Sachin PalMoneycontrol Research

Kajaria Ceramics reported another tepid quarter. The volume growth in high single digits was aided by a low base last year but bottom line dipped as operating margins slumped due to increased cost pressures. Q1 FY19 turned out to be another challenging quarter for Kajaria.

However, the management seems optimistic on the growth outlook as the revival of consumer demand on account of a normal monsoon and increasing rural spending bode well for the building materials industry.

Another subdued quarter

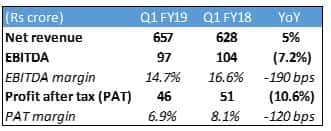

Revenue for the quarter increased 5 percent year-on-year (YoY) to Rs 657 crore. The revenue growth was muted as volume growth of around 9 percent in tiles was partially offset by softening of glazed vitrified tile prices (2-3 percent). The gross margins remained flat as the raw materials costs remained largely stable.

A rise in the fuel costs (mainly natural gas), higher manufacturing and employee expenses weighed on earnings as earnings before interest, tax, depreciation, and amortization (EBITDA) declined 7 percent to Rs 97 crores in Q1 FY19 from Rs 104 crores in Q4 FY18. A contraction in EBITDA resulted in lower net profits which declined from Rs 51 crores to Rs 46 crores.

Bathware segment continues to do well

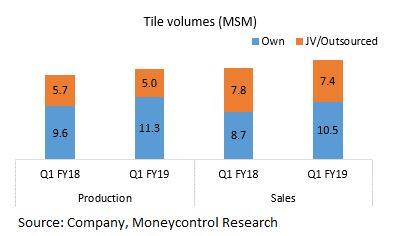

The tile volume for the quarter stood at 17.9 million square meters (MSM) and was aided by a favourable base last year. Despite the 9 percent volume growth in the tiles, the segment revenues remained largely flat YoY as realisations took a hit amid increased competitive intensity. Revenues from the tiles business came in at Rs 617 crores compared to Rs 605 crores a year ago.

While the tiles business seems to be facing subdued demand, the bathware segment (sanitaryware and faucets) continues to expand at a healthy pace. Revenues from the bathware segment jumped from Rs 23 crores in Q1FY18 to Rs 40 crores in Q1FY19.

While the tiles business seems to be facing subdued demand, the bathware segment (sanitaryware and faucets) continues to expand at a healthy pace. Revenues from the bathware segment jumped from Rs 23 crores in Q1FY18 to Rs 40 crores in Q1FY19.

Margins continue to face pressure

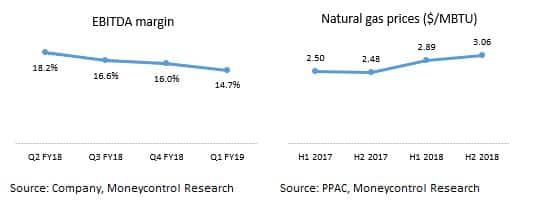

Tile manufacturing is a power-intensive industry with natural gas and electricity accounting for 40-45 percent of total costs. The operating margins of the industry have been under pressure as the price of natural gas has seen a steep increase of around 23 percent in the past one year.

Amid rising input costs, operating margins have been on a consistent decline over the past 4 quarters. The dip in the margins has intensified in the last couple of quarters due to softer realisations. Increased competitive intensity from unorganised players (post-Vibrant Gujarat meet in December last year) had resulted in prices of glazed vitrified tiles declining 2-3 percent in Q4 FY18. However, prices seem to have stabilised after this correction.

Amid rising input costs, operating margins have been on a consistent decline over the past 4 quarters. The dip in the margins has intensified in the last couple of quarters due to softer realisations. Increased competitive intensity from unorganised players (post-Vibrant Gujarat meet in December last year) had resulted in prices of glazed vitrified tiles declining 2-3 percent in Q4 FY18. However, prices seem to have stabilised after this correction.

We feel the margins would bottom out in the next one to two quarters as the upward movement of gas prices as well the price erosion of the glazed vitrified tiles appears to have halted.

Outlook and recommendation

Kajaria’s performance during last year was impacted by a number of factors including demonetisation, GST, and RERA. The industry demand appears to be stabilising post these market disruptions.

The e-way bill is anticipated to be a game-changer as it will reduce tax evasion from unorganised players and aid market share of organised players. However, surveillance measures in the current e-way bill need to be stricter to ensure a higher level of tax compliance and create a level playing field for organised players.

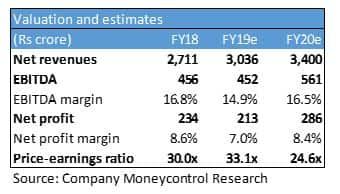

We remain sanguine on the long-term prospects of Kajaria as it enjoys a market leadership position and strong brand recall. We reiterate our view that the company is expected to witness a growth revival from the second half of the current financial year (FY19). The margin compression seems to have played out and we anticipate branded players like Kajaria to regain pricing power closer to the festive season. We, therefore, advise long-term investors to buy this stock on dips.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.