The benchmark Nifty index was trading firm above 22,500 on May 21, albeit with high volatility. On a weekly scale, it has formed a sizeable bullish candle. The broader market indices have strongly outperformed.

In the past week, Nifty Realty and Nifty Metal were the best-performing sectors, posting gains of 7.43 and 7.03 percent, respectively, while Nifty FMCG was the worst-performing sector, losing 0.11 percent. This week, SBI Securities believes that select sectors will continue their strong performance.

According to Sudeep Shah, DVP and Head of Derivative Research at SBI Securities, "On a daily scale, the Nifty CPSE and Nifty PSE indices have given a horizontal trend breakout. Both indices have strongly outperformed the frontline indices. We believe these indices are likely to continue their upward journey in the next couple of trading sessions."

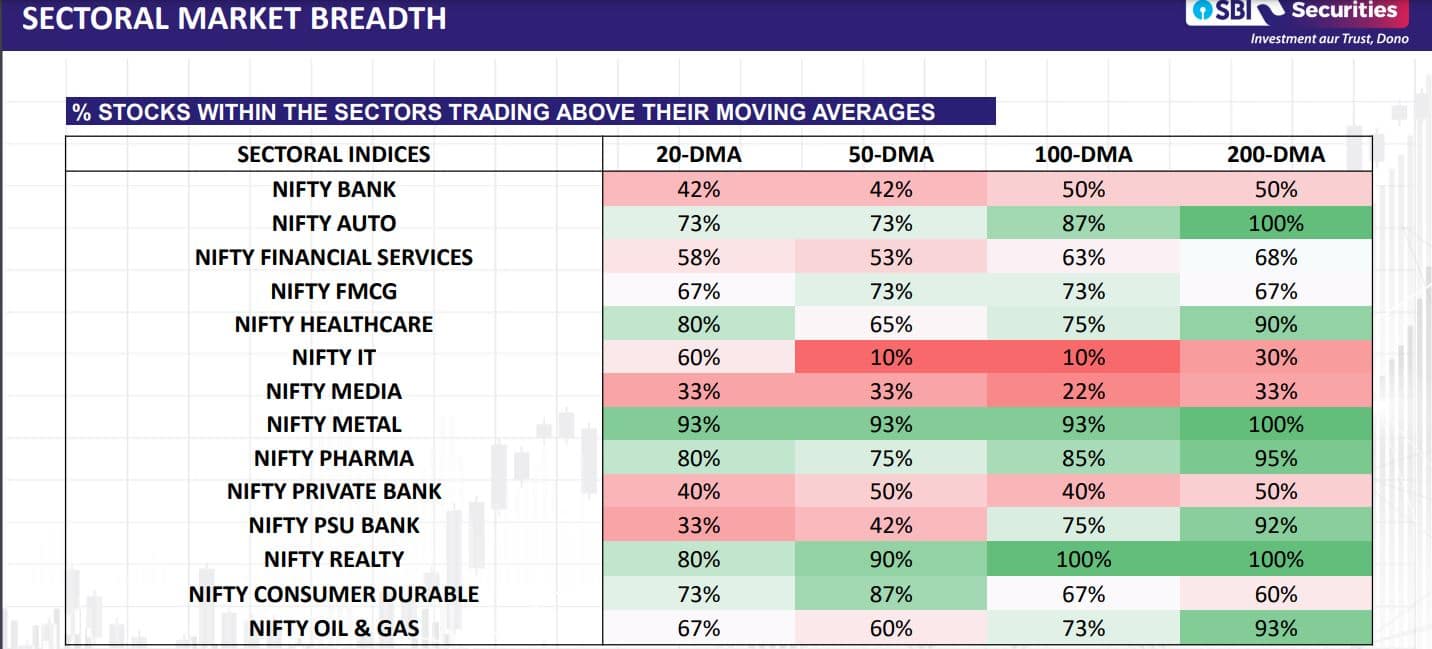

"Apart from this, the Defense, Auto, Metal, and Realty sectors are likely to continue their upward journey in the next couple of trading sessions. On the flip side, we recommend avoiding Nifty IT and Nifty Media for the next couple of trading sessions. Technically, both sectors are in a strong downtrend," he added.

Considering the current chart structure and OI data build-up, stocks from Capital Goods, Oil & Gas, Metal, Cement, Realty, Infrastructure, Power, Telecom, Banking, Finance, and Pharma may outperform the frontline indices.

Nifty Auto

The Auto index recorded a notable gain of 2.16 percent in the past week, achieving a fresh all-time high for the fourth consecutive week. The ratio chart of Nifty Auto versus Nifty has been in a steep uptrend during the consolidation of price action, and its most recent swing low is remarkably shallow, suggesting sustained outperformance in the sector. Going ahead, as long as it sustains above 22,900, it can test 23,700 on the upside, followed by 24,200. On the flip side, a close below 22,900 can pave the way for a correction towards 22,400.

From a broader perspective, the index is undergoing a significant consolidation phase following a robust 4,600-point rally from late October 2023 to mid-February 2024. Going forward, the level of 11,900-12,000 will act as immediate resistance for the index. Any sustainable move above 12,000 will lead to a further rally to the level of 12,300. On the downside, if 11,500 is breached, 11,300-11,200 could act as the next support zone.

Nifty FMCG

Nifty FMCG buyers have demonstrated resilience, evidenced by a recovery of approximately 2 percent from the week's lows. Going ahead, the level of 55,800-55,900 will act as immediate resistance for the index. Any sustainable move above 55,900 will lead to a further rally to the level of 56,400. On the downside, if 54,700 is breached, 54,200-54,300 could act as the next support zone.

Nifty IT

For the last four weeks, the index has been navigating a broad sideways consolidation phase. This consolidation has slightly tempered the trend strength indication; the 14-period daily ADX remains robust at 33.60, suggesting that negative sentiment within the IT sector persists. Going ahead, the level of 33,800-33,900 will act as immediate resistance for the index. Any sustainable move above 33,900 will lead to a further rally to the level of 34,300. On the downside, support is placed at the 32,900-32,800 zone.

Nifty Metal

The momentum indicator MACD has recently experienced a bullish crossover, despite the Metal index already being perched at a high altitude. The fast-paced 10-period Rate of Change, currently at 4.56, suggests significant potential for further upside, as does its trend strength indicator, the 14-period ADX. Going ahead, as long as the index trades above the support zone of 9,450-9,400, it can trend towards 9,800, followed by 10,000 in the short term. On the downside, if 9,400 is breached, 9,250 could act as the next support level.

Also read: Option strategy of the day|Long build up in Bata India; Use bull call spread for upside

Nifty Pharma

The index recovered from near its two swing lows. Although the index remains within the consolidation phase initiated in mid-March, it sustains the bullish momentum established by the pre-consolidation rally. Going ahead, the level of 19,300-19,400 will act as immediate resistance for the index. Any sustainable move above 19,400 will lead to a further rally to the level of 19,600 in the short term. On the downside, support is placed at the 18,950-18,900 zone.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.