Highlights:- Yield improvement offset by decline in passenger growth, reported flat revenue - Fuel prices continue to mount pressure on operating profitability leading to huge contraction in margin - Funding gap of Rs 8,500 crore needs to be addressed - Apart from getting funds for continuing operations, business strategy needs to be looked at to impart efficiency - Stay away until more clarity on structure and business come --------------------------------------------------

Jet Airways continues to face turbulence and posted a bad set of numbers for Q3 FY19, further denting its liquidity situation. Financial performance in the quarter gone by was marred by a cocktail of higher fuel cost, rupee depreciation, lower capacity and loss of market share. Though the company has proposed a resolution plan to keep itself afloat and improve its financial performance, there's still not enough clarity. In this note, we analyse the latest quarterly performance of Jet and what does this resolution plan has in it for the company and its lenders.

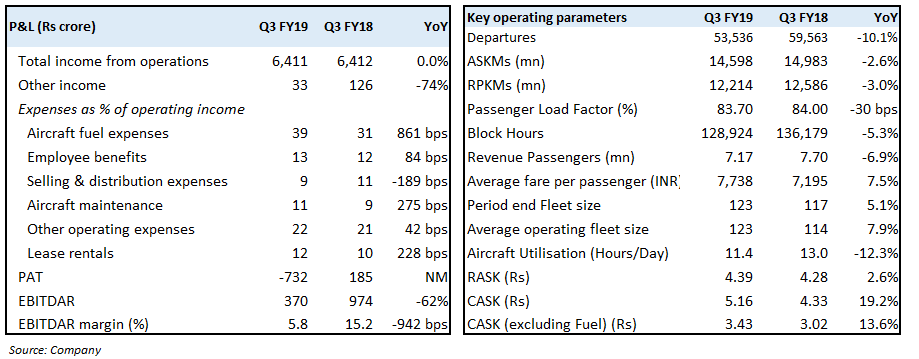

Quarter in a Snapshot: Fuel cost played spoilsport Revenue from operations remained absolutely flat on year-on-year (YoY) basis led by decline in revenue passengers (3.0 percent), and in capacity (down 2.6 percent) which partially got offset by increase in yields by 2 percent to Rs4.56/ RPKM (revenue passenger per kilometre). The load factor remained flat as RASK (revenue per seat kilometre) was up 2.6 percent. Capacity was down due to restructuring of its network during winter schedule of 2018.

Revenue from operations remained absolutely flat on year-on-year (YoY) basis led by decline in revenue passengers (3.0 percent), and in capacity (down 2.6 percent) which partially got offset by increase in yields by 2 percent to Rs4.56/ RPKM (revenue passenger per kilometre). The load factor remained flat as RASK (revenue per seat kilometre) was up 2.6 percent. Capacity was down due to restructuring of its network during winter schedule of 2018.

The company reported YoY decline of 62 percent in earnings before interest, tax, depreciation, amortisation and rental (EBITDAR) margin primarily because of the rise in fuel expenses (up 861 bps as a percentage of operating revenues), aircraft maintenance cost (up 275 bps as a percentage of operating revenues), employee and other expenses. The company has, however, been able to manage its selling and distribution cost (down 189 bps as a percentage of operating revenues).

What is being done to keep it going? Jet has been under liquidity strain on the back of mounting losses it has been posting due to higher fuel prices, weaker currency and high leverage. The management, however, seems to be taking note of the situation and planning to navigate through turbulent times.

Apart from usual steps such as cutting down on loss-making routes, focus on revenue management and cost optimisation, the company has come up with a resolution plan in order to continue to navigate in sky and avoid crash landing.

The resolution plan - bank led Provisional Resolution Plan (BLPRP) - proposes restructuring to meet a funding gap of nearly Rs 8,500 crores which is to be met by an appropriate mix of equity infusion, debt restructuring, sale/ sale and lease back/ refinancing of aircraft, among other things.

In this plan, the existing lenders will be issued 11.4 crore shares for a consideration of Re 1 only (lenders can convert debt to equity at Re 1, when the book value per share of a company is negative) which will result in fall in holding of the existing promoters Naresh Goyal's stake to 25.5%, and Etihad's to 12% while lenders will have a majority stake of 50.1%. Apart from this, equity infusion, and additional debt would be taken to keep the company afloat.

The intriguing question here is that would this plan help company to see light at the end of the tunnel?

The company has been struggling to perform well operationally as well. In fact, it has been losing market share to its competitors which stood at 13.9 percent as of December 2018, much lower than the high of above 20 percent that it achieved in July 2014. And, Jet being a full service carrier has very high cost structure making it vulnerable to higher fuel prices which is not in control of the airline.

Besides, Jet's business model is asset heavy business, leading to mounting of debt and rising interest outlay. The resolution plan could give some liquidity to the business but to get its competitive edge back, Jet warrants a complete overhaul of its strategy under a dynamic leadership team.

While the closure of Jet barely months before the general election would have been politically unpalatable and would have added to the woes of the banks, it remains to be seen if equity holders can really see the unfolding of events as an opportunity.

For lenders, the conversion of debt to equity paves the way for equity upside, should the business turnaround meaningfully.

We would advise investors to wait for further details on the restructuring plan before boarding it.

For more research articles, visit our Moneycontrol Research Page.

(Moneycontrol Research analysts do not hold positions in the companies discussed here)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.