The market started off the week on a positive note with the Nifty50 closing at a five-month high tracking a northward journey in global counterparts. Most of the sectors participated in the run-up.

The BSE Sensex rallied 318 points to 62,346, while the Nifty50 jumped 84 points to 18,399 and formed a bullish candlestick pattern on the daily scale making higher top higher bottom formation.

“A reasonable positive candle was formed on the daily chart with upper and lower shadows. Technically, this pattern indicates a formation of a high wave type candle pattern at the highs. Normally, such high wave patterns reflect ongoing volatility in the market at the highs,” Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He feels the underlying short-term trend of Nifty continues to be positive.

“The market is still facing hurdles around 18,400 levels and the intraday weakness is emerging from the highs. Any dips could be a buying opportunity around 18,280-18,200 levels,” he said, adding a sharp upside above 18,400 could open further upmove towards 18,600-18,800 levels in the near term.

The Nifty Midcap 100 and Smallcap 100 indices climbed 0.7 percent and 0.8 percent, respectively on positive breadth.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot charts indicate that the Nifty may get support at 18,317, followed by 18,276 and 18,211. If the index advances, 18,447 would be the initial key resistance level to watch out for, followed by 18,488 and 18,553.

The Bank Nifty was the key driver for a rally in Nifty50, gaining 278 points to end at a record closing high of 44,072. The banking index has formed a bullish candlestick pattern on the daily scale, making higher tops for the third straight session.

It managed to close just above the psychological level of 44,000, which is a positive indication. “The decent addition in the 44,000PE suggests that there is strong support at 44,000. However, a decisive fall below 44,000 could potentially trigger panic in the banking sector,” Rupak De, Senior Technical analyst at LKP Securities said.

On the other hand, a decisive move above 44,152 might propel the Bank Nifty towards the 44,500 level, while the key support levels to watch out for are 44,000 and 43,700.

As per the pivot point calculator, the Bank Nifty may take support at 43,778, followed by 43,664 and 43,478. Key resistance levels are expected to be 44,149 along with 44,263 and 44,449.

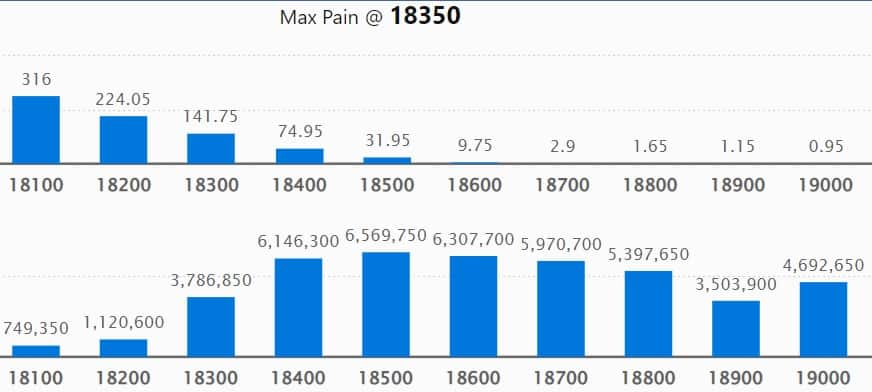

On the weekly options front, the maximum Call open interest (OI) was at 18,500 strike, with 65.69 lakh contracts, which is expected to be a crucial resistance level for the Nifty in the coming sessions.

This was followed by 18,600 strike comprising 63.07 lakh contracts, and 18,400 strike with more than 61.46 lakh contracts.

Call writing was at 18,400 strike, which added 18.45 lakh contracts, followed by the 18,700 strike, which added 16.29 lakh contracts, and 18,600 strike, which added 14.99 lakh contracts.

Meaningful Call unwinding was at 18,300 strike, which shed 24.15 lakh contracts, followed by 18,200 strike, which shed 11.08 lakh contracts, and 19,300 strike, which shed 1.58 lakh contracts.

