Highlights

- Fed opts for “no change” in the federal funds rate

- Prefers to wait for delayed impact of previous rate cuts on the economy

- Fed stance is for credible improvement in inflation before resuming rate hike cycle

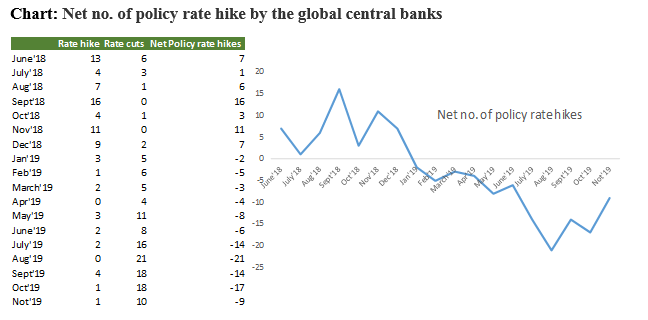

- Rate outlook adds to global accommodative stance; Positive for EMs

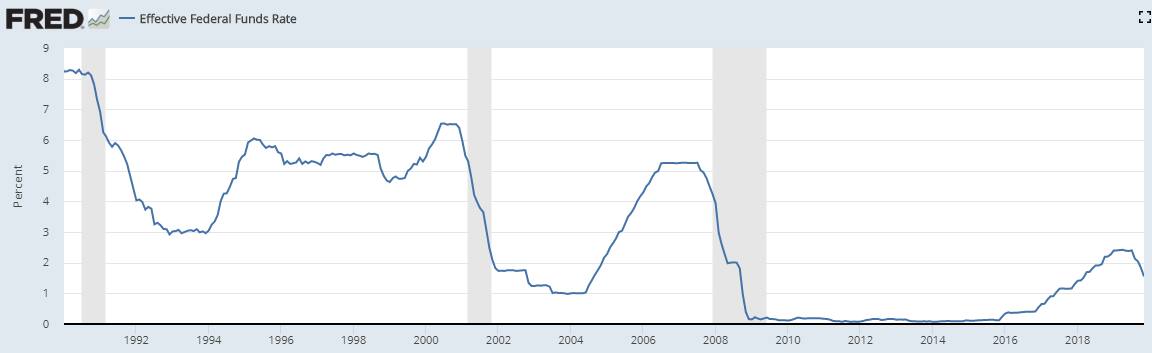

As widely anticipated, the Federal Reserve decided to keep the policy rate unchanged in its December meet. Post three rate cuts, which remind us of similar “mid-cycle adjustments” in the policy rate trajectory for 1995 and 1998, a pause was anticipated.

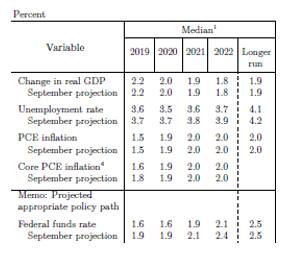

Median projections by the Fed Board for GDP and inflation came in largely same as the previous September meeting. However, a dovish commentary by the Fed chair Jerome Powell during the press conference dragged the dollar down. It weakened against major currency pairs and the US treasury yield curve clamped down, with the short-term end dropping more than long term yields.

Source: fred.stlouisfed.org

Backdrop

Fed’s commentary for the US economy remains largely similar to what has been the premise of the last three rate cuts – Strong labour market, improving household spending but weakness in investments and exports. Sluggish growth abroad, trade developments and muted inflation have been key risks to the US domestic growth outlook.

Table: Economic projections by Federal Reserve Board members

Source: Federal Reserve

Even the economic projections were broadly stable compared to those of September. Forecasts for GDP and inflation were steady while those for unemployment were further tweaked down, reflecting recent strong labour market numbers.

Given this context, the Fed chose to pause on rate cuts and mentioned that the Fed funds rate policy would remain at the current level unless there is a material change to the economic outlook, particularly on inflation.

Justification for a status quo - Policy rate change acts with a lag

The current cycle of policy rates reflects “insurance cuts” to hedge growth downside. The stance is that the positive impact on economy, particularly interest rate sensitive sectors, will come about with a lag.

Similarly, any trade deal – the key extraneous variable – even if successful will have material impact on the global economy with some delay. These two factors are seen to help inflation edge up to the 2 percent target level gradually.

By reiterating this narrative, the Fed is reaffirming that rates are expected to remain lower for longer. This is also conveyed in the federal funds rate projection which doesn’t indicate a rate hike in 2020. To be sure, this is in-line with market expectations. According to CME Fed Watch tool, the market expects a higher probability of a status quo in policy rate throughout 2020.

Overall by choosing a status quo, the Fed is essentially saying let’s wait for recent rate cuts to play out, along with any development on the trade front. And hence, wait for their impact on the economy till there is a substantial change in outlook – either way.

What to look for?

Interestingly, the November reading of the consumer price index after excluding food and energy prices rose 2.3 percent. However, core PCE (personal consumption expenditure) inflation (after excluding food and energy), which is the preferred inflation metric of the Federal Reserve, is trending lower. It stood at 1.6 percent for October 2019.

Additionally, consumer long-term inflation expectations remain subdued which can potentially pull down inflation numbers further. Wage inflation is at a moderate 3-3.5 percent, reflecting weak productivity, with a possible further slack in the labour market, along with the impact of globalisation. This clearly highlights the challenge for the Fed in terms of meeting the inflation target.

Coming to outlook, the Fed explained what it would look for before considering resumption of the rate hike cycle – a significant increase in inflation that also stays for a considerably long duration. In other words, the Fed is indirectly positive on a scenario when inflation overshoots the target of 2 percent and stays there for some time before a rate hike.

In an earlier press conference, Powell had also mentioned that the key extraneous variable – the trade war - should see a reduction in tensions, which would aid business sentiment. The Fed believes that resumption of business activities will feed into inflation with a lag.

All this means the Fed is not in a hurry even if the phase one of the US-China trade deal materialises as expected and there is a dramatic positive change in geopolitical situation. Keeping such pointers in mind, the Fed wants to rule out any structural disinflationary trend before taking further action.

The threshold set by the Federal Reserve for a rate hike is sufficiently high. Only when inflation goes past the target and remains there for a while, it makes a case for a rate hike. Thus, in our view, Powell’s narrative of “lower for longer” is positive for emerging market assets – from currencies to equities.

Source: Moneycontrol Research, www.cbrates.com

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.