A host of things can trigger bitter rivalry between top fintech companies. These include – apart from market share – the creation of slicker apps, developing better credit algorithms, hiring the best talent, or winning the most important licences.

Fintech unicorns Paytm, PhonePe and BharatPe are now competing fiercely on another front: Deploying more speaker devices in stores that announce receipt of payments made through their apps.

Picture this. A shopkeeper is catering to several customers. Some pay cash and others use payment apps to scan the now ubiquitous quick response (QR) code pasted on the front desk. The busy merchant barely manages a glance at the message on their mobile phone screens confirming payment and they leave.

Later, the merchant discovers the payment did not reach his account. And he realises that he was duped – the mobile screen message confirming completion of the payment was fake. Embittered by the fraud, some merchants shift to using another company’s QR code, industry executives say.

Paytm was the first to take a shot at solving this problem by launching its Soundbox in 2020, during the first wave of the pandemic. According to brokerage firm CLSA, 80 percent of the fintech company’s 3.8 million point of sale devices deployed in stores were Soundboxes as of June.

With customers flocking back to stores for their shopping as the pandemic recedes, the other fintech companies have also thrown their hat into the ring.

BharatPe launched its speaker device in February and claims to have onboarded 300,000 merchant partners. And then PhonePe, the leader in United Payments Interface (UPI) transactions, was quick to read the tea leaves and came out with its speaker last month.

Touching a raw nervePaytm and PhonePe have always been fierce competitors. Paytm executives are said to leave no chance to highlight that PhonePe, owned by US retailer Walmart, presents a “sovereign risk” to the country’s payments ecosystem. PhonePe executives are said to counter by pointing fingers at Paytm’s Chinese backers Alibaba and Ant Financial.

Such covert hostility might now be escalating into a more open battle.

Moneycontrol reported on August 1 that PhonePe approached the police alleging that Paytm employees set a pile of its QR code sheets ablaze in Greater Noida. The complaint dated July 29 identified three Paytm employees who are allegedly in the video, one of them a former PhonePe employee.

Paytm said it has suspended the three employees, pending investigations. The company said the issue is between PhonePe and its former employee.

While clashes between overzealous staff of both companies have been going on for months, things changed after PhonePe launched the Smart Speaker two weeks ago.

“Usually these clashes are resolved amicably by the two companies through talks. However, since PhonePe launched the device at a lower cost, there have been increased instances of issues on the ground,” said one person who did not want to be identified.

These speakers are crucial sources of revenue for companies that operate UPI apps. The apps don’t generate revenue for fintechs because merchants don’t have to pay them anything for accepting UPI payments. However, once these companies onboard merchants and customers, they can cross-sell other revenue-generating products. Paytm offers merchant loans.

In its recent note, CLSA touted the Soundbox as a use-case for payment monetisation through value-added services. Soundbox users pay for using the device, which has also facilitated merchant retention.

“This is a meaningful alternative revenue stream for the company, especially in cases where the merchant mainly processes UPI transactions and the company does not earn money. Paytm plans to add 800k-1m devices a quarter going forward,” CLSA said.

The Soundbox has helped Paytm scale up its merchant lending. Paytm said disbursals of merchant loans had grown 178 percent year-on-year to Rs 565 crore in the March quarter. While the company doesn't lend from its own books, it enjoys a single digit percentage point take rate from banks and nonbanking finance company partners.

The average size of these loans is Rs 1.3 lakh to Rs 1.5 lakh and the average tenure is 12 to 14 months.

PhonePe told Moneycontrol that while it doesn't have a lending programme for merchant partners yet, the company plans to pursue such a path in the future.

“Earnings from rentals may not matter so much in the long term. The larger opportunity that everyone is chasing is lending working capital to small businesses and the shopfront is the best point of entry for that,” said a fintech founder who did not want to be identified.

There’s another reason for Paytm to fiercely guard its Soundbox market share. The company discovered the device is the secret sauce to retain merchants on the platform. In its earnings call in the previous quarter, Paytm said 85 percent of the merchants using the device remain active after six months, whereas industry estimates for the same number for a typical QR code is 25 percent.