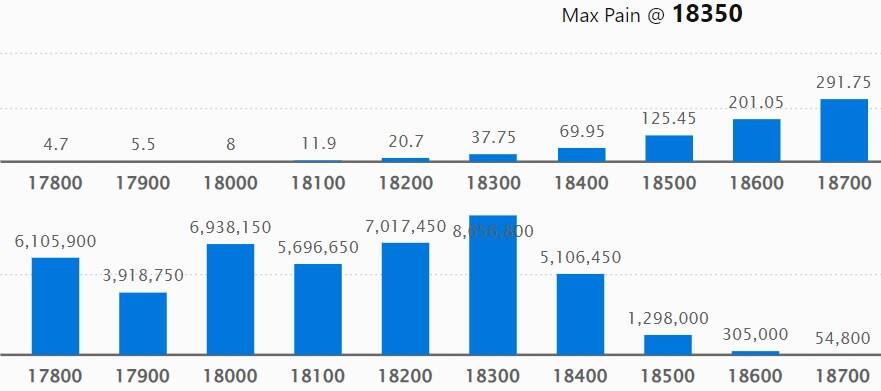

The maximum Put open interest was at 18,300 strike with 86.56 lakh contracts, which is expected to act as an important support level in the coming sessions.

This was followed by the 18,200 strike, comprising 70.17 lakh contracts, and the 18,000 strike where we have 69.38 lakh contracts.

Put writing was seen at 18,400 strike, which added 40.9 lakh contracts, followed by 18,300 strike, which added 22.11 lakh contracts, and 17,800 strike which added 21.77 lakh contracts.

We have seen Put unwinding at 17,500 strike, which shed 5.36 lakh contracts, followed by 17,200 strike, which shed 1.61 lakh contracts, and 17,600 strike, which shed 1.16 lakh contracts.

