The government has finally set the stage for the disinvestment of debt-laden national carrier, Air India (AI), and has given an ‘in-principle’ approval for the strategic disinvestment of AI.

As per the financial eligibility criteria, IndiGo emerges as the probable candidate. In this note, we value the transaction and the likely impact of debt on the acquirer’s financials.

The proposed transaction – what is up for sale?The government has given the approval to divest AI by way of management control and sale of 76 percent stake in AI equity share capital including the shareholding interest AI has in the Air India Express Limited (AIXL) and Air India SATS Airport Services Private Limited (AISATS).

Following table summarises shareholding interest of AI in various entities and indicate whether those are part of the proposed transaction or not.

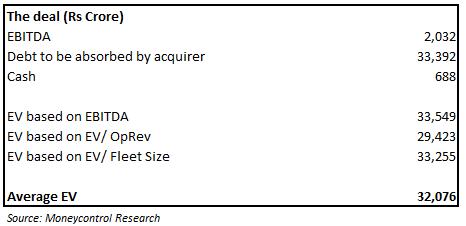

We value the transaction on the basis of three methods - EV/ EBITDA, EV/ Fleet Size, EV/ Revenue from operations. We analyse these multiples for the listed Indian Carriers - IndiGo, Jet Airways and SpiceJet and then take their average to value AI along with its subsidiary.

Using these multiples, we get average Enterprise Value (EV) of Rs 32,076 crore for AI and subsidiaries which are part of the transaction.

IndiGo, the leader in Indian Sky, has expressed the interest in acquiring AI publicly. In fact, as per the financial eligibility criteria set in preliminary information memorandum, IndiGo is the only carrier among domestic carriers which can bid for Air India. Others may bid in a consortium with foreign players.

Does the acquisition make sense for IndiGo?The management of IndiGo wishes to capture long-haul international market and believes that there are untapped international opportunities and Indigo has not yet got its fair share. The management believes that AI acquisition would give them access to coveted AI and AIXL’s network.

Currently, AI and AIXL has domestic passenger market share of around 12.27 percent and around 42.84 percent international traffic share. Acquiring the airline would give immediate access to domestic network and to the various restricted and closed foreign markets. Air India will strengthen its partners’ reach and give access to highly coveted prime slots on the foreign soil.

Moreover, going by the fleet size, IndiGo will almost double its fleet by acquiring AI and AIXL.

We did some back-of-the-envelope calculations and found that IndiGo is expected to face stress on both its balance sheet (debt burden of Rs 20.6 thousand crore) and income statement with the acquisition of Air India’s international and Express operations. However, carried forward losses of Rs 32,194 crore from AI are likely to give a lot of tax benefit to IndiGo during the initial turbulence with AI.

As of 3QFY2018, IndiGo has net cash of Rs11,454.7 crore in its balance sheet. IndiGo will have to take debt of close to Rs20,618.3 crore for acquiring AI. Given the current strong financial standing of IndiGo, it would not be very difficult for IndiGo to arrange that much money to acquire AI.

Assuming that IndiGo brings in operational efficiencies in AI and takes it EBITDA margin from 8 percent currently to 12 percent in two years and then gets 15 percent growth in EBITDA going forward then it would take approximately 8-9 years for the company to recover its cost. Prima facie, the payback period looks long but IndiGo, being the best-managed entity, may find many more synergies to shorten the payback period.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.