The Indian market closed in the green for the second straight day on April 28, which helped the Sensex climb above 32,000 and the Nifty reclaim 9,300 levels, a shade below its crucial resistance level of 9,400.

The Sensex closed the day with a gain of 1.17 percent at 32,114.52 and the Nifty settled 1.06 percent higher at 9,380.90.

The Nifty failed to hold on to the 9,400 level but closed near its strong opening levels and formed a Dragonfly Doji pattern on the daily charts.

A Dragonfly Doji pattern signals indecision among traders but also indicates that the bulls managed to bring the index close to the opening level. The index has to clear the immediate hurdle of 9,400 for bullish sentiment to continue.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for Nifty According to pivot charts, the key support level for Nifty is placed at 9,292.47, followed by 9,204.03. If the index continues moving up, key resistance levels to watch out for are 9,436.87 and 9,492.83.

Nifty Bank The Nifty Bank closed 2.94 percent up at 20,671.10. The important pivot level, which will act as crucial support for the index, is placed at 20,370.84, followed by 20,070.57. On the upside, key resistance levels are placed at 20,861.34 and 21,051.57.

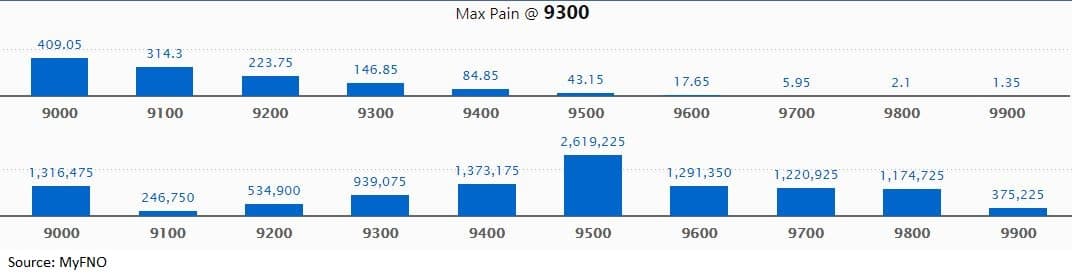

Call option data Maximum call OI of 26.19 lakh contracts was seen at the 9,500 strike. It will act as crucial resistance in the April series.

This is followed by 9,400, which holds 13.73 lakh contracts, and 9,000 strikes, which has accumulated 13.16 lakh contracts.

Significant call writing was seen at the 9,700, which added 2.45 lakh contracts, followed by 9,400 strikes that added 2.15 lakh contracts.

Call unwinding was witnessed at 9,300, which shed 2.9 lakh contracts, followed by 9,200 strikes, which shed 1.97 lakh contracts.

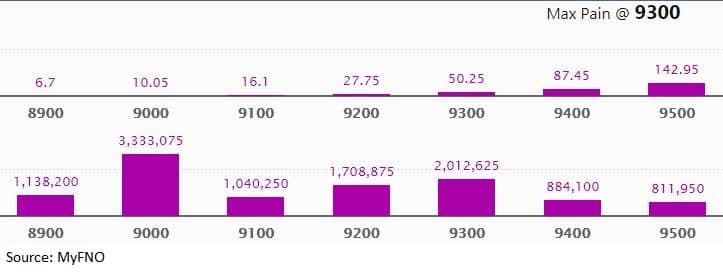

Put option data Maximum put OI of 33.33 lakh contracts was seen at 9,000 strike, which will act as crucial support in the April series.

This is followed by 9,300, which holds 20.13 lakh contracts, and 9,200 strikes, which has accumulated 17.09 lakh contracts.

Significant put writing was seen at 9,300, which added 9.63 lakh contracts, followed by 9,400 strikes, which added 5.72 lakh contracts.

Put unwinding was seen at 9,100, which shed 45,375 contracts, followed by 9,600 strikes that shed 16,950 contracts.

Stocks with a high delivery percentage A high delivery percentage suggests that investors are showing interest in these stocks.

