The market on August 29 continued its upward journey for the second consecutive session but with volatility and amid consolidation. The Nifty faced strong resistance at 19,350-19,400; hence breaking the level decisively can lift the index towards 19,500-19,600, whereas the support is expected to remain at 19,250, experts said.

The BSE Sensex rose 79 points to 65,076, while the Nifty50 climbed 37 points to 19,343, and formed a bearish candlestick pattern on the daily charts as the closing was lower than opening levels, but continued making higher tops and higher bottoms formation for yet another session.

"On the daily charts, we can observe that the Nifty has been hovering around the 40-day moving average (19,359) since the past couple of trading sessions. As long as the Nifty holds above 19,250, we can expect the consolidation to continue," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

On the downside, he feels 19,250-19,230 is the crucial support zone while on the upside, 19,450-19,470 shall act as a crucial resistance from a short-term perspective.

"Daily and hourly momentum indicators have a positive crossover, which is a buy signal. However, prices are trading at a resistance and hence we shall wait for a price confirmation," he said.

The broader markets continued their northward journey, with the Nifty Midcap 100 and Smallcap 100 indices rising 0.3 percent and 0.5 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may get support at 19,317, followed by 19,301 and 19,274. In case of an upside, 19,370 can be the key resistance, followed by 19,386 and 19,412.

On August 29, the Bank Nifty ended the volatile session on a flat note, rising just 0.6 points to 44,495.3 and forming a bearish candlestick pattern on the daily charts, but made higher highs and higher lows formation for yet another session.

"The Bank Nifty index remains engaged in a struggle between bulls and bears, resulting in a phase of sideways trading. The Option data reflects a broad range, with notable open interest concentrations at both the 44,000 Put strike and the 45,000 Call strike," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

In terms of immediate technical levels, he feels the index faces a resistance obstacle at 44,650. "A decisive breach above this level is anticipated to ignite a fresh upward movement, potentially steering the index towards the 45,000 mark," he said.

The pivot point calculator indicates that the Bank Nifty is likely to take support at 44,440, followed by 44,382 and 44,289. On the upside, the initial resistance is at 44,626, followed by 44,683 and 44,776.

As per the options data, the maximum monthly Call open interest (OI) remained at 19,500 strike with 1.38 crore contracts, which can act as a key resistance for the Nifty. It was followed by 19,400 strike, which had 1.18 crore contracts, while 19,600 strike had 94.36 lakh contracts.

The maximum Call writing was seen at 19,400 strike, which added 20.84 lakh contracts, followed by 19,700 and 19,900 strikes, which added 11.55 lakh and 10.34 lakh contracts, respectively.

We have seen the maximum Call unwinding at 19,800 strike, which shed 14.21 lakh contracts, followed by 19,300 strike and 19,000 strike, which shed 6.76 lakh contracts, and 84,300 contracts, respectively.

On the Put front, we continued to see the maximum Put open interest at 19,300 strike, with 1.26 crore contracts. This can be an important support for Nifty in the coming sessions.

It was followed by 19,000 strike, comprising 1.09 crore contracts, and 19,200 strike with 97.2 lakh contracts.

The maximum Put writing was seen at 19,300 strike, which added 18.28 lakh contracts, followed by 19,100 strike and 19,000 strike, which added 15.4 lakh and 14.99 lakh contracts, respectively.

Meaningful Put unwinding was at 18,700 strike, which shed 9.81 lakh contracts, followed by 18,600 and 18,500 strikes, which shed 5.32 lakh and 2.32 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Infosys, Alkem Laboratories, SBI Life Insurance Company, Bharti Airtel, and UltraTech Cement were among the stocks that saw the highest delivery.

