The benchmark indices rebounded smartly after a day of correction, rising six-tenths of a percent on January 20, with the market breadth favouring bulls. A total of 1,662 shares advanced against 926 shares that declined on the NSE. The market may extend its upward journey, but sustainability is the key to watch, given the elevated volatility. Below are some trading ideas for the near term:

Jigar S Patel, Senior Manager - Equity Research at Anand Rathi

Indian Railway Catering & Tourism Corporation | CMP: Rs 791.1

On January 14, 2025, IRCTC formed a Bullish Harami pattern near a key historical support level from September 2023, signaling a potential trend reversal. This pattern was followed by a strong 7 percent rally, supported by a bullish RSI divergence, indicating shifting momentum. The confluence of these factors strengthens the bullish case for an upside move. Traders may consider entering long positions in the Rs 785-790 zone.

Strategy: Buy

Target: Rs 880

Stop-Loss: Rs 745

Chennai Petroleum Corporation | CMP: Rs 597.85

On December 19, 2024, Chennai Petroleum formed a strong bullish engulfing pattern, followed by a robust 15 percent rally, signaling significant buying interest. The recent pullback near the engulfing candle’s low held firm, with consistent closes above it, suggesting strong support and a potential reversal. Additionally, the RSI (Relative Strength Index) displayed a bullish divergence, reinforcing upward momentum. This confluence of technical factors points to a bullish outlook. Traders may consider entering long positions in the Rs 590-600 zone, with an upside target around Rs 665.

Strategy: Buy

Target: Rs 665

Stop-Loss: Rs 560

Rico Auto Industries | CMP: Rs 91.25

Rico Auto has recently formed a bullish triple bottom pattern accompanied by a bullish divergence, signaling a potential trend reversal. Additionally, in the current month, the stock took support at the monthly CPR (Central Pivot Range), a crucial zone often indicating strong buying interest, and reversed upward. On January 17, 2025, it surged by 4.66 percent, further confirming bullish momentum. Traders may consider entering long positions in the Rs 90-92 zone, with an upside target of Rs 103.

Strategy: Buy

Target: Rs 103

Stop-Loss: Rs 85

Jay Thakkar, Vice President & Head of Derivatives and Quant Research at ICICI Securities

Divis Laboratories | CMP: Rs 6,000.6

Divis Labs has been an outperformer in the pharma pack so far in this series, as most of the pharma stocks have corrected in the January series, apart from a few like Divis Labs and Biocon. As far as the technical setup is concerned, the stock has been consolidating for the past couple of weeks, forming a rectangular pattern, which is a bullish continuation pattern.

The momentum indicator MACD (Moving Average Convergence Divergence) has moved well into the buy mode on the daily charts, indicating a fresh upmove to resume from hereon. On the options front, the Rs 6,000 strike has the highest Call open interest, which, when taken off, will lead to further short covering, as there has been unwinding in Calls from Rs 5,800 to Rs 5,950 strikes. Moreover, there is good Put open interest at Rs 6,100 strike as well, so the bulls have an upper hand until the Rs 5,800 level is held on a closing basis.

Strategy: Buy

Target: Rs 6,300

Stop-Loss: Rs 5,830

Bajaj Finance | CMP: Rs 7,440

Bajaj Finance has been trading within a range and has reversed from the lower end of the range with a bullish crossover in the momentum indicator MACD on both the daily and weekly charts. The stock has outperformed the Nifty as well as Nifty Financial Services in the recent fall, as it didn’t decline much and has again provided a breakout from the sideways consolidation. On the options front, the stock has witnessed significant Put writing from the Rs 6,500 strike to Rs 7,400 strike, as well as Call unwinding. There is only the Rs 7,500 strike where significant Call writing is observed, so once that level is taken out, the overall momentum will likely drive the stock toward Rs 7,700 levels.

Strategy: Buy

Target: Rs 7,700

Stop-Loss: Rs 7,240

Bajaj Auto | CMP: Rs 8,544.4

Bajaj Auto has been forming a falling wedge pattern on the daily charts, a bullish reversal pattern. The stock has seen significant short buildup and is oversold in the near term. There has been a huge positive divergence on the daily charts, and the stock may witness short covering anytime soon, so a contra bet can be considered at current levels.

