Last night, US Federal Reserve Chair Jerome Powell delivered a 25 basis point rate hike on expected lines. Even as markets now believe that the rate hike cycle may be coming to an end, there is fear looming that the US may be heading towards a recession while inflation continues to be sticky and stubborn. Ritesh Jain, co-founder of Pinetree Macro, based out of Calgary in the US, talks about the rate trajectory going forward and the risk to global and Indian equities.

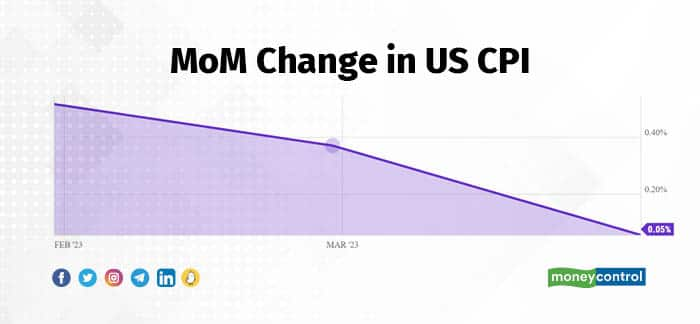

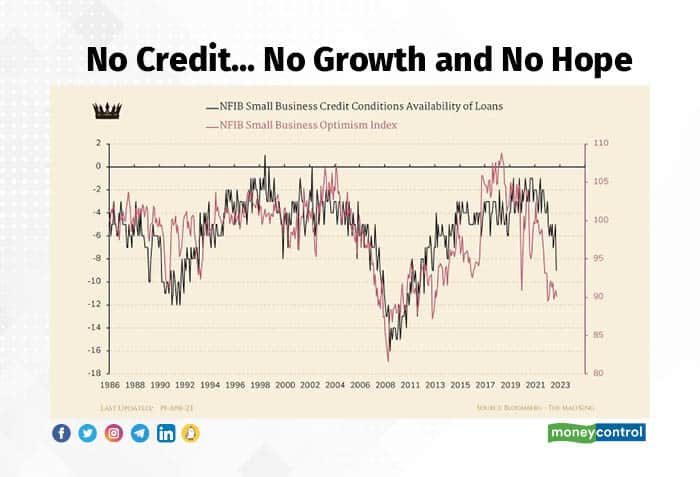

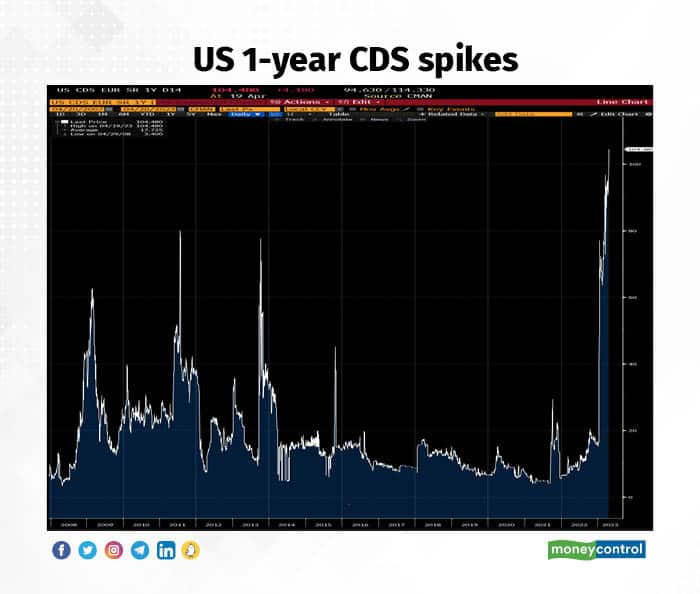

Excerpts from the interview:Yesterday’s rate action was on the expected lines. Do you think we are at the end of the rate hiking cycle?Yes, because month-on-month inflation in the US is flattening and year-on-year will be comfortably within the Fed range of 2-3 per cent by the third quarter of this year. Unemployment, which is the most lagging economic indicator, has started rising. Secondly, the US small and regional banks are losing bank deposits to large banks and money market mutual funds, and that means credit creation in the US is slowing down as we speak. Thirdly, the US has not been able to raise its debt ceiling and that effectively means that the US government will not be able to pay its bills starting May end and there is no light at the end of the tunnel as debt ceiling talks are dead-locked. This has already led to a spike in 1-year CDS in the US. All these reasons put together present a solid case for pause at the current levels itself. The only caveat I have is oil prices. If oil starts pushing 90 and above, then Fed will start becoming hawkish again.

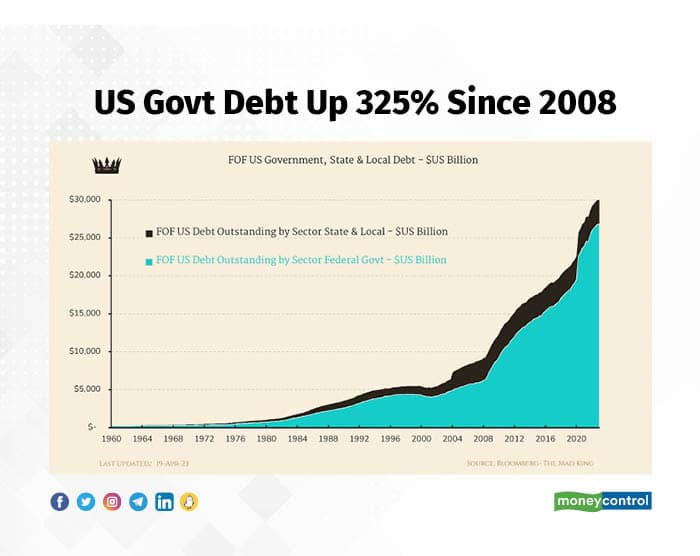

US debt/GDP was 70 percent in 2007-08 and today it is 130 percent, which means rate hikes will have more negative impact on the US economy. The only difference is that in 2007-08 it was the consumer who was leveraged but today it is the US government which is leveraged. So what we have today is a sovereign debt bubble with $11 trillion of US bonds maturing in the next 18 months. These bonds need to be refinanced and the new rate is closer to 4 percent, the old rate was close to 1.5 percent. This will lead to the US government interest expense rising from 9 percent of the Budget to 17 percent. If the US government does not cut spending, then the interest rates required to fund the US government will blow up its finances. So, in short, we are in a much more precarious condition than before but the government can always inflate away the debt.

