Nitin Agrawal Moneycontrol Research

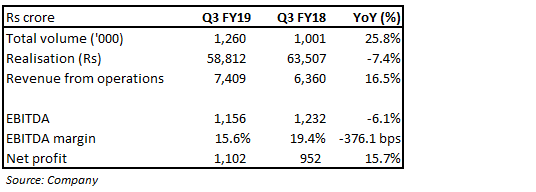

Bajaj Auto posted an operationally disappointing set of numbers in Q3 FY19. On a year-on-year (YoY) basis, net operating revenue clocked a strong growth of 16.5 percent driven by a strong volume growth of 25.8 percent. Average realisation, however, witnessed a YoY decline of 7.4 percent due to price action taken by the company in entry level segment and subdued industry demand.

In terms of volume performance, Bajaj Auto registered an overall YoY volume growth of 25.8 percent, helped by 27.5 percent YoY growth in domestic market and 23.5 percent growth in export market. Overall, motorcycle segment witnessed a growth of 31.7 percent in its volume while 3W segment remained largely flat due to large base of last year.

In line with the new strategy of gaining market share in entry level motorcycle segment, the company has taken price cut in that segment. This, coupled with rise in raw material prices, have affected the EBITDA margin negatively, which came at 15.6 percent, down 376.1 bps on YoY basis.

We believe the stock to have limited upside potential given subdued near-term outlook although we have a positive long-term view on the stock.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.