Strategy: Buy

Target: Rs 9,000, Rs 9,150

Stop-Loss: Rs 8,390

Anshul Jain, Head of Research at Lakshmishree Investments

Biocon | CMP: Rs 401.55

Biocon closed the day showcasing a promising 91-day bullish Cup-and-Handle pattern on its daily charts, signaling strong upside potential. With volumes surpassing the 50-day moving average near Rs 398, the stock's positive structure is well-established. Notably, the right side of the pattern displayed robust volume bars, a clear indicator of institutional accumulation. This technical breakout suggests growing investor confidence in Biocon's trajectory. As the pharmaceutical giant continues to attract attention, traders and investors may find this a compelling opportunity for further gains. Keeping a close eye on volume trends and support levels could help capitalize on this upward momentum.

Strategy: Buy

Target: Rs 490

Stop-Loss: Rs 380

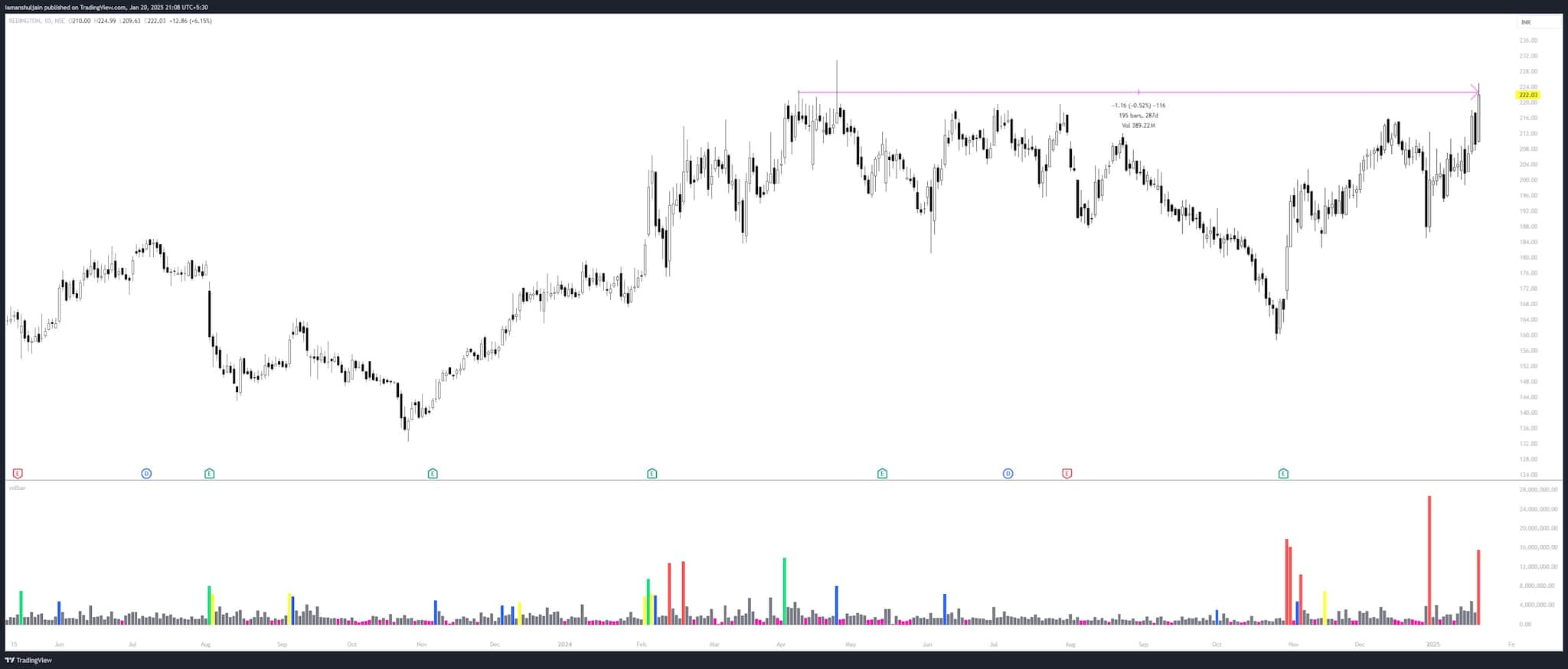

Redington | CMP: Rs 222

Redington ended the last day with an impressive 153-day bullish Cup-and-Handle breakout, signaling a robust upward trend. Volumes surged to over 500 percent of the 50-day average, a strong indication of institutional participation driving the breakout. The right side of the pattern features multiple bars with volumes exceeding the 50-day average, further confirming steady institutional accumulation. This well-formed structure reflects growing confidence among investors and sets the stage for potential sustained gains. With strong volume backing and a positive technical setup, Redington appears poised for a compelling upward trajectory in the coming sessions.

Strategy: Buy

Target: Rs 280

Stop-Loss: Rs 190

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!