Highlights: - Disappointing volume growth; weakness across rural and urban areas - EBITDA margin looks up despite lower gross margin and higher ad spend - Promoter pledge reduction to zero removes key overhang - Current promoters to increase shareholding over time - Focus on market gains in hair oil at the cost of margins – A change in strategy - Positive outcome from the pilot project for West Bengal adds to conviction

Bajaj Consumer Care’s quarterly results turned out to be strikingly disappointing. Its volume growth stalled and offtake weakness was visible in both rural and urban areas. Subdued consumer demand and heightened competitive intensity weighed, forcing the company to reset business strategy with a focus on gaining market share in the hair oil category.

We believe that this is a welcome change as the company is ready to sacrifice margins. This is in line with what is practised by other prominent players in the category. In addition, its promoters sold a substantial stake to completely reduce share pledge. This removes a key overhang on the stock performance.

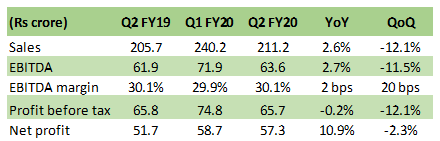

Table: Financials

Bajaj Consumer Care posted a disappointing sales growth of 2.65 percent YoY (year on year) in Q2 FY20, which came on an already weak growth in the base quarter. In Q2 FY19, volume growth was -2.8 percent YoY.

Its discretionary spend witnessed a sharp drop across channels. Both urban and retail offtake has seen substantial moderation. General trade, which constitutes 84.4 percent of sales, grew 0.8 percent YoY. International business (2.7 percent of sales) as well lost momentum during the said quarter (-5.6 percent YoY) after a decent performance earlier.

These were partially offset by a double-digit growth in modern trade (9.8 percent of sales) and the Canteen Stores Department (CSD, 3 percent) channels. Note that the CSD channel sales were recently impacted by a procedural delay related to registration of the company with the CSD with its new name (Bajaj Consumer Care as against the earlier Bajaj Corporation).

The big positivesSequentially, gross margin dropped by 156 bps (QoQ). However, the consumer goods company saw EBITDA margin improve on various cost cutting measures, which led to lower employee cost (-5.2 percent QoQ) and Other expenses (-19.4 percent).

Further, advertising spend increased by 12.6 percent YoY, which underlines the company's focus on defending its market share.

The biggest positive development of the quarterly update was that promotors have reduced their pledge holding to zero after selling 22 percent. They have also made it known that they don’t intend to take any additional debt at the promoter group level.

It was also clarified that the current promoters don’t have any intention to sell the company and there is an inclination to increase shareholding to 51 percent -- from the current 38 percent -- through creeping acquisition.

Major observationsOver the past two years and a half, the company has lowered wholesale channel contribution to 33 percent, from 60 percent previously. While part of the impact stemmed from the GST implementation, the firm had a plan to increase direct reach, which helped make good the revenue loss. Its direct reach is 5.15 lakh outlets as against 2.8 lakh at the end of FY18.

Bajaj Consumer Care is busy overhauling its existing hair oil business, for which consulting firm Bain & Company has been roped in. The initial pilot project results for West Bengal has been encouraging as the firm posted double digit primary and secondary sales growth during the September quarter. This is commendable as the hair oil category witnessed sales decline in the state in Q2.

OutlookGrowth headwinds in the legacy business (hair oil) has made the company re-strategise its business objectives. Product diversification outside hair oil now takes a back seat. It's now focussed on gaining market share in the hair oil category and is trying to double market share over the medium term.

Note that the organised hair oil market is estimated to be about Rs 13,500 crore, which is dominated by Marico, Dabur, Patanjali and Bajaj Consumer. These four players have a market share of about 70 percent. Other than the 30 percent of the organised market (~Rs 4,000 crore), which may be up for grabs for the national players, there is also an unorganised hair oil market estimated to be of about Rs 4,000 crore.

The FMCG company’s recent success from the pilot project is encouraging and the next phase of pilot in another state is set for November 2019. It's now willing to sacrifice operating margin to gain market share. This is broadly in line with similar strategy by peers – Marico and Dabur. Bajaj Consumer has also intensified its effort towards cost optimising (lower employee cost & other expenses) and deploying heavily towards advertising spends.

We believe that the strategy change, though delayed, is directionally apt. As far as the stock is concerned, after having corrected by 34 percent from its 52-week high, it is showing a positive bias. The key overhang of pledge share is removed.

Though these are early days for the new strategy, we believe that the firm has sufficient financial cushion to execute it and take on competition. It has a strong balance sheet and operating margin hovers around 28-30 percent (as against ~20 percent for Marico and Dabur).

Furthermore, after the downward adjustment to our medium-term assumptions for top line growth and EBITDA margin, the stock is trading at an attractive multiple of 18x FY21e earnings. This makes it one of the cheapest FMCG stocks available. We are of the view that there is a case of valuation discount (as against the overall sector) to narrow as the new strategy unfolds.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.