur himself. He has also seen the Silicon Valley models evolve up, close and personal. Therefore, he acts as a mirror for founders to help them understand how the Valley ecosystem would look at a business,” said Madhusudanan R, founder of M2P Fintech.

“We are however interested in looking at startups which want to build for ONDC integrations such as inventory management and logistics for e-commerce,” he added.

According to industry players, one big departure compared to last year might be in terms of exits. While the first half of 2021 saw several IPOs like Zomato, Paytm, Nazara, CarTrade and Policybazaar being launched, logistics startup Delhivery was the only notable tech IPO in H1 this year.However, this year is expected to see a lot of M&A transactions taking place as a result of consolidation and lack of follow-on funding in segments like edtech and e-commerce.“Public market exits are certainly looking difficult this year. And otherwise, exits are going to be challenging. If there's no money at growth stages, then exits will become difficult,” said Padmaja Ruparel, founding partner of IAN fund.“I think this is a great time to buy companies, invest in companies as valuations are attractive. 2021 was very different but the foam has settled, the froth has gone. So valuations are more attractive and I think M&A activity will pick up this year,” she added.While the investment narrative last year was driven by growth and high valuations, the focus has now shifted to reining in cash burn and a correction of prices in the private market. “If you last for two years, there are tremendous opportunities out there. But you have to wait for that to happen and have to be patient, and so this is the time to build. And when we talk about winter, winter is not all bad right?,” asked Vani Kola, founder of early stage VC firm Kalaari Capital.“What happens in winter is everything slows down a bit, but the trees don't die and then spring follows and then you see what happens, greenery everywhere,” she said.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.