Selling pressure in the last couple of hours of trade on April 10 wiped out all gains clocked on April 9, dragging the Sensex 354 points and the Nifty 50 below 11,600 levels.

Investors and traders turned cautious ahead of the first phase of general elections on April 11 and top technology companies' quarterly earnings on April 12.

The BSE Sensex was down 353.87 points or 0.91 percent to close at 38,585.35 while the Nifty 50 fell 87.70 points to 11,584.30 and formed bearish candle on the daily scale.

"After showing a minor upside bounce in the last session, the Nifty slipped into weakness on Wednesday and closed the day lower. Alternative candle formation continued in the Nifty as per daily time frame chart (formation of positive and negative sessions alternatively). This pattern is signalling a sideways range movement in the market," Nagaraj Shetti – Senior Technical & Derivative Analyst, HDFC Securities told Moneycontrol.

He said the short term trend of Nifty is choppy and as per the theory of alternative candle pattern, one may expect a minor upside bounce from the support in the next session.

India VIX moved up sharply by 4.19 percent to 21.13 levels.

A sudden spike in VIX indicates limited upside with a volatile swing in the market, experts said, adding Option band signifies a lower trading range in between 11,500 to 11,760 zones.

"Nifty has been consolidating in a narrow range of 11,550-11,700 since the past few trading sessions. In the short term, breach of 11,550 is expected to limit the upsides for the April series and push the index towards 11,300-11,350 levels," Sahaj Agrawal of Kotak Securities said.

He advised accumulating on meaningful corrections for the larger trend which remains extremely strong.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

Nifty closed at 11,584.3 on April 10. According to the Pivot charts, the key support level is placed at 11,544.07, followed by 11,503.83. If the index starts moving upward, key resistance levels to watch out are 11,652.27 and 11,720.23.

Nifty Bank

The Nifty Bank index closed at 29,803.5, down 310.35 points on April 10. The important Pivot level, which will act as crucial support for the index, is placed at 29,662.46, followed by 29,521.43. On the upside, key resistance levels are placed at 30,050.17, followed by 30,296.83.

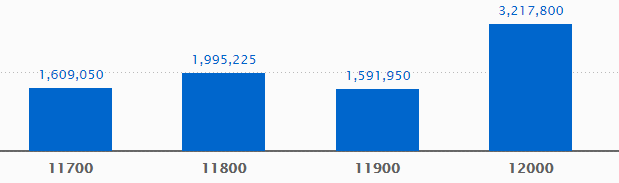

Call options data

Maximum Call open interest (OI) of 32.17 lakh contracts was seen at the 12,000 strike price. This will act as a crucial resistance level for the April series.

This was followed by 11,800 strike price, which now holds 19.95 lakh contracts in open interest, and 11,700, which has accumulated 16.09 lakh contracts in open interest.

Significant Call writing was seen at the 12,000 strike price, which added 3.39 lakh contracts, followed by 11,700 strike that added 2.35 lakh contracts and 11,800 strike that added 1.82 lakh contracts.

Call unwinding was seen at the strike price of 11,500 that shed 0.45 lakh contracts.

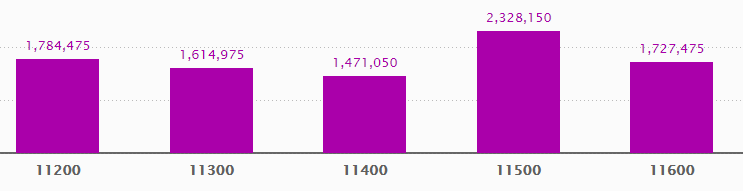

Put options data

Maximum Put open interest of 23.28 lakh contracts was seen at 11,500 strike price. This will act as a crucial support level for the April series.

This was followed by 11,200 strike price, which now holds 17.84 lakh contracts in open interest and 11,600 strike price, which has now accumulated 17.27 lakh contracts in open interest.

Put writing was seen at the strike price of 11,200 which added 1.11 lakh contracts.