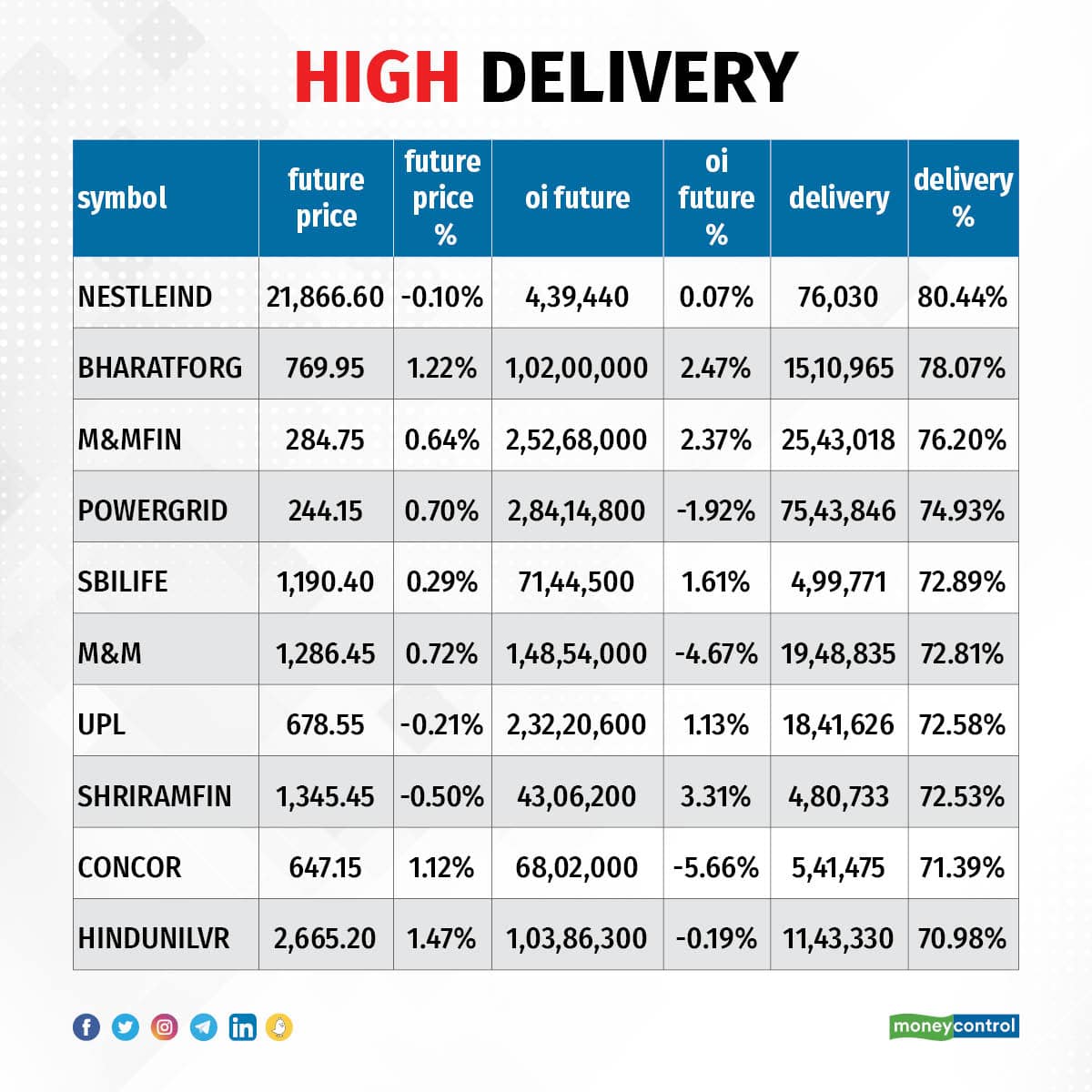

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Nestle India, Bharat Forge, M&M Financial Services, Power Grid Corporation of India and SBI Life Insurance Company among others.

