Investing in India’s listed startups is among the most polarising topics on Dalal Street but Devina Mehra, founder and chairperson of asset manager First Global, is clear — new-age tech companies are still richly priced and carry the risk of further correction.

In an exclusive interview to Moneycontrol, Mehra cited the examples of US-listed firms like Uber and DoorDash to drive home the point that even on a multi-year basis, these new-age companies have not been great performers.

“I'm not saying that at certain price if you will buy, you will not make money. But we are not really in that business…,” she said.

Mehra said First Global is a “risk-averse” portfolio manager and the focus is on avoiding big losses. Just because startup stocks have corrected by some margin, it does not mean they can’t fall more, she said.

“There are enough outperformers in the market without having to take extra risk,” Mehra said .

Also read: Capital goods our top sectoral pick in India, says Devina Mehra

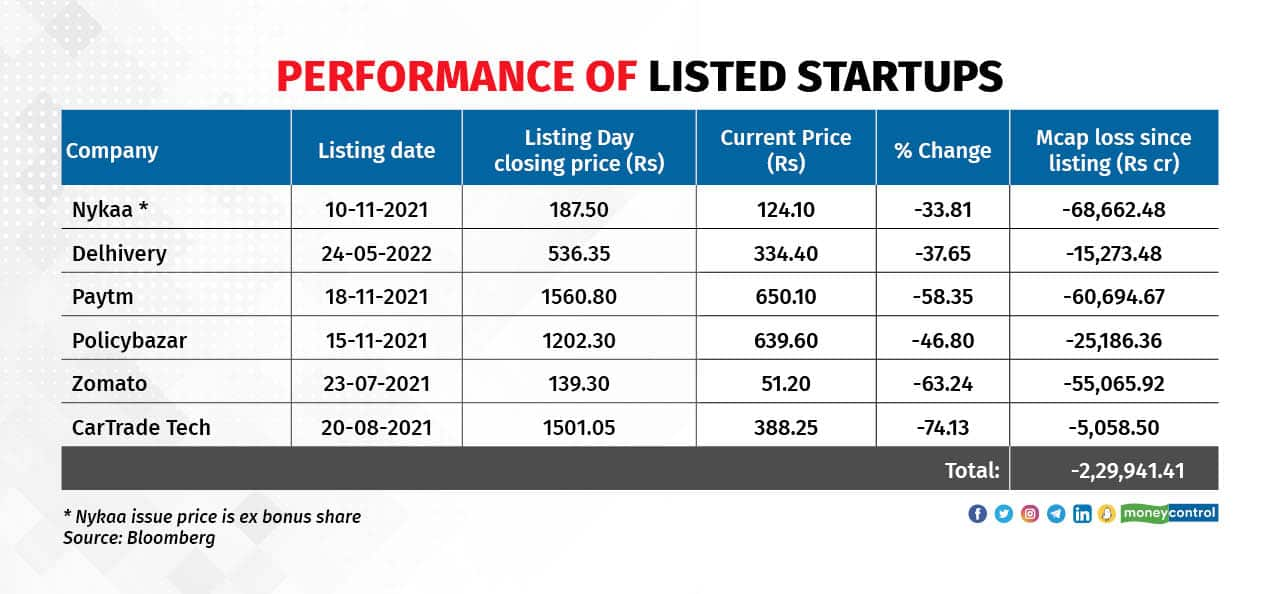

Listed new-age companies in India include Paytm, Zomato, Nykaa, Delhivery, PB Fintech and CarTrade Tech. After high-profile IPOs, all these counters are trading anywhere between 40-75 percent below their issue price.

With rising interest rates leading to the so-called funding winter for internet firms across the globe, companies are now focusing more on profitability, cost rationalisation and margin growth.

More pain ahead

However, India’s internet stocks could be in for more pain as more pre-IPO investors look to sell shares, analysts say.

As of March 2023, private equity and venture capital firms hold around $7 billion in listed Indian internet companies, Kotak Institutional Equities said in a recent report.

“While IPOs have slowed in the past 18 months, the velocity of exit has remained elevated in secondary markets in recent months, based on our analysis of shareholding data and bulk transactions,” the report said.

BofA Global Research believes that in the next three-six months, consumer tech companies will witness slightly slower growth on consumption slowdown and as they look to curtail discounts/expenses to focus on profitability.

But some analysts maintain that the long-term growth potential of these companies is significant and despite short-term challenges, these counters can provide decent returns.

Too much food, too much fashion?

In a report published on March 31, 2023, ICICI Securities said B2B e-commerce is likely to continue on a strong growth trajectory in Q4FY23E led by penetration increase, as small businesses explore means to expand their digital footprint both on supply and demand sides.

However, it projected a rocky road ahead for the B2C segment.

“Q3FY23 was a difficult quarter for most B2C e-commerce companies and investors were expecting a recovery in Q4FY23E. However, our channel checks indicate B2C growth may underwhelm expectations. We note signs of consumption fatigue across online food ordering and BPC e-commerce. This is in contrast to the buoyancy in some offline discretionary categories such as travel and hospitality,” its analysts noted.

ICICI Securities’ key picks are Delhivery, IndiaMart, Just Dial and Nazara Technologies.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.