-------------------------------------------------

Multimodal logistics company AllCargo Logistics delivered a strong operating performance in the second quarter of FY19. The earnings are anticipated to improve as the end market is witnessing a gradual shift to organised transporters. The company has multiple triggers and remains well positioned to scale the domestic business as well as gain share in the global trade market.

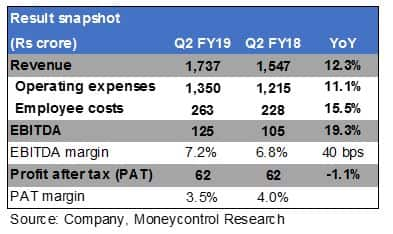

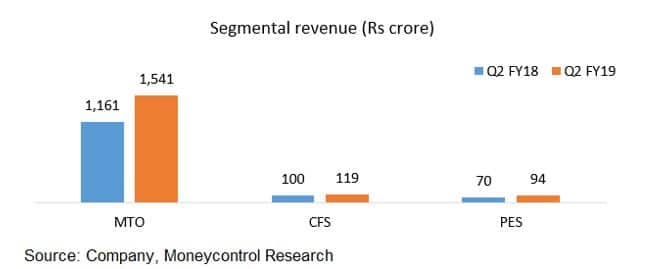

Healthy topline growth drives the operational performanceFor the quarter ended September 2018, AllCargo’s revenues increased 12 percent year-on-year (YoY) to Rs 1,737 crores driven by the healthy volume growth across all three business verticals – Multi-Modal Transport Operations (MTO), Container Freight Station (CFS) and Project & Engineering Solutions (PES). Operating performance was also strong as the earnings before interest, tax, depreciation and amortization (EBITDA) was 19 percent higher than last year.

MTO, Allcargo’s largest revenue segment, continued to gain share in global trade and reported healthy volume growth of 22 percent YoY. CFS volumes grew 22 percent YoY. The incremental volumes were driven by Kolkata operations as well as an increased share of Direct Port Delivery at JNPT. Both these segments have a strong operating history and generate a return on capital in excess of 25 percent.

PES business remains weak

PES business remains weak The performance of PES segment continues to be a drag on the overall business. In Q2FY19, the segment reported an operating loss of nearly a crore despite the 34 percent jump in the topline. Low asset utilisation, on account of subdued capex activity in the power, oil & gas, cement and steel sectors, is the primary reason for the weak operational performance.

The management is hopeful of an improved performance in coming quarters as the project transportation has an executable order book of nearly Rs 175 crore. In the equipment business, it has an order-book of Rs 75 crore which needs to be executed over next 6-10 months.

To reduce the idle capacity amidst subdued demand environment, the management has sold some of its assets (cranes & trailers) at 1.5x book value. The asset monetisation would not only free up locked-in capital but also allow the segment to achieve break-even much faster.

The logistics sector is witnessing a consolidation of warehouses post the implementation of Goods and services tax (GST). To tap into the market opportunity, Allcargo has decided to monetise its land banks across Bangalore (110 acres), Jhajjar (180 acres) and Hyderabad (30 acres) through the development of logistics parks. The construction at these locations is under way and revenue benefits from these facilities would start accruing from next financial year. The company aims to offer warehousing, contract logistics and first and last mile connectivity through these multi modal logistics parks. Further, the company is evaluating to set-up new warehouses across locations - Ahmedabad, Pune, Kolkata and Chennai.

Supply chain business gaining tractionThe logistics sector has seen a gradual transformation from transportation to supply chain management as the companies have started outsourcing non-essential business functions to focus on core business competencies. The introduction of the e-way bill has further strengthened the existing tailwinds in the supply chain business and should propel the industry to a double digit growth rate. Allcargo, through its supply chain & contract logistics subsidiary Avvashya CCI, is targeting a topline of Rs 1,000 crore in the next five years by offering warehousing, transporting & inventory management solutions to clients across sectors. The topline would be achieved by nearly tripling its warehousing facility to 10 million square feet by FY23.

Trade war remains a key business riskWorld trade activity has increased at a steady pace of 4-5 percent on the back of economic growth in the US, China, India & other emerging markets. While the global trade is expected to grow at a similar pace, the escalation of trade tensions between the US and China poses a short term risk. As per Maersk, the world's largest container shipping company, these restrictions could result in the realignment of trade activity among nations and potentially result in 0.5-2.0 percent container volume contraction.

Gradually build positions for long term

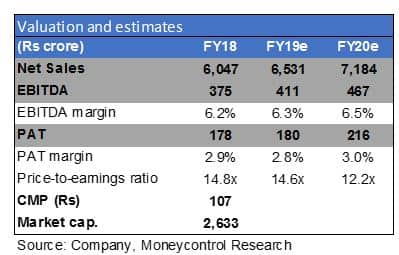

Investors should take advantage of the market volatility to build their positions in the stock over the next 3-6 months. We anticipate the positive developments will result in an acceleration in earnings towards the second half of next fiscal year. Further, an improvement of return ratios (FY18 RoCE was subdued at 10.6 percent) in line with the earnings could trigger a re-rating for Allcargo Logistics.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.