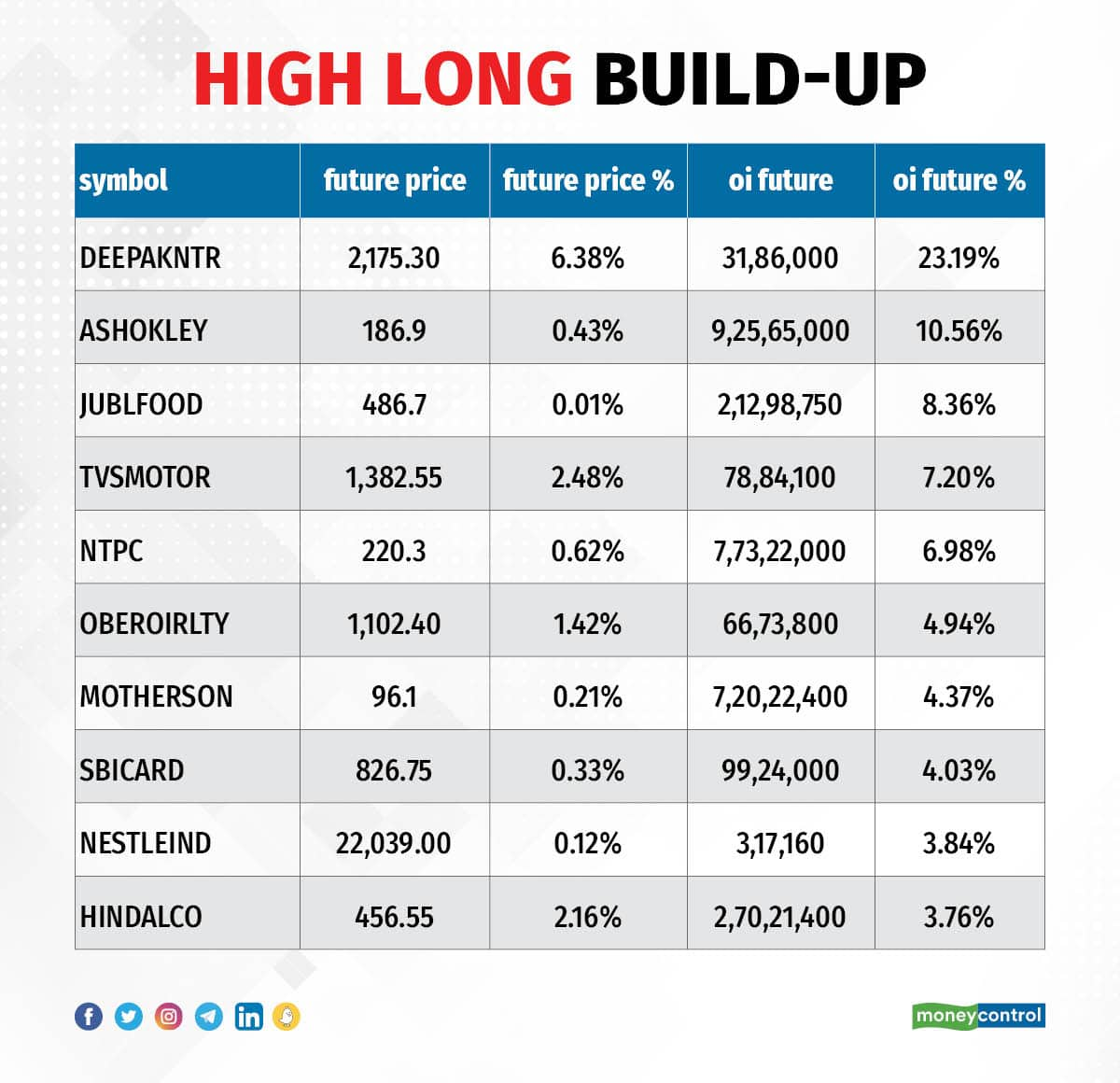

Deepak Nitrite, Ashok Leyland, Jubilant Foodworks, TVS Motor Company, and NTPC were among the 40 stocks to see a long build-up. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 40 stocks, including Ipca Laboratories, Bata India, Dr Lal PathLabs, ICICI Lombard General Insurance, and IndiaMART InterMESH saw long unwinding. A decline in OI and price indicates long unwinding.