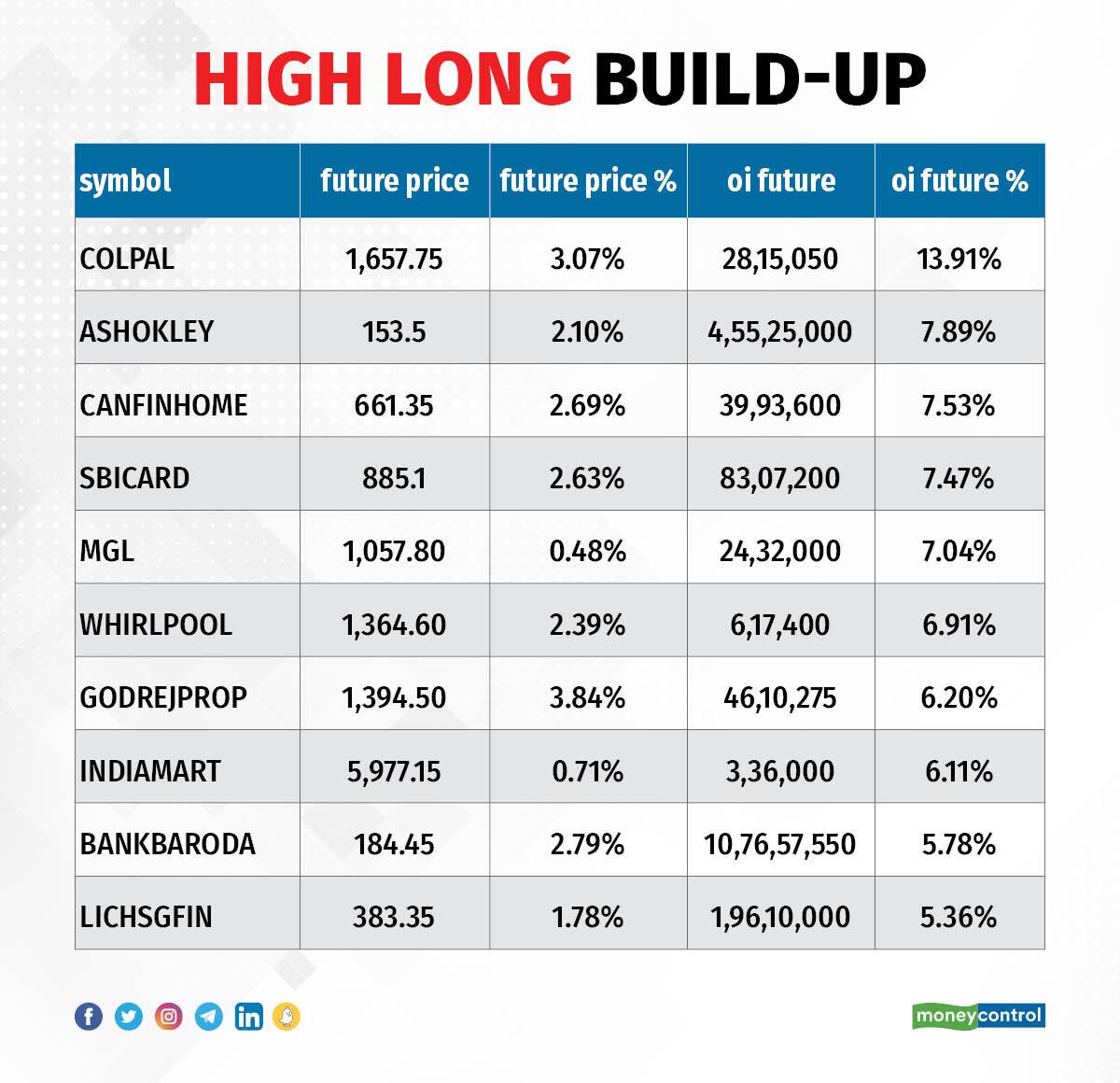

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 74 stocks, including Colgate Palmolive, Ashok Leyland, Can Fin Homes, SBI Card and Mahanagar Gas saw long build-ups.

