Sachin Pal

Moneycontrol Research

Highlights:

- Subdued performance in Q3 FY19

- Venkys has to comply with changing industry regulations

- Favourable socio-economic factors support long-term outlook

- Valuations reasonable

-------------------------------------------------

Poultry-producer Venkys reported a tepid performance in Q3 FY19. While topline came in higher, the twin impact of weaker realisations and higher input prices resulted in subdued profitability. Despite a disappointing performance in Q3, we remain optimistic on the company's growth prospects as the increase in volumes was heartening and indicates a positive trend for non-vegetarian consumption.

Quarterly results highlights

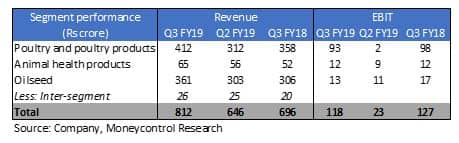

- Revenue increased 17 percent year-on-year (YoY) to Rs 812 crore and was driven by a healthy growth across its three business verticals. Earnings before interest, tax, depreciation and amortisation (EBITDA) declined to Rs 112 crore in Q3 FY19 from Rs 123 crore in corresponding quarter of last year. However, profit after tax (PAT) came in stable at Rs 68 crore.

- Topline for the poultry and poultry products’ segment increased 15 percent aided by higher volume. However, profit margin for the segment came under pressure due to soft realisations and higher poultry feed (soya up 15-20 percent and corn up 25-30 percent YoY) prices.

- The same for the animal health products segment grew 24 percent with steady margin. Revenue from the oil seed business increased 18 percent YoY to Rs 361 crore, but profits continued to remain under pressure.

Other key developments

- Capacity expansion is underway and its new specific pathogen free eggs capacity at Patan (Maharashtra) and solvent extraction plant at Srirampur (Maharashtra) will come on-stream by Q1 and Q3 FY20, respectively.

- Cash flow from operations continue to be strong and has been used for debt reduction. The leverage ratio continues to improve and interest costs for the quarter gone by has nearly halved to Rs 5.9 crore in comparison to Rs 13.2 crore in the year ago period.

- In a recent sectoral development, the government is also contemplating a ban on the usage of colistin – an antibiotic used to fatten chicken. The developments regarding the proposed ban on cage farming of poultry and meat animals also need to be monitored closely as the company needs to remain compliant with changing industry requirements and environmental norms to ensure smooth running of the business.

Outlook and recommendation

- Backed by favourable socio-economic factors, the domestic poultry industry is expected to grow at a steady pace over the medium to long-term. Consumption preferences are increasingly tilting towards snacking and convenience. Quick-service restaurants such as Burger King India, Kentucky Fried Chicken and McDonalds etc have been riding this trend through aggressive store expansion. Venkys being a primary supplier to majority of these fast food chains stands to benefit from overall growth in this sector.

- The stock is trading at a reasonable valuation of nearly 12 times FY20 estimated earnings. Long-term investors interested in steady earnings growth can look to accumulate this stock on dips as there exists significant scope for multiple re-ratings in the future.

Also Read: Alcoholic beverages: Which stocks will give your portfolio a high?

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!