19 stocks see a short build-up

A short build-up was seen in 19 stocks, including Aditya Birla Capital, Balrampur Chini Mills, AU Small Finance Bank, HDFC AMC, and M&M Financial Services. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 88 stocks were on the short-covering list. These included Persistent Systems, Bosch, Coforge, India Cements, and UltraTech Cement. A decrease in OI along with a price increase is an indication of short-covering.

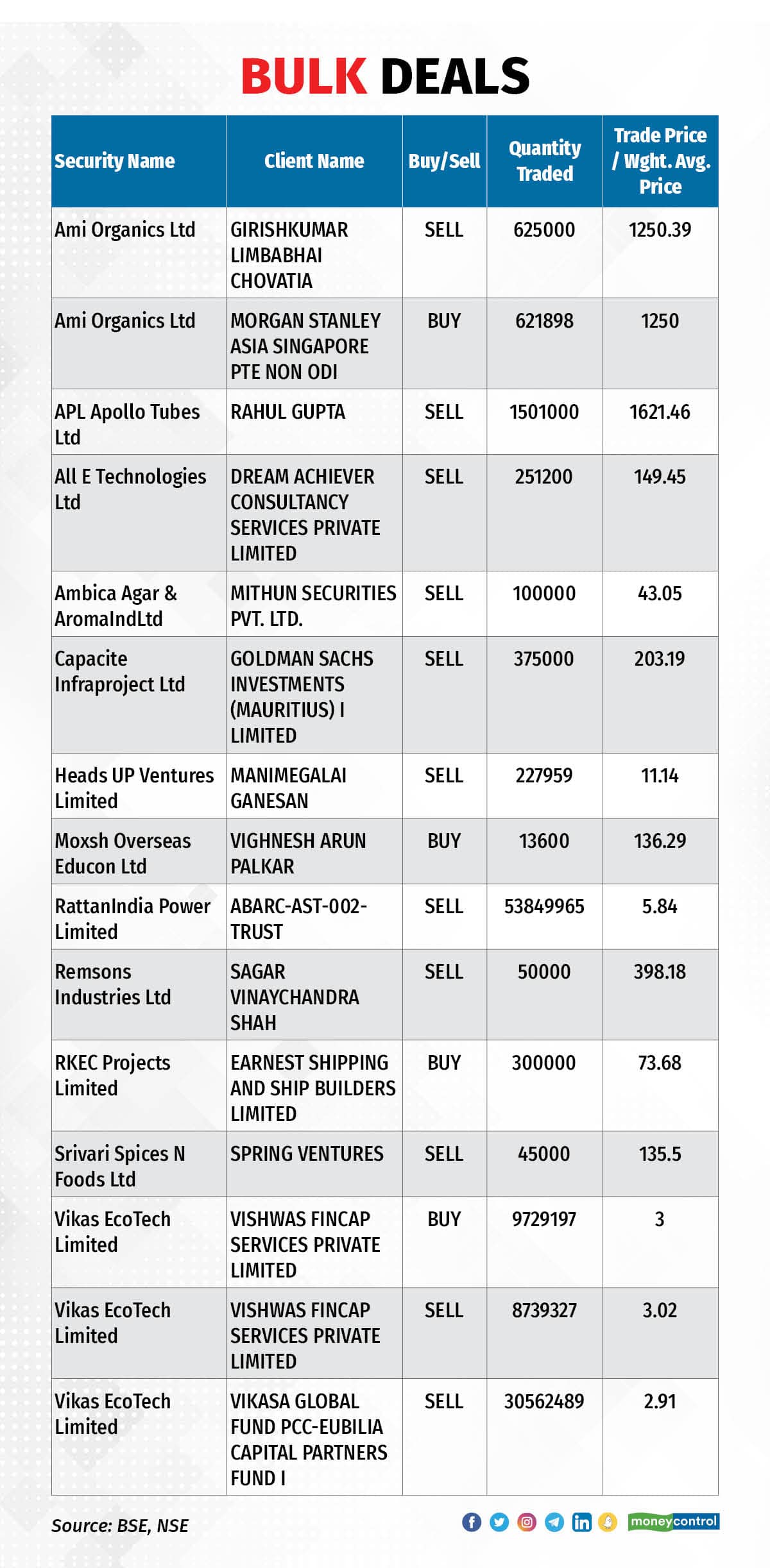

(For more bulk deals, click here)