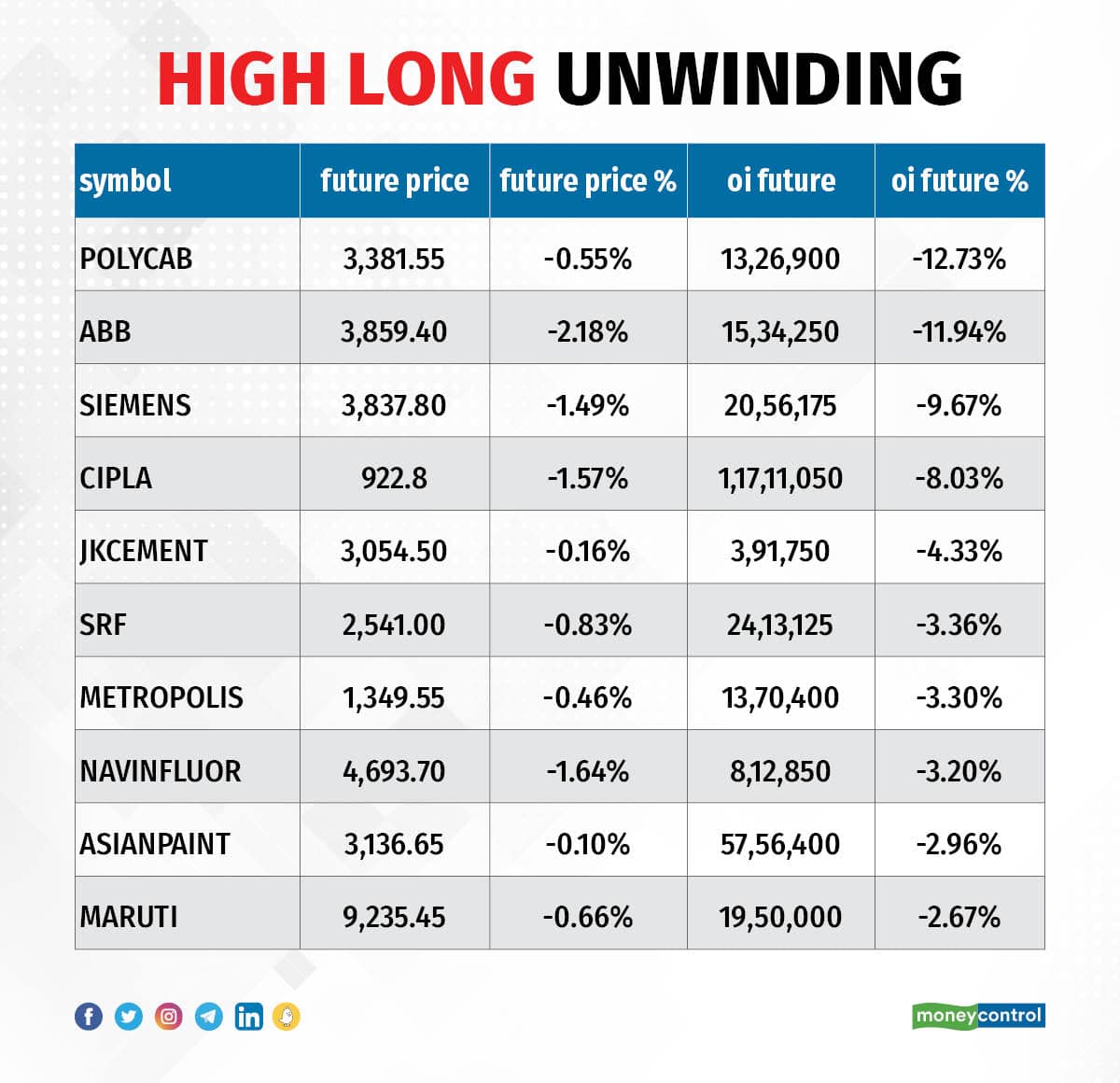

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 22 stocks including Polycab India, ABB India, Siemens, Cipla, and JK Cement saw a long unwinding.

