The benchmark indices extended their downtrend for the third straight session, with the Nifty 50 down by 0.9 percent on October 17. About 1,907 shares declined, while 584 shares gained on the NSE. The index may see further selling pressure in the upcoming session, given the negative sentiment. Below are some trading ideas for the near term:

Amol Athawale, VP-technical Research at Kotak Securities

Tata Consultancy Services | CMP: Rs 4,109

After the short-term correction in TCS from the higher levels, the downward momentum has stopped around its support area. On daily charts, the counter has formed a Morning Star candlestick reversal formation at its important demand zone. Therefore, the structure suggests a revival of the uptrend from the current levels in the near term.

Strategy: Buy

Target: Rs 4,400

Stop-Loss: Rs 3,950

State Bank of India | CMP: Rs 811

On the daily scale, post-correction from the higher levels, SBI is trading in a rangebound mode. However, it has given a range breakout along with good volumes. In addition, on the daily charts, the counter has formed a higher bottom series. Therefore, the closing above the resistance line indicates that further bullish momentum may continue in the coming horizon.

Strategy: Buy

Target: Rs 860

Stop-Loss: Rs 780

NCC | CMP: Rs 310.6

After the decline from the higher levels, NCC rebounded from its support zone and has witnessed a steady recovery from the lower levels. Additionally, on the daily charts, the counter has given a breakout from its sloping channel formation. The up moves in the counter suggest a new leg of bullish trend from the current levels.

Strategy: Buy

Target: Rs 330

Stop-Loss: Rs 295

Mandar Bhojane, Equity Research Analyst at Choice Broking

V-Mart Retail | CMP: Rs 4,440

V-Mart Retail has recently consolidated within a range, indicating a possible breakout on the daily chart, supported by a significant increase in trading volume. This suggests potential bullish momentum. If the price sustains above the Rs 4,475 level, it could target short-term levels of Rs 4,900 and Rs 5,000. On the downside, immediate support is at Rs 4,200, offering a potential buying opportunity on dips. The Relative Strength Index (RSI) is currently at 65 and trending upward, indicating increasing buying momentum.

Strategy: Buy

Target: Rs 4,900, Rs 5,000

Stop-Loss: Rs 4,070

Infosys | CMP: Rs 1,968

Infosys has recently formed a rounding bottom pattern on the daily chart, accompanied by a significant increase in trading volume. This indicates a possible breakout and a strong bullish trend. If the price closes above the Rs 1,980 level, it could potentially reach short-term targets of Rs 2,090 and Rs 2,150. On the downside, immediate support is at Rs 1,920, which could offer a buying opportunity on dips. The RSI currently stands at 59.35 and is trending upward, signaling increasing buying momentum.

Strategy: Buy

Target: Rs 2,090, Rs 2,150

Stop-Loss: Rs 1,880

Chandan Taparia, Head - Equity Derivatives & Technicals, Wealth Management at Motilal Oswal Financial Services

Mphasis | CMP: Rs 3,080

Mphasis has bounced from its major support levels with higher-than-average buying volumes, suggesting a bullish move can be seen. It has formed a strong bullish candle on the daily scale, and the RSI, which measures the momentum of a stock, has turned up from the centerline, indicating the stock has room to move up.

Strategy: Buy

Target: Rs 3,300

Stop-Loss: Rs 2,970

Larsen & Toubro | CMP: Rs 3,570

L&T has taken support near the 200 DEMA (daily Exponential Moving Average) and has also given a range breakout on the daily scale with noticeable volumes, which may support the ongoing bullish momentum. The MACD (Moving Average Convergence Divergence) indicator is on the verge of giving a bullish crossover, which could support the upward momentum.

Strategy: Buy

Target: Rs 3,720

Stop-Loss: Rs 3,480

HDFC Asset Management Company | CMP: Rs 4,728.7

HDFC AMC is trading near its all-time high price and is in a strong uptrend. The price has broken out of a long consolidation zone on the upside with higher-than-average buying volumes, supporting the up move. The ROC (Rate of Change) momentum indicator has turned up, reinforcing the up move.

Strategy: Buy

Target: Rs 5,200

Stop-Loss: Rs 4,500

Virat Jagad, Technical Research Analyst at Bonanza

GMM Pfaudler | CMP: Rs 1,468

GMM Pfaudler has broken out of an ascending triangle pattern on the daily chart, indicating a potential uptrend. The sharp increase in trading volume suggests strong buying interest, supporting a bullish outlook. The stock is trading above key EMAs, adding to the positive momentum, with the RSI also moving higher, confirming the bullish trend. The stock might face resistance around Rs 1,500, and if it breaks above this level, it could rise further towards Rs 1,575. On the downside, immediate support is at Rs 1,420.