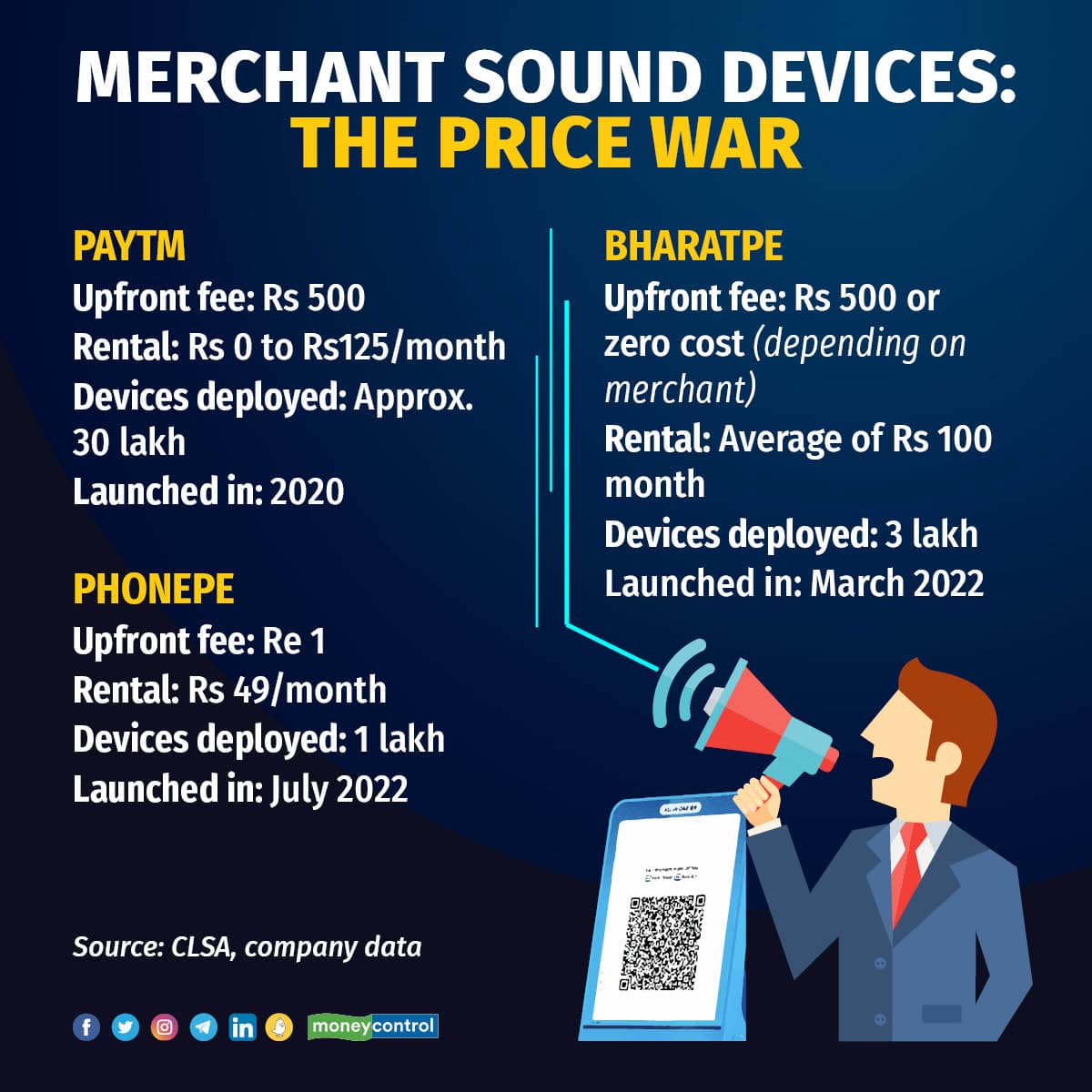

Price warsPaytm has been charging merchants an upfront fee of Rs 500 for the Soundbox and an average monthly rental of Rs 125 (varies from merchant to merchant). BharatPe charges Rs 500 upfront and Rs 100 as monthly rental.

Two weeks ago, PhonePe launched the device at an upfront cost of a negligible Re 1, and a monthly rental of Rs 49. According to PhonePe, the company has installed 100,000 devices already across the top 8 cities of the country.

What has been added to the mix is that PhonePe’s device supports 11 languages – English, Hindi, Telugu, Kannada, Malayalam, Tamil, Marathi, Bengali, Gujarati, Punjabi and Odia.

The competitive intensity in pricing is said to have pushed Paytm to lower its upfront cost to Re 1 in some areas and the monthly rental to zero. The rental has been cut to Rs 49 for merchants doing less than 30 transactions a month and zero for more than 30 transactions.

However, bringing the cost to zero is not a viable option, according to industry experts.

“The recurring cost for the device is Rs 25 per month for these companies. The capital expenditure per device is Rs 2,000. Besides that, there are servicing costs. Making it free of cost will be a loss of over Rs 7 crore per month for the company,” said an industry executive on condition of anonymity.

While the companies may have looked at the speakers as a source of revenue from merchants, the widening of the current feud might lead to deep discounting.

Over the past couple of years, fintech companies have blamed the government for their inability to make money on UPI payments. In this case, though, the fintech companies have only themselves to blame for not making money.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.