28 stocks see a short build-up

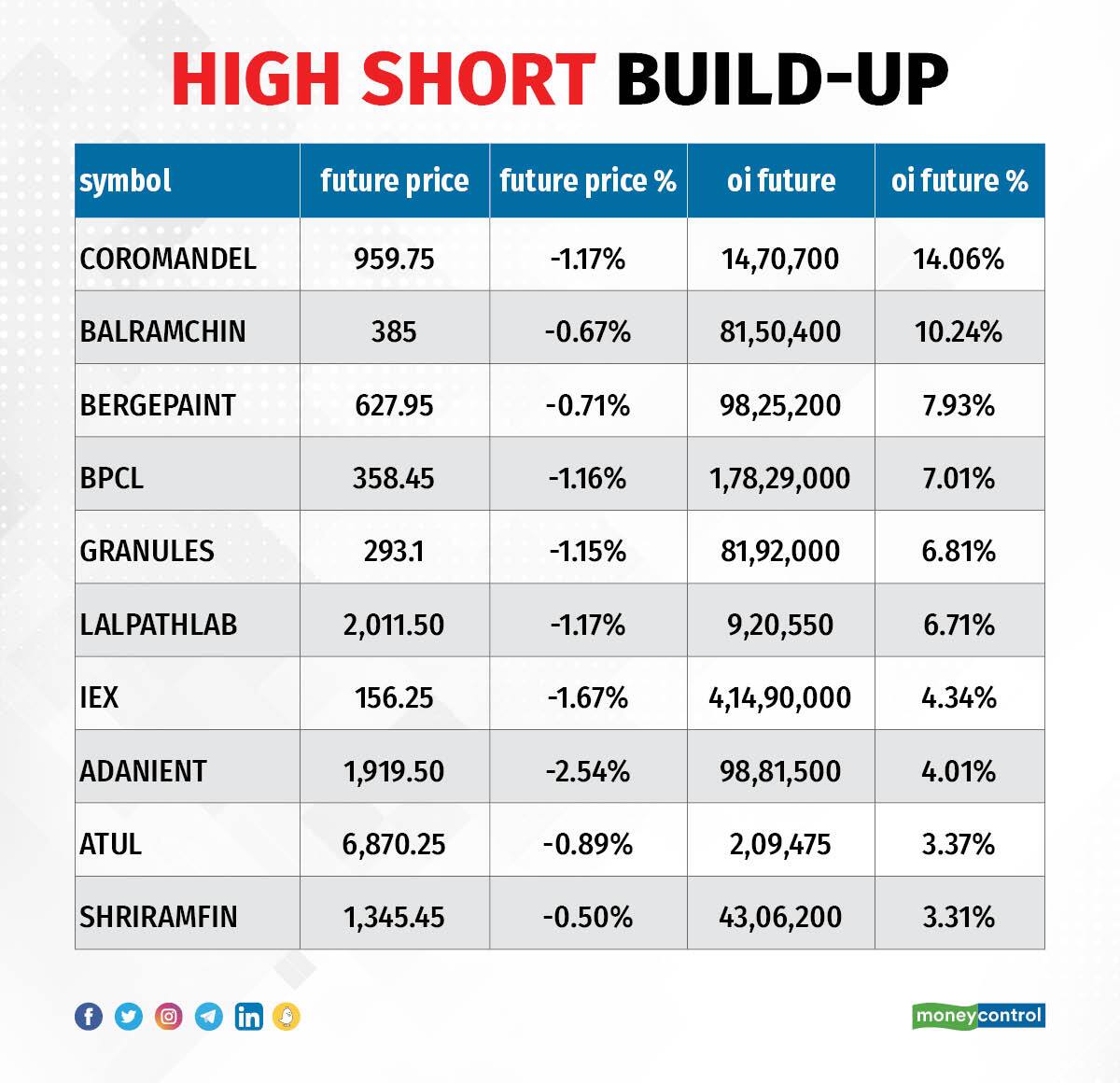

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 28 stocks, including Coromandel International, Balrampur Chini Mills, Berger Paints, BPCL and Granules India saw a short build-up.

