Highlights

- Steady Q3 from Safari – Modest top line, strong margin

- Shift from unorganised to organised in value category, post GST

- Multi-product multi-channel model paying off

- Creating successful brands

- Focusing on high growth categories and channels- De-risking business by diversifying sourcing

- Long-term macro drivers in place

- Accumulate for the long term

Luggage manufacturer Safari Industries (CMP: Rs 671, Market Cap: Rs 1487 crore) offers a rare blend of growth and quality that is hard to ignore in the current environment. The overall weak consumer sentiment has impacted consumer discretionary companies, and Safari Industries is no exception. Still, it has fared better and so far succeeded in keeping its head above water.

While the stock made a decent run in the past couple of months, it remains an underperformer from a 1-year perspective. Its prima facie expensive valuation should not dissuade long-term investors from buying it as the moats of the business are difficult to give a miss. The novel Coronavirus-led supply disruption from China could result in a couple of soft quarters, which could provide an excellent accumulation opportunity.

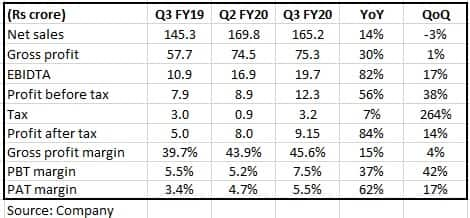

A stable quarter

It was a quarter of good execution. While top line growth has slowed from over 30 percent in the first half, gross margin improved further. Product mix and a decline in raw material prices along with some concessions from Chinese vendors positively impacted gross margin. Finally, the company managed to put operating leverage to its advantage with a sequential improvement in margin at the profit before tax and profit after tax levels. The company tries to maintain margin either through price hikes or better negotiation with suppliers without impacting volumes.

GST cheer?

For Safari, the growth in top line in the first half in excess of 30 percent was remarkable and the momentum continued in Q3, albeit with a little deceleration. This reiterates our thesis that there is a meaningful shift from unorganised to organised players post GST, and Safari being well-entrenched with the economy offerings is at a vantage position.

Its short-term outlook may remain subdued as the downturn takes a toll, with air passenger traffic growth as well as discretionary consumption in a slow lane. However, the superlative execution in a challenging environment is a true hallmark of a great business and that makes us confident about Safari’s moats.

Safari is the third-largest player in the organised luggage market and has close to 17 percent market share. In terms of price hierarchy, Safari’s products fall at the bottom end of the pyramid as it is more of a value for money brand. The company is more into a mass category and thus is a preferred choice for a customer who wants to upgrade after reduction in price gap between organised and unorganised players after implementation of GST. In fact, post GST, Safari has grown faster than its organised peers.

Safari’s products are tailored for all customer categories that suit all possible occasions, but the portfolio is currently dominated by Soft luggage (close to 70 percent). Within the soft luggage category, transition towards 4 wheels and rolling duffels will drive growth. In the hard luggage category, there is clear shift from polypropylene to polycarbonate.

Creating the right brand

Despite this competitive environment, the company has bolstered its position in the travel lifestyle market place and is confident of growing faster than the market. The confidence stems from its new and better product offerings, a wide distribution network and investment in brand building.

The secret sauce behind its success is its well-diversified multi-brand, -channel and -category business. It continues its focus on building the Safari brand through the launch of innovative new products and a new advertising campaign to drive visibility. The Magnum brand has been strengthened with a larger product portfolio and wider channel availability. The Genius & Genie brands that cater to teenagers and young adults has grown well in both backpacks and the newly introduced fashion bags category. This is in line with the company's strategic intent of addressing the complete short-haul needs of target consumers.

Focus on fast-growing categories and channels

Safari continues its emphasis on polycarbonate and backpack products. The share of hard luggage is close to 30 percent now. It increased its polycarbonate ranges, especially for e-commerce and hypermarkets, to dominate these high-growth channels. Further, it rolled out a fresh new range of backpacks with a significant upgrade in terms of features, design and price, which included several novel concepts. It has also started its own e-commerce enabled website.

De-risking business

While soft luggage is imported from China, hard luggage is manufactured at its plant in Halol in Gujarat. Safari has increased its hard luggage manufacturing capacity at the Halol plant. To de-risk business, it's exploring possibilities to tap some local vendors to make back packs in order to reduce dependence on China.

Macro drivers in place

Long-term macro drivers are in place despite the temporary slowdown. The continued shift of consumer preference from unbranded to branded products, accelerated growth in air travel, wedding season-based purchasing, the shortening of replacement cycle and the overall GDP growth are the structural drivers for the luggage industry.

Safari boasts of marque investors like Malabar India Fund, Rohinton Screwvala and Tano India Private Equity Fund.

The company has aggressive growth ambitions and plans to grow at 2x the industry rate. Apart from the changes set in motion by the management, structural tailwinds from gains in market share after GST, emergence of new product categories and strong demand for backpacks is likely to catalyse growth.

Investment risks

A prolonged macro slowdown severely impacting consumption, rise in raw material prices, depreciation of the rupee making raw material costlier, supply disruption from China due to Coronavirus and higher taxes on imports are some of the investment risks that could upset the applecart.

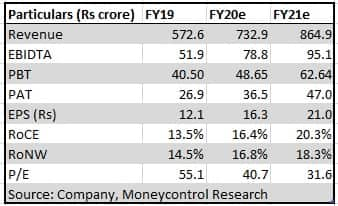

Safari trades at 31.6x FY21e earnings and has run up quite a bit. However, given the strong industry dynamics and its vantage positioning, the weakness in future could be an opportunity to accumulate the stock for the long term.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!