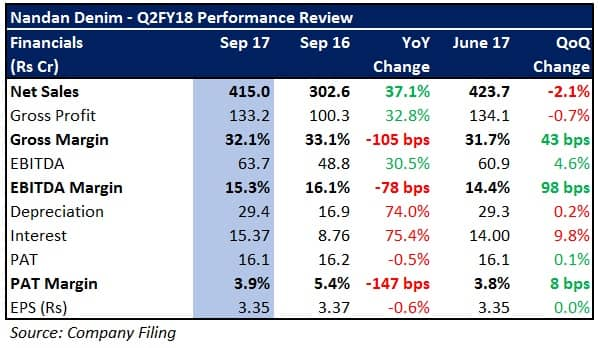

Nandan Denim, India's largest and world’s fourth largest denim fabric manufacturer, reported a decent operating performance. The muted bottom-line was attributable to higher depreciation on the back of capacity expansions undertaken in the recent past.

Conclusion of capacity upgradation processes (in connection with denim fabric, spinning, shirting facbric) by Q4FY17, coupled with a marginal increase in realisations (pertaining to denim and shirting material) in H2FY18 (as compared to FY17), played a key role in boosting Nandan's Q2 turnover. However, high cotton prices and post-GST pricing pressure impacted gross and operating margins.

Furthermore, the company’s efforts towards diversifying its product portfolio (from denim to other categories) were apparent in the quarter gone by, as the contribution of denim fabric to the quarterly revenue declined significantly.

What’s the plan ahead?The utilisation rate at Nandan’s newly commissioned manufacturing facilities is likely to see a gradual uptick in the upcoming fiscal. With no major capex lined up in the near future, an operating leverage kick-in may enable the company’s return ratios to scale up, too.

Nandan’s emphasis on value-added products is on account of better realisations and a superior margin profile. This transition from commoditised denim to high-quality variants will gain traction once the incremental capacities stabilise. Consequently, the company’s target is to achieve 20 percent EBITDA margins in due course.

Going forward, the share of exports to Nandan’s top-line is expected to increase from the current level of 35 percent to 45-50 percent by the end of FY20 with the objective of tapping the immense growth potential in international markets, apart from diversifying risks associated with geographical concentration within India.

Industry tailwinds such as Gujarat state subsidies, reduction in GST rate on textile job work (from 18 percent to 5 percent), post-GST demand/trade channel normalisation, and clauses pertaining to the new textile policy are anticipated to augur favourably for the company.

Arrival of fresh cotton from October 2017 will offer some margin respite to Nandan in Q3 and Q4 by virtue of declining raw material procurement costs (cost per candy now stands at around Rs 38,000, roughly 14 percent lower than what it was in Q2FY18). Moreover, the company aims to use its new yarn processing capabilities optimally to ensure that the captive consumption of the same (for manufacturing denim and shirting fabric) increases.

Nonetheless, these developments can lead to better EBITDA margins only if Nandan’s denim unit’s utilisation ramps up (from 80 percent at the moment to 90 percent or above) quickly enough and the shift towards specialised denim fabric (that is less volatile to changes in cotton prices) is simultaneously accelerated. Should the company succeed in doing so, debt repayments of Rs 60 crore each in FY18 and FY19 will lead to good profitability as well.

At 10.3x FY19 projected earnings, investors may consider the stock from a long-term investment perspective.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.