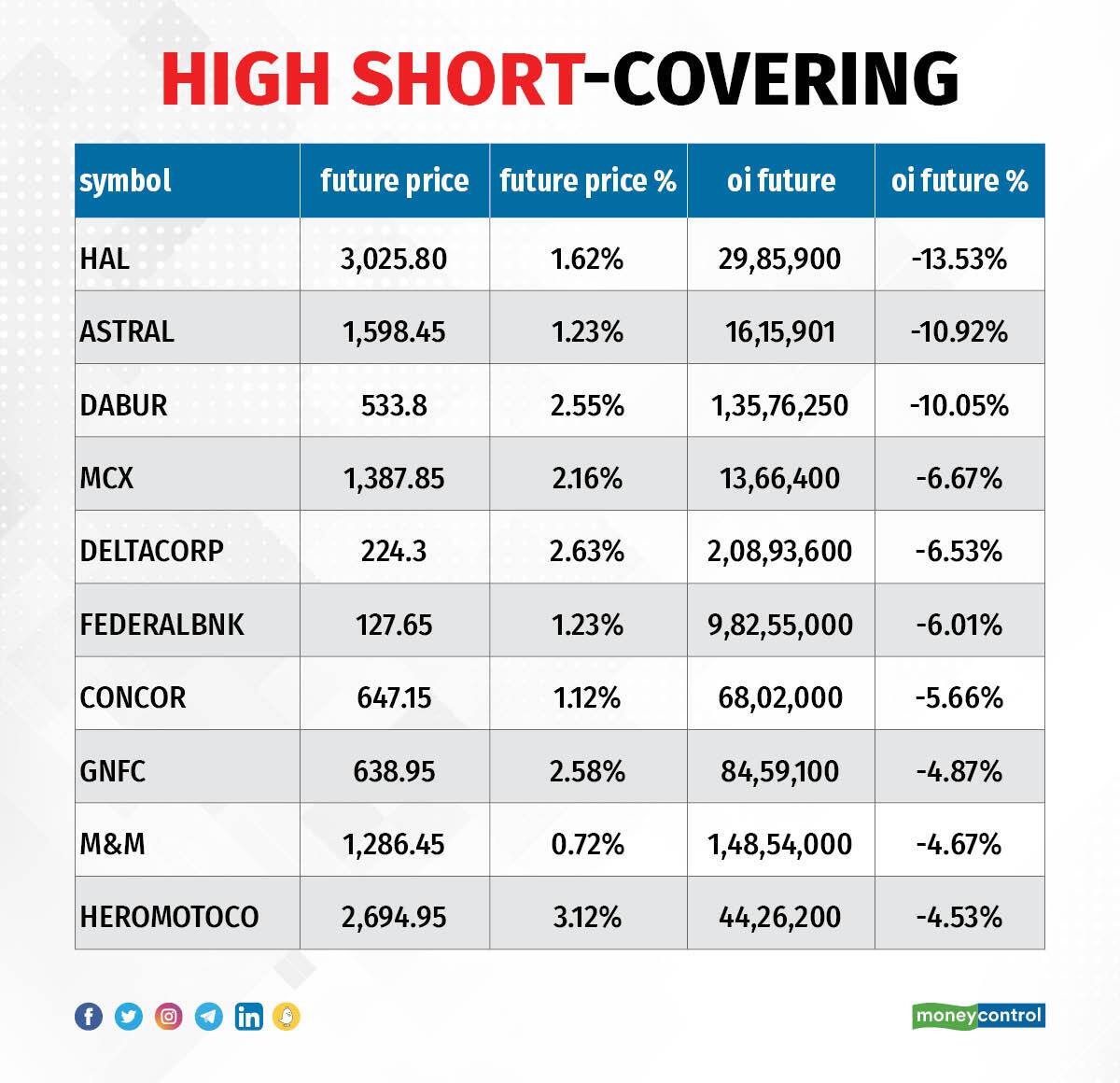

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 67 stocks were on the short-covering list. These included Hindustan Aeronautics, Astral, Dabur India, MCX India and Delta Corp.

Home First Finance Company India: Norges Bank on Account of the Government Pension Fund Global acquired 21 lakh equity shares in the company via open market transactions at an average price of Rs 700 per share, and Societe Generale bought 7.1 lakh shares at the same average price. However, Orange Clove Investments BV sold 18.85 lakh shares at an average price of Rs 700 per share, Aether Mauritius offloaded 11.31 lakh shares at Rs 700 per share and True North Fund V LLP sold 16.97 lakh shares at an average price of Rs 700.97 per share.

Neuland Laboratories: BNP Paribas Arbitrage bought 70,897 shares in the company at an average price of Rs 2,898.38 per share.

Saksoft: Premier Investment Fund sold 5.65 lakh shares in the company at an average price of Rs 200.92 per share.

(For more bulk deals, click here)

Stocks in the news

Berger Paints: The paint manufacturing company has recorded a nearly 16 percent year-on-year decline in consolidated profit at Rs 185.7 crore for the quarter ended March FY23 impacted by a fall in operating margin performance. Revenue from operations for the quarter at Rs 2,443.6 crore grew by 11.7 percent over a year-ago period.

Coromandel International: The fertiliser company has recorded a 15 percent year-on-year decline in consolidated profit at Rs 246.44 crore for the quarter ended March FY23, dented by contraction in operating profit margin. Revenue from operations remained strong, rising 29.5 percent to Rs 5,476 crore compared to the year-ago period.

PVR Inox: The multiplex chain operator has reported first quarterly earnings performance after merged entity, posting consolidated loss of Rs 333.4 crore for quarter ended March FY23. Consolidated revenue from operations for the quarter stood at Rs 1,143.2 crore and EBITDA at Rs 263.9 crore with margin at 23.1 percent. It had one-time loss of Rs 10.8 crore for the quarter.

HDFC Bank: The Sebi has granted approval for the proposed change in control of HDFC Capital Advisors, a subsidiary of HDFC and a co-investment portfolio manager, pursuant to proposed composite scheme of amalgamation for the amalgamation of HDFC with HDFC Bank. The proposed amalgamation is subject to receipt of final approvals from Sebi in respect of change in control of certain subsidiaries of HDFC.

Pfizer: The biopharmaceutical company has recorded a 3 percent year-on-year growth in profit at Rs 129.65 crore for quarter ended March FY23, and revenue from operations during the same period grew by 4.2 percent to Rs 572.64 crore. At the operating level, EBITDA (earnings before interest, tax, depreciation and amortisation) increased by 10 percent to Rs 181.9 crore with margin expansion of 170 bps to 31.8 percent compared to same period last year.

Astral: The CPVC pipes and fitting manufacturer has reported a massive 45.5 percent year-on-year growth in consolidated profit at Rs 205.7 crore for the quarter ended March FY23, driven by healthy operating performance. Revenue from operations for the quarter grew by 8.3 percent to Rs 1,506.2 crore compared to the same period last year with the plumbing business growing 3.6 percent and the paints & adhesives business showing a 25 percent growth.

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 1,685.29 crore, while domestic institutional investors (DII) purchased shares worth Rs 191.20 crore on May 15, provisional data from the National Stock Exchange showed.

Stocks under F&O ban on NSE

The National Stock Exchange has retained Delta Corp, GNFC, Punjab National Bank and BHEL on its F&O ban list for May 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!