Bata India’s derivative data reveals a long build-up with an open interest addition in futures and put writing at Rs 1,300 strike. The open interest in futures is at 41 lakhs, with a significant addition in the last two sessions.

The stock is currently trading at around Rs 1,374, up by 0.80 points. According to Avdhut Bagkar, Head of Technical and Derivative Research at Stoxbox, the at-the-money implied volatility (IV) is at 30.30, signaling a favorable bias.

Shah recommends taking a bull call spread strategy on Bata India stock to capture this momentum. "On the options side, long additions can be seen in the 1360 CE, 1380 CE, and 1400 CE. The PCR stands at 0.64, signaling a positive turnaround for the price action," he said.

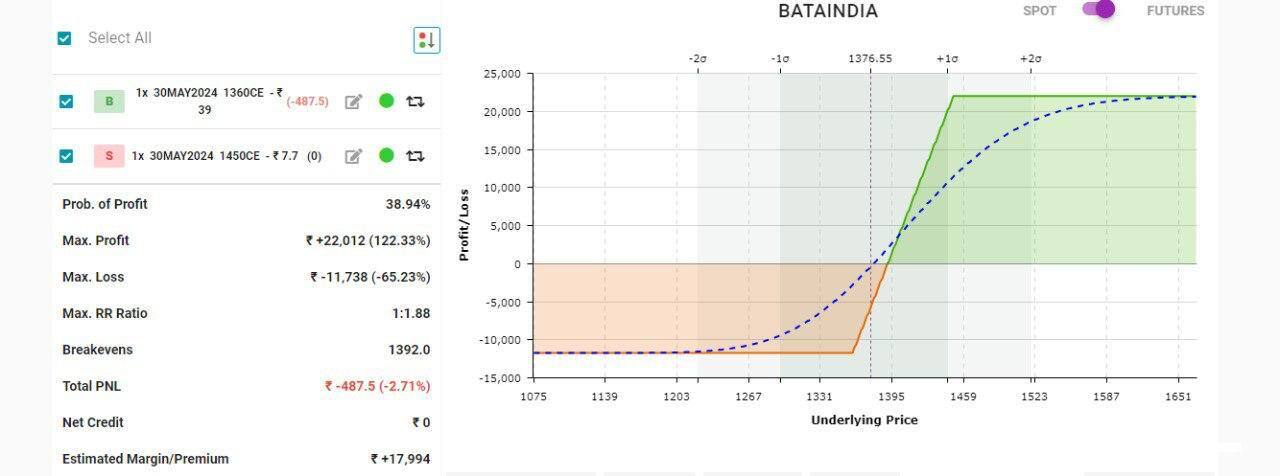

Bata India: (Bull Spread: 30th May Expiry)

- Buy 1360 CE at Rs 37-39

- Sell 1450 CE at Rs 8-9

- Maximum profit: Rs 22,000

- Maximum loss: Rs 11,000

- The estimated margin required stands at Rs 18,000.

The bull call spread is a type of options trading strategy that involves two call options. This type of strategy is used when the trader expects a moderate rise in the price of an underlying asset. The bull call strategy is executed by buying call options at a specific strike or exercise price while also selling the same number of calls of the same asset at a higher strike price.Technical View:Bagkar highlights that the stock has been on a downward spiral for several months, revealing bearish aggression. However, the recent reversal exhibits a pullback, which could lead to an upside if follow-up momentum emerges in the near term.

Derivative Setup:According to Bagkar, derivative data shows a long build-up in Bata India. "The at-the-money implied volatility (IV) is at 30.30, suggesting a favorable trend. The traded volume is at 1,63,000. The open interest for the in-the-money option stands at 9,55,150, while for the out-of-the-money option it is 23,80,875," he said.

Bagkar recommends taking a bull call spread, considering minor selling pressure around the 1500 level, where the next open interest appears to have significant interest.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.