Reliance Nippon Life Asset Management (RNAM), the third largest asset management company (AMC) in India, reported strong annual earnings for FY18, with net profit rising 30 percent year-on year (YoY) on the back of increase in assets under management (AUM) and better asset class mix.

With 11 percent market share as at the end of March, it will continue to be one of the key beneficiaries of enduring growth in the mutual fund industry. With its strong retail brand and well-diversified sourcing platform, we expect RNAM to continue to grow its AUM and profitability.

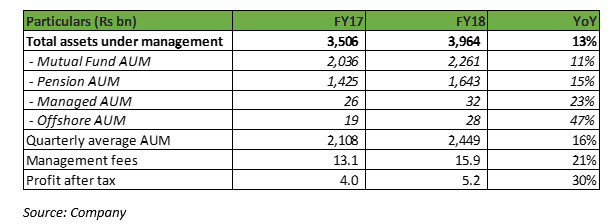

Earnings growth aided by rise in equity AUMAUMs stood at Rs 3.96 lakh crore as of March end. Despite total AUM growth of 13 percent YoY, that lagged industry AUM growth of 26 percent YoY, growth in management fees was a healthy 21 percent YoY on better asset class mix. Share of equity funds improved to 36 percent of average AUM versus 27 percent last year. This is very comforting as fees on the equity book is much higher compared to other asset classes.

Despite not enjoying a captive bank distribution channel, assets sourced from beyond top 15 cities (referred to as B15 locations) increased 25 percent YoY. B15 assets now constitute 21.3 percent of average AUM versus 18.8 percent for the industry. The company added 1.1 lakh retail folios per month in FY18, taking its total retail folios to 81.7 lakh and retail assets to 31 percent of average AUM versus 24 percent for the industry. The current run-rate of systematic investment plans (SIPs) is Rs 750 crore per month.

Quarterly average AUM on an uptrend

AUM for the Indian mutual fund industry stood at Rs 23 lakh crore as at the end of March, following a robust compounded annual growth rate (CAGR) of 23 percent in the past five years. The Association of Mutual Funds in India (AMFI) expects AUM to touch the Rs 95 lakh crore mark by 2025, which is 22 percent CAGR for the next seven years.

Industry average AUM

We see the mutual fund industry in a sweet spot with multiple growth levers. The gradual but steady shift of household savings away from physical to financial assets and increasing share of mutual funds within financial savings are key catalysts for future growth. The trend, referred to as ‘financialisation of savings’, received a fillip post demonetisation resulting in a sharp uptick in mutual fund inflows.

The industry’s focus of expanding beyond top 15 cities will drive growth as mutual funds are largely an under-represented investment class in these places. Various Amfi initiatives such as investor awareness campaigns have improved retail participation through systematic investment plans (SIPs). Moreover, progressive reforms and regulations by the Securities and Exchange Board of India (Sebi) such as introduction of direct plans and capping of expense ratio is expected to further popularise MFs drawing in a number of smaller retail investors.

Growth in assets is likely to be aided by new product offerings such as alternative investment funds (AIF) and exchange traded funds (ETFs). Traction in pension funds (National Pension Scheme) and increased equity allocation from Employee Provident Fund Organisation (EPFO) corpus has led to large inflows into equity ETFs in the recent past and the growth momentum is likely to continue.

Overall, we expect robust AUM growth of the past decade to continue going forward, with deepening and widening of the investor base.

Reasonable valuation, AUM growth sustainableAt the current market capitalisation of Rs 15,485 crore, RNAM is trading at 3.9 percent its FY18 AUM. Since earnings growth is expected to lead AUM growth due to increasing share of equity assets, we considered looking at valuation using the price to earnings (P/E) metric as well. The stock is currently trading at trailing P/E of 29. Given the return on equity (RoE) of 25 percent and expected earnings growth of over 20 percent, the current valuation looks reasonable and in line with retail companies.

While we don’t see much downside to the current market price, the potential source of downside would be weakness in equity markets and adverse regulatory changes, both which can negatively impact flows and profits. RNAM is one of the direct beneficiaries of the formalisation of the economy, making it a positive bet for the medium- to long-term.

Follow @nehadave01For more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.