Strategy: Buy

Target: Rs 1,575

Stop-Loss: Rs 1,420

Kalyani Investment Company | CMP: Rs 7,110.7

Kalyani Investment Company has broken out from a rectangle pattern on the daily chart, a strong bullish signal suggesting the potential for continued price gains. The rise in trading volume during the last session shows growing buying interest, reinforcing the positive outlook. The stock is trading above key EMAs, aligning with the bullish trend. The DMI+ (Directional Movement Index) has crossed above the DMI-, indicating a favourable trend shift, while the ADX (Average Directional Index) is moving up, signaling a strengthening trend. Overall, these indicators point to a bullish scenario with potential for further gains in the near term.

Strategy: Buy

Target: Rs 7,850

Stop-Loss: Rs 6,760

Rohan Shah, Technical Analyst at Asit C Mehta Investment Interrmediates

Bata India | CMP: Rs 1,435

After two years of underperformance, Bata has dropped to a key support zone, coinciding with the 100-month EMA and demand zone. Around this level, multiple long wicks have formed, indicating buying demand at lower levels. On the lower time frame, the momentum indicator has formed a bullish divergence, complementing the bullish bias in the price.

Strategy: Buy

Target: Rs 1,550

Stop-Loss: Rs 1,375

Hindalco Industries | CMP: Rs 734.8

Hindalco has been in an uptrend for several months, with a gradual increase in volumes. Recently, the stock broke out from an elevated basing pattern and has since rebounded, finding support at the neckline of the pattern, indicating inherent strength. The stock is trading above all its key moving averages, signaling continued strength and momentum in price.

Strategy: Buy

Target: Rs 795

Stop-Loss: Rs 700

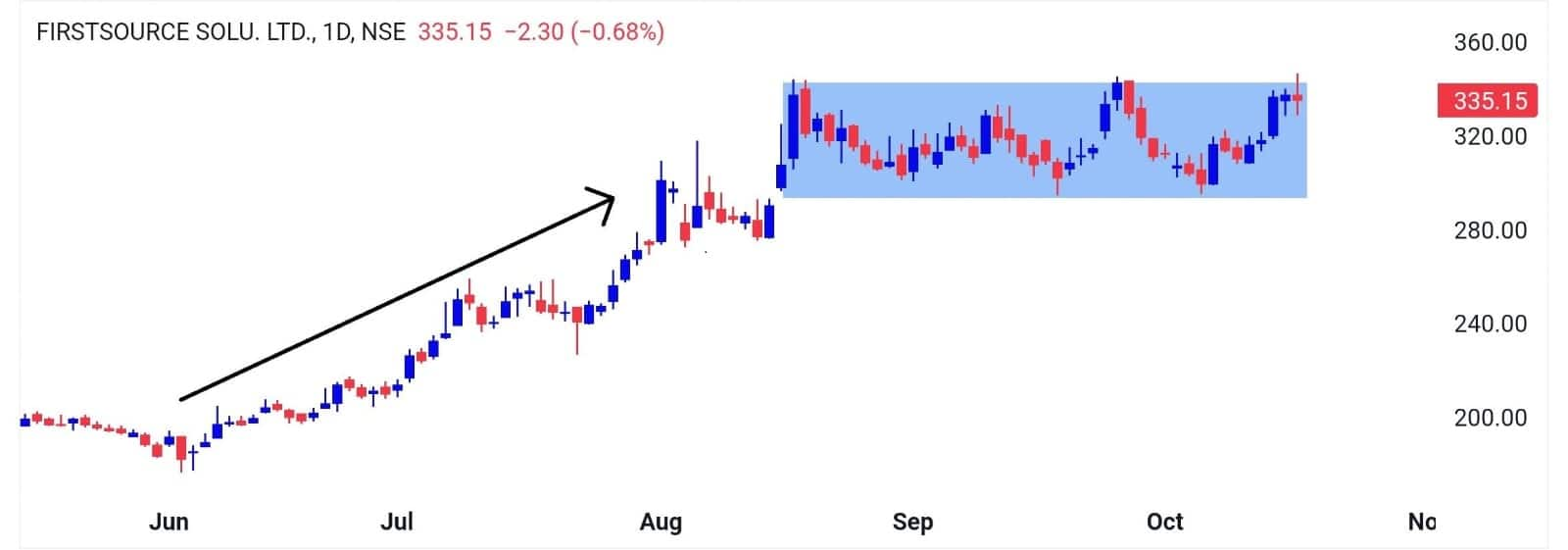

Firstsource Solutions | CMP: Rs 338

Firstsource Solutions witnessed a vertical rally from June 2024 to August 2024, followed by a period of sideways trading within a defined range. However, despite profit booking in the broader markets, the stock is attempting to break out of this consolidation, reflecting inherent strength and higher relative strength in price.

Strategy: Buy

Target: Rs 370

Stop-Loss: Rs 315

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.