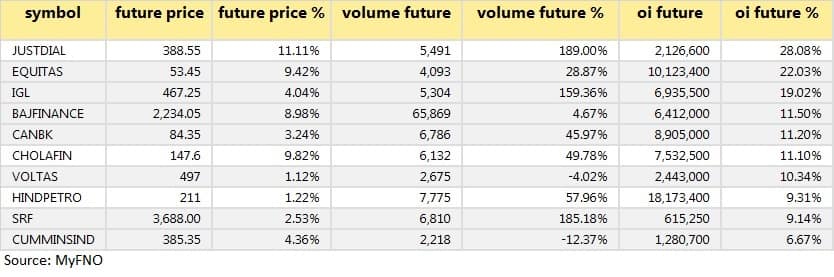

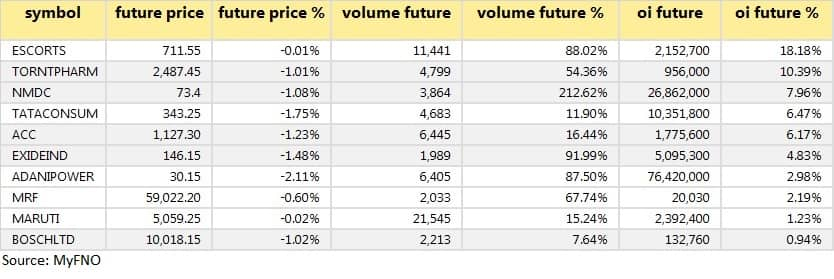

37 stocks saw long build-up Based on OI future percentage, here are the top 10 stocks in which long build-up was seen.

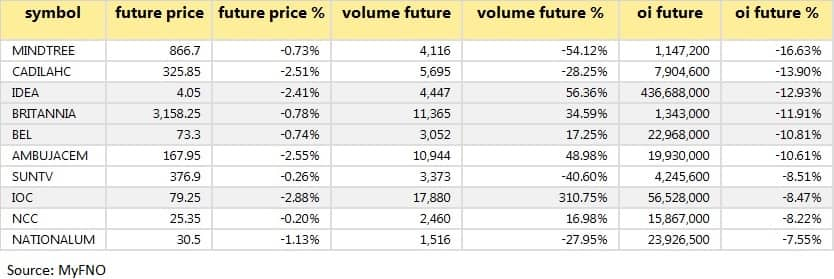

42 stocks saw long unwinding Based on OI future percentage, here are the top 10 stocks in which long unwinding was seen.

15 stocks saw short build-up An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on OI future percentage, here are the top 10 stocks in which short build-up was seen.

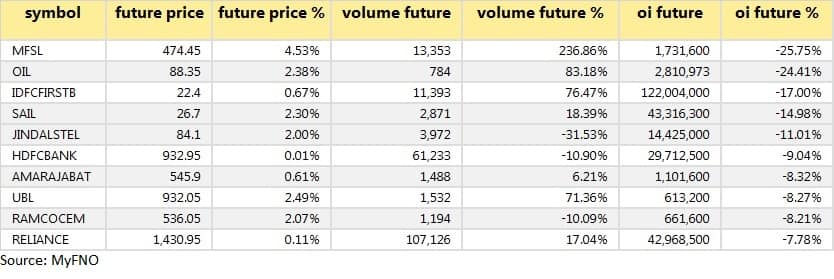

52 stocks witnessed short-covering A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on OI future percentage, here are the top 10 stocks in which short-covering was seen.

Board meetings Hexaware Technologies: The board will meet on April 29 to release its March quarter scorecard.

The respective boards of Hester, Kanchi Karpooram, Nxtdigital and VTM will meet on April 29 for general purposes.

Stocks in the news Axis Bank Q4: Net loss at Rs 1,388 crore versus a profit of Rs 1,505 crore; net interest income rose 19.3 percent to Rs 6,807.74 crore YoY. Board authorised the bank to borrow/raise funds up to an amount of Rs 35,000 crore.

PNB Housing: Neeraj Vyas to be interim MD and CEO of the company.

Biocon: Company and Mylan launched biosimilar Fulphila in Canada.

NLC India:Company commenced coal production at Talabira II and III mines.

Zee Entertainment:FPIs rose stake to 68.27 percent in Q4FY20 (from 67.38 percent QoQ), SBI-ETF Nifty50 increased stake to 2.03 percent (from 1.47 percent).

Fund flow

FII and DII data Foreign institutional investors (FIIs) sold shares worth Rs 122.15 crore, while domestic institutional investors (DIIs) bought shares worth Rs 389 crore in the Indian equity market on April 28, provisional data available on the NSE showed.

Stock under F&O ban on NSE No security is under the F&O ban for April 29. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!