The second follow-on issue of Bharat 22 Exchange Traded Fund (B22ETF) has been subscribed over 10 times. B22ETF is the chosen vehicle/route through which the government is divesting stake in 22 companies; 19 public sector units (PSUs) and three private sector companies. The ETF is benchmarked to an index named Bharat 22 consisting of these 22 companies.

The base issue size was fixed at Rs 3,500 crore. Since it received an overwhelming response, the government has decided to retain Rs 10,000 crore as divestment proceeds.

The ETF sale is a part of the government’s efforts to meet its divestment target of Rs 80,000 crore. The government has mobilised Rs 34,000 crore until December end. Once PFC buys the government’s stake in REC (as announced earlier), the divestment proceeds would soar to Rs 50,000 crore. A couple of days ago, the government exited around 3 percent stake in Axis bank held through the Specified Undertaking of the Unit Trust of India (SUUTI). Axis’s offer for sale (OFS) is expected to contribute around Rs 5,300 crore to the disinvestment pool.

With the proceeds from B22ETF added to this, disinvestment receipts will work out to be around Rs 65,000 crore.

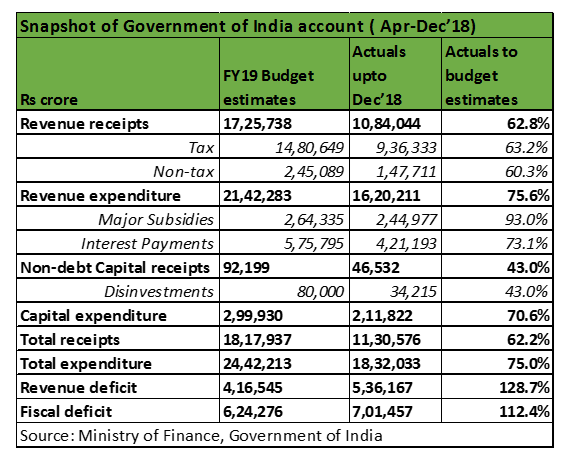

The central government is staring at overshooting the budgeted revised fiscal deficit to GDP target for 3.4 percent for FY19. The pressure on finances is mainly arising from the revenue side, particularly from indirect taxes and non-tax revenue.

On the revenue side, tax revenue accounts for more than 80 percent of total revenue. While the tax collection between April-December 2018 was 30 percent higher compared to same period last year, only Rs 9.36 lakh crore (63 percent) has been collected vis-a-vis FY19 targeted collection of Rs 14.8 lakh crore.

The non-tax revenue mainly includes 1) dividend from RBI and public sector institutions, 2) receipts from the auction of telecom spectrum and 3) disinvestment proceeds. Of the FY19 budgeted estimate of non-tax revenue of Rs 2.45 lakh crore, only Rs 1.47 lakh crore or 60 percent was achieved until December end. The fiscal deficit for 9MFY19 has exceeded the full-year target by 12 percent until December end. With limited scope to cut committed expenditure, attaining the revised fiscal deficit target of 3.4 percent for FY19 would be contingent on strong collections of the indirect tax proceeds mainly GST in the last quarter, probable RBI dividend and targeted disinvestment receipts. Given this backdrop, the higher amount mobilised through B22ETF is encouraging news on the fiscal front. Follow @nehadave01For more research articles, visit our Moneycontrol Research page

The non-tax revenue mainly includes 1) dividend from RBI and public sector institutions, 2) receipts from the auction of telecom spectrum and 3) disinvestment proceeds. Of the FY19 budgeted estimate of non-tax revenue of Rs 2.45 lakh crore, only Rs 1.47 lakh crore or 60 percent was achieved until December end. The fiscal deficit for 9MFY19 has exceeded the full-year target by 12 percent until December end. With limited scope to cut committed expenditure, attaining the revised fiscal deficit target of 3.4 percent for FY19 would be contingent on strong collections of the indirect tax proceeds mainly GST in the last quarter, probable RBI dividend and targeted disinvestment receipts. Given this backdrop, the higher amount mobilised through B22ETF is encouraging news on the fiscal front. Follow @nehadave01For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.