Anubhav Sahu Moneycontrol research

Apcotex Industries, the leading producer of synthetic latexes and rubber, posted another stellar Q1, marked by improving end-market demand and internal efficiencies. While the stock has already re-rated, regardless of the turmoil seen in most chemical stocks in the last one year, we see further potential primed by expansion-led double-digit earnings growth.

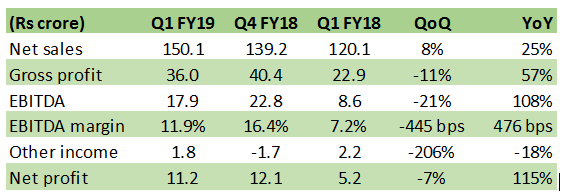

Improving topline growth Sales surged 25 percent year-on-year (YoY) led by new product launches and improved realisations, particularly for nitrile rubber (NBR) segment. Latexes have also witnessed robust growth. One of its largest paper industry clients has resumed offtake, though it is way behind the earlier run-rate.

Earnings before interest, tax, depreciation and amortisation (EBITDA) margin improved 476 basis points on better realisations and operating leverage. On a quarter-on-quarter (QoQ) basis, margin contracted due to higher raw material cost (styrene and butadiene) and lower contribution of exports (14 percent of sales versus 18 percent of sales in Q1 FY18). The latter was due to one client which faced operational issues (fire incident).

Result snapshot

Source: Moneycontrol Research

The management remains upbeat on new product launches. In Q4 FY18, it launched a latex variant called XNBR (carboxylated nitrile), which has an application in the gloves industry and is widely in demand in Malaysia and Indonesia.

Capacity expansion plans As a part of the first phase of capacity expansion (Rs 30 crore), efficiency improvement initiatives are largely undertaken at the Valia plant. Debottlenecking of NBR (Nitrile rubber) production (increase in capacity by about 30 percent) is expected to get complete by Q2. The power plant is expected to come on stream by Q1 FY20.

In the second phase, the company plans to expand capacity (about Rs 150-200 crore) for synthetic latex, nitrile rubber and some new products. This mega plan is expected to be launched by FY19-end and would lead to additional NBR capacity of 15,000 tonne and latex capacity of 40,000 tonne in the next 2-3 years.

Valuation/recommendation We acknowledge improving end-markets (automobile, footwear, paper/paper board, tyre cord) and increasing market share. At present, plants have been operating at optimum utilisation and hence further share in domestic market would be governed by timely execution of expansion plans.

Internal efficiency measures, higher share of new products and exports aids higher operating margin and should offset the challenge of surging raw material prices in the context of improving demand.

Financial projections  Source: Moneycontrol Research

Source: Moneycontrol Research

Improving business outlook has led to strong stock performance of 60 percent in the last one year. The stock is currently trading at 20 times FY20e earnings and partially prices in improving industry outlook. Its multi-year expansion plan and operating efficiency measures make it an accumulation candidate

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.