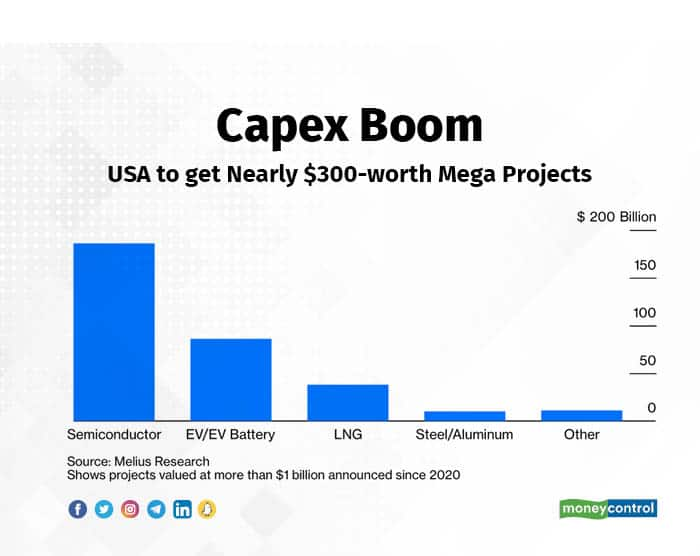

Yes and No. I believe we will relive the inflation of 1944-52 because I see a lot of similarities with the current situation. 1944 and 2021 both times US debt/GDP was 130 percent. In 1944 the US was getting out of the World War and was looking to industrialise. In 2022 the US passed the Inflation Reduction Act and is looking to industrialise again. Between 1944-52 inflation went up to 8-10 percent …3-4 times in an 8-year period but due to base effect it also came down to 0 and even -2 percent. I think we will see inflation doing this round trip 3-4 times between 2022 and 2030. Overall, inflation was up 70 percent during 1944-52. The US was industrialised, debt/GDP came down to 70 percent and bondholders lost money due to financial repression. This, if repeated in the next few years will be a very challenging environment for the corporate sector which will have to spend a lot more time on timing inventory buying/rebuilding and also on selling prices of their goods and these need to change constantly with changing inflation dynamics.

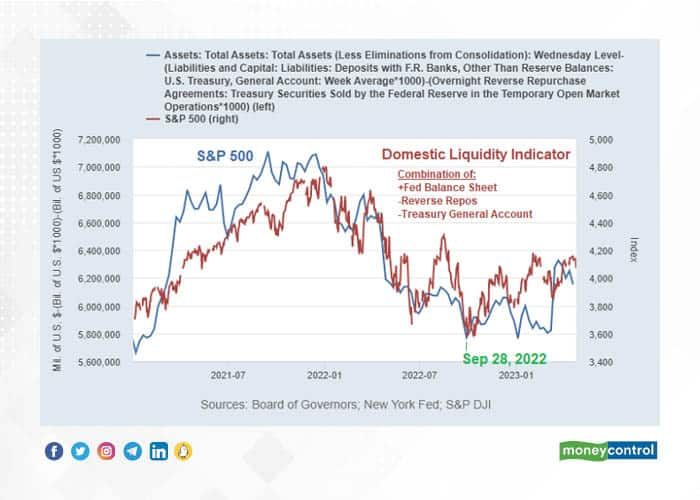

I believe liquidity creates fundamentals but fundamentals don’t necessarily create liquidity. Hence, if liquidity is tightened then it will certainly affect fundamentals, and it is bad for almost every asset, except the US dollar, short-term US treasuries and probably gold.

Chart courtesy: Lyn AldenWe have so far not seen any significant contraction in liquidity by way of shrinking of the Fed balance sheet. Do you see this happening? Do you believe the threat of financial instability will prevent the Fed from doing this?

Chart courtesy: Lyn AldenWe have so far not seen any significant contraction in liquidity by way of shrinking of the Fed balance sheet. Do you see this happening? Do you believe the threat of financial instability will prevent the Fed from doing this?We have seen G-7 central banks adding almost $1 trillion in liquidity since December 2022 and you can see that markets have been behaving well. But I also think that the best of central bank liquidity is behind us. Why? Because as soon as the US debt ceiling will get raised...the US treasury will come to the bond market to raise funds to replenish its coffers, which are becoming empty.

This could lead to tightness in global liquidity and there is no doubt that the US banking system outside of big banks is not in great shape and even the other too-big-to-fail institutions like private equity and real estate guys are seeing the value of their holding going down and becoming illiquid. This could lead to the Fed reversing its stance quickly but not before some damage has been done to the system.

What does today’s FOMC decision mean for India?Honestly, it does not matter if we can continue to buy oil in either rupees or renminbi or roubles. India runs a current account deficit of only $50 billion (ex-oil) on a $3 trillion economy, and if we can continue the process of bypassing the US dollar then we are delinked from the Fed tightening cycle. Of course, this is not an event but a process but it is going in the right direction. Having said that, I am more concerned about a spike in oil than the 5 percent Fed rate.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.