Anubhav Sahu

Moneycontrol Research

Highlights:

- Sole manufacturer of Vitamin D3 API in India; significant global share

- Beneficiary of China supply-side reforms in API industry

- New capacity with multi synthesis capabilities to aid earnings growth

- Long-term positioning as a nutraceuticals company

--------------------------------------------------

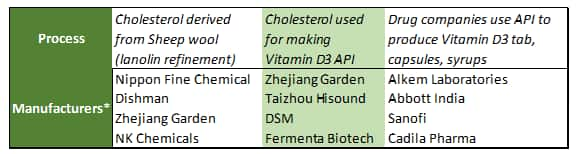

DIL (market cap: Rs 919 crore) through its subsidiary Fermenta Biotech is among the major manufacturers of Vitamin D3 (Cholecalciferol) API (active pharmaceutical ingredient) in the world.

In the past few quarters, the company has witnessed strong earnings growth on account of steady improvement in the demand for Vitamin D. Additionally, ongoing supply-side reforms in China has led to favourable supply-demand dynamics.

China's supply-side reforms are initiatives that the country has taken to streamline production in line with environmental norms. The net effect has been costs have increased or production has gone down.

Fully addresses the domestic demand

Fermenta Biotech is the sole manufacturer of Vitamin D3 (Cholecalciferol) API in India and almost fully caters to the domestic industry needs of vitamin D3 applications in pharma, dietary supplements, food and animal feed. It’s noteworthy that 20 percent of the company’s revenue comes from the domestic market.

As per pharma market research firm, AICOD AWACS, the domestic vitamin D3 market size has increased at a CAGR (2014-18) of around 16 percent, more than the growth rate of overall vitamin market. This implies a similar growth in demand for vitamin D3 API.

Significant market share in international market

DIL derives rest of its revenue from the international market, where it has a significant market share. Europe followed by the USA are the key export markets. Globally, Fermenta Biotech has a market share of about 25-30 percent in the Vitamin D3 API market for humans. In the animal feed market for Vitamin D3, market share is about 6-7 percent in terms of volumes.

Internationally, the company competes with MNCs like DSM. Further, Chinese manufacturers such as Zhejiang Garden Biochemical High-tech, Taizhou Hisound Pharmaceutical, Kingdomway and NHU are also key players.

Opportunities for Indian firms in the international vitamin D3 market have increased over the years. Data from the Ministry of Commerce suggests that export of Vitamin D3 has surged sharply in recent years. During April-Oct period of FY19, export volumes has increased by 77 percent compared to the corresponding period last year.

Table: Vitamin D3 value chain

Source: Moneycontrol research

Source: Ministry of Commerce and Industry, Moneycontrol research

Barriers to entry

The barriers to entry in this segment are similar to that prevalent for any pharma API market which includes technology and regulatory permissions. However, other than being a niche segment, Vitamin D3 production involves a heavy upfront investment as there needs to be a certain threshold scale of production to start with. Technology for photosynthesis replication is also tricky. Further, long process optimization gestation for the new plant and long client approval cycle are other hurdles for the new players.

Beneficiary of strong price trend

Supply-side reforms in China have impacted the financials of various companies in pharma API industry depending on where they are placed in the supply chain. DIL has been a beneficiary of this trend and has witnessed a strong operating performance in the last few quarters aided by pricing tailwinds.

Steps taken by China on the environment front has impacted the supply side of Vitamin D3 market – particularly the animal feed market. The price rise in this category has been of the order of 3-4x in last one year. Additionally, vitamin D3 prices in the human segment have also risen by 20-25% on account of structural changes like limited supply and increasing awareness.

New capacity with multi synthesis capabilities

DIL has been adding capacity on a periodic basis to meet structural improvement in demand. Last capacity addition was in early 2017 in Dahej which added about 25-30% increase in production capacity.

Fermenta Biotech is undergoing an investment of Rs 55 crore which will lead to capacity enhancement of 15-20 percent by the end of FY20. The project is majorly funded through debt (Rs 40 crore).

The company has availed ECB route requiring 3-3.5 percent interest rate. Interest liabilities are not hedged for currency movement as it can be paid through export earnings. The project will have multi synthesis capabilities which in turn would facilitate product extensions and new product rollouts.

Balance sheet remains supportive

Company’s balance sheet remains supportive. At the consolidated level, net debt to equity is about 0.75x which gives it a leeway to fund capex program. Peak D/E is not expected to go beyond 1x during the upcoming capex cycle.

Factors to watch out for

Since the recent pricing tailwinds in animal segment is because of China supply-side reforms, one needs to watch out for the new supplies from China. Secondly, key raw material (Cholesterol) is entirely imported and there are few players active in its production so sourcing of raw material is tricky.

At present Fermenta Biotech ensures the supply from manufacturers in Europe and Japan through annual contracts. Raw material prices have been relatively stable for last two years after surging during the period 2010 to 2016.

Stock outlook aided by double-digit volume growth in the human segment

The company has a key focus in the human applications for the vitamin D3. This segment is expected to grow by double-digit in volumes terms aided by structural demand and applications in personal care and nutrition. Another, supportive driver for earnings is that in case of animal segment, pricing can remain high and may not revert to pre 2017 phase because the factor cost for producing Vitamin D3 in China has increased significantly over the years.

Positioning as a nutraceuticals company

At a strategic level, we are enthused that company is positioning itself as a nutraceuticals company. To meet this objective company is looking for both organic and inorganic opportunities. Company’s plan for a multi synthesis platform is a step in that direction.

Table: Financials

Source: Moneycontrol research

Finally, valuation remains supportive with the stock trading at about 12x FY19e earnings which is closer to the lower range for the API segment. In our view, Investors with high-risk appetite can watch out for this stock.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!