Investors meeting on August 30

Stocks in the news

Lupin: Subsidiary Lupin Pharma Canada has launched Propranolol LA (long-acting) capsules, with 60 mg, 80 mg, 120 mg and 160 mg strengths in Canada. Propranolol LA is a generic equivalent of Inderal LA, which is used to treat heart problems, anxiety, and migraines.

Zomato: SoftBank Vision Fund (SVF Global) is likely to offload 1.17 percent stake it holds in food delivery giant Zomato for Rs 940 crore via a block deal, CNBC TV-18 reported citing sources. A total of 10 crore shares will be sold by SVF Growth Fund, at a price of Rs 94 apiece, the sources added. Svf Growth (Singapore) Pte Ltd holds 3.35 percent stake in Zomato as of June 2023.

Central Bank of India: The public sector lender has entered into a strategic co-lending partnership with IKF Home Finance to offer MSME and home loans. IKF Home Finance manages assets totalling Rs 696.10 crore via operations in 6 states. Also, Central Bank of India entered into a strategic co-lending partnership with Samunnati Financial Intermediation & Services to offer agriculture and MSME loans. Samunnati is functioning in 22 states, with an AUM of Rs 1,150 crore.

GR Infraprojects: Subsidiaries GR Belgaum Raichur (Package-5) Highway Private Limited and GR Belgaum Raichur (package-6) Highway Private Limited, have executed the concession agreement, for road projects worth Rs 1,457.24 crore, with the National Highways Authority of India.

MPS: Subsidiary MPS Interactive Systems has agreed to acquire 65 percent stake in Liberate Group (comprising Liberate Learning Pty Ltd (Australia), Liberate eLearning Pty Ltd (Australia), App-eLearn Pty Ltd (Australia), and Liberate Learning (New Zealand)). The remaining 35 percent shareholding of each of the entities of the Liberate Group will be acquired by MPSi in subsequent tranches.

SBFC Finance: The non-banking finance company has recorded a standalone net profit of Rs 47 crore for the quarter ended June FY24, rising 46.5 percent over Rs 32 crore profit in the year-ago period. Net interest income grew by 40.6 percent on-year to Rs 141 crore during the same quarter.

Fund Flow (Rs Crore)

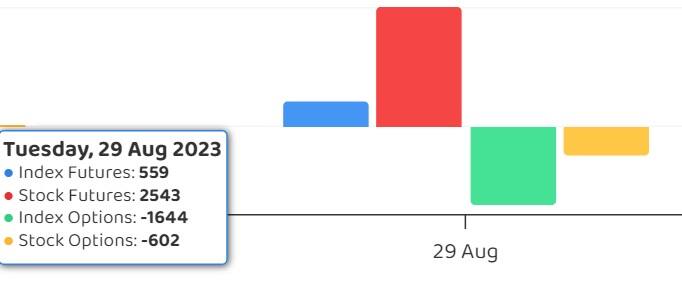

Foreign institutional investors (FII) bought shares worth Rs 61.51 crore, while domestic institutional investors (DII) purchased Rs 305.09 crore worth of stocks on August 29, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has retained Escorts Kubota, GMR Airports Infrastructure, Hindustan Copper, Indiabulls Housing Finance, Manappuram Finance, RBL Bank, and Sun TV Network to its F&O ban list for August 30, while removing BHEL, and India Cements from the said list.

Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!