Nitin Agrawal

Moneycontrol Research

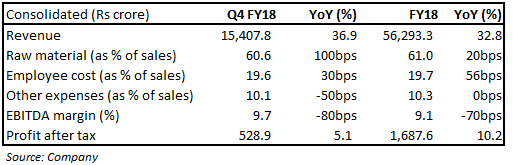

Motherson Sumi Systems Limited (MSSL), one of India’s largest auto components firm, reported robust numbers for the March quarter. Consolidated revenues grew 37 percent, but higher raw material costs and capacity expansion costs chipped 80 basis points off the EBITDA margin.

The new plants which recently started production should help the company achieve economies of scale.

This and the shift towards towards EV (Electric Vehicles) should boost the topline as well as operating margins. At current price, MSSL is reasonably valued and could be a good portfolio fit for the patient investor.

Quarter in a nutshell

MSSL’s operating revenues of Rs 15,407.8 crore was the highest in a single quarter, driven by strong performances of the standalone entity as well as subsidiaries. Samvardhana Motherson Peguform, the Europe-based subsidiary and is a leading global supplier of door, instrument panels and bumpers, reported a 10.5 percent rise in revenues. Finnish subsidiary PKC, which is a wiring harness specialist, too turned in a good performance. SMR, a leading global supplier of exterior mirrors, reported flat numbers due to weak order flows from Hyndai and Kia Motors.

MSSL has multiple growth levers ahead:

Strong order book

The company has reported the highest ever order book of Euro17.2 billion at SMRPBV with EUR2.4 billion (Rs. 18,109 crores) of new orders coming in 2HFY18.

Huge expansion on track

Currently, the company has many plants at different stages of completion. The management indicated that SMP’s Kecskemet and Hungary plants will become operational by Q1 FY19. They also mentioned that the Tuscaloosa plant in the US will be operational by the December quarter. These three new plants are expected to add EUR1 billion in revenues on full ramp-up in FY19.

Once the new plants start operations and ramp up fully, operating leverage will kick-in thereby contributing to margin expansion. The company has said it would spend around Rs3,000 crore on capex.

Strong volume growth:

The management said topline growth for the India operations was due to demand new model launches and refreshers. The growth was also led by an increase in content per vehicle.

With regulatory headwinds in Indian automobile industry easing, MSSL was able to register strong growth, indicating the strong position of the company in Indian market. With the teething problems related to Goods and Service Tax behind, we believe that MSSL is in a vantage position to gain from the increased demand in vehicles.

Additionally, the management believes that demand growth remains strong across businesses and across key markets, especially for commercial vehicles in the US.

PKC – Smooth integration

Integration of PKC is happening smoothly as evident from the strong growth during the quarter. The firm benefitted from the strong demand in North American and European truck markets. Further, PKC has received an order from a German vehicle maker.

EVs – An important catalyst

The Government’s thrust on EVs (electric vehicles) will be an important catalyst for the next leg of growth of MSSL’s India operations. The management says EVs would need more wiring component which would increase the content per vehicle by close to 10-20 percent. Other businesses related to polymer and mirror based products would also not be affected because of the shift to EVs.

ValuationsMSSL is currently trading at 11.4 and 9.5 times FY19 and FY20 projected EV/EBITDA multiples, which we believe are reasonable seen in the context of the opportunity. On the back of multiple growth levers and reasonable valuations, we advise investors to be a part of this long-term journey.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!