Put unwinding was seen at the strike price of 11,500 strike, which shed 0.90 lakh contracts, followed by 11,700 strike that shed 0.68 lakh contracts.

FII & DII data

Foreign Institutional Investors (FIIs) bought shares worth Rs 1,429.92 crore and Domestic Institutional Investors (DIIs) purchased Rs 461.29 crore worth of shares in the Indian equity market on April 10, as per provisional data available on the NSE.

Fund Flow Picture

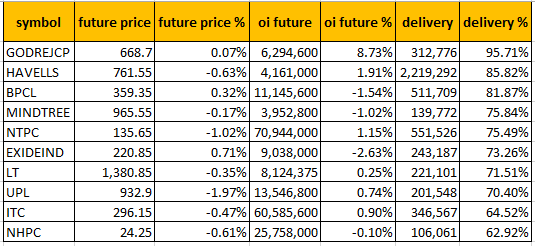

Stocks with a high delivery percentage

High delivery percentage suggests investors are accepting the delivery of the stock, which means that investors are bullish on it.

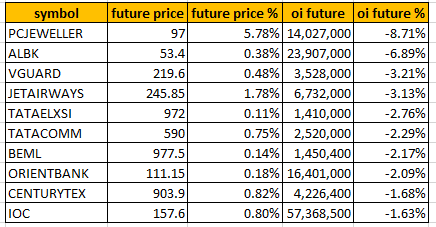

47 Stocks saw a long buildup

19 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

105 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

25 stocks saw long unwinding

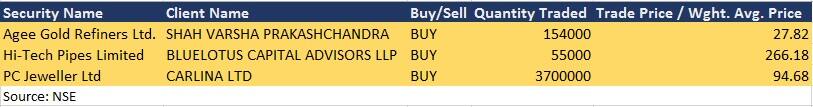

Bulk Deals on April 10

(For more bulk deals, Click Here)

Analyst or Board Meet/Briefings

Indiabulls Housing Finance: Company will announce its March quarter results, declaration of interim dividend if any, and fundraising on April 24.

AU Small Finance Bank: Company will announce its March quarter results on April 22.

Coromandel Engineering Company: Company will announce its March quarter results on May 15.

Tata Metaliks: Board meeting to be held on April 15, 2019, to consider a proposal for recommending a dividend to equity shareholders for the financial year 2018-19.

Stocks in news:

TCS: Company partnered with Google cloud to build industry-specific cloud solutions.

Welspun Corp: Company received additional pipe orders of 180 KMT on a global basis.

Wipro: Board meeting scheduled to be held on April 16 to consider a proposal for buyback of equity shares of the company.

Tanla Solutions: Company completed the acquisition of Karix Mobile as per the signed share purchase agreement.

Blue Star: Company filed a petition for liquidation of Blue Star Oman Electro-Mechanical Company LLC, its joint venture in Oman with the jurisdictional court in Oman.

Sobha: Sobha Developers (Pune), a wholly owned subsidiary of Sobha acquired 100 percent equity shares of Sobha Interiors.

HT Media: ICRA revised rated limits for the commercial paper programme from Rs 1,500 crore to Rs 1,000 crore. The credit rating assigned to CP programme re-affirmed as A1+.

Info Edge: Company invested through its wholly-owned subsidiary about Rs 14 crore in Agstack Technologies Private Ltd.

Kansai Nerolac Paints: Company acquired 100 percent equity shareholding of Perma Construction Aids Pvt. Ltd.

Jet Airways: IOC halts ATF supply to the company across India - CNBC-TV18 Sources.

Jet Airways: SBI issued a clarification to Jet Airways' potential bidders - CNBC-TV18

NBCC: Company received orders worth Rs 3,030 crore in March.

Hindustan Media Ventures: ICRA revised rated limits of commercial paper (CP) programme from Rs 400 crore to Rs 200 crore. The credit rating assigned to CP programme re-affirmed as A1+.

Seven stocks under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For April 11, Adani Power, DLF, IDBI Bank, Jet Airways, PC Jeweller, Reliance Power and Wockhardt are present in this list.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!