The equity market continued to reel under selling pressure for the second consecutive session on June 1 with the Nifty50 falling 62 points to 16,523 and the BSE Sensex declining 185 points to 55,381, dragged by technology, pharma, and FMCG stocks.

The Nifty index closed below opening levels and hence formed a bearish candle on the daily charts, underperforming frontline indices. The Nifty Midcap 100 index gained 0.04 percent and Smallcap 100 index rose 0.28 percent.

The market also remained volatile for the second straight session with India VIX rising 1.79 percent to 20.85 levels, indicating the discomfort for bulls going ahead.

"A small negative candle was formed on the daily chart with upper and lower shadows. Technically, this pattern indicates a formation of a high wave type candle pattern, which displays high volatility in the market," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He further said normally, such high wave formations after a reasonable upmove or down moves act as an impending trend reversal. But, having formed this pattern within a range movement, the predictive value of this pattern could be less, Shetti added.

He feels the near-term uptrend of the Nifty remains intact and present consolidation or minor weakness could be considered as a buy-on dips opportunity for the short term.

The market could shift into another 1 or 2 sessions of range move or minor weakness, before showing a sharp upside bounce from the lows, the market expert said, adding the near-term upside target remains intact at 16,800 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,425, followed by 16,327. If the index moves up, the key resistance levels to watch out for are 16,635 and 16,747.

Nifty Bank rose 133 points to close at 35,621 on Wednesday, outshining the broader space. The important pivot level, which will act as crucial support for the index, is placed at 35,348, followed by 35,075. On the upside, key resistance levels are placed at 35,831 and 36,042 levels.

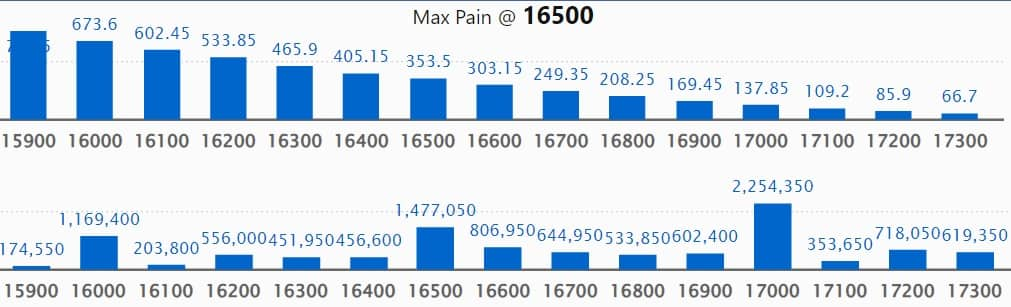

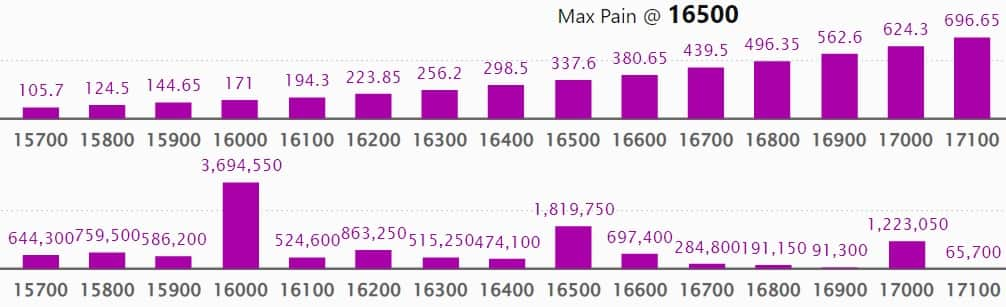

Maximum Call open interest of 22.54 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 17,500 strike, which holds 22.37 lakh contracts, and 18,000 strike, which has accumulated 15.82 lakh contracts.

Call writing was seen at 16,900 strike, which added 3.18 lakh contracts, followed by 16,600 strike which added 2.45 lakh contracts and 16,500 strike which added 2.28 lakh contracts.

Call unwinding was seen at 17,300 strike, which shed 18,950 contracts, followed by 16,000 strike which shed 7,550 contracts and 15,800 strike which shed 2,150 contracts.

Maximum Put open interest of 36.94 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the June series.

This is followed by 15,500 strike, which holds 31.16 lakh contracts, and 15,000 strike, which has accumulated 23.66 lakh contracts.

Put writing was seen at 16,600 strike, which added 2 lakh contracts, followed by 16,500 strike, which added 1.1 lakh contracts and 16,400 strike which added 1.08 lakh contracts.

Put unwinding was seen at 16,000 strike, which shed 1.59 lakh contracts, followed by 15,200 strike which shed 31,600 contracts, and 15,600 strike which shed 26,700 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Bata India, ICICI Lombard General Insurance Company, Power Grid Corporation of India, PFC, and HDFC Life Insurance Company, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Coromandel International, Voltas, Ashok Leyland, and Gujarat Gas, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Persistent Systems, L&T Infotech, Intellect Design Arena, Coforge, and Escorts, in which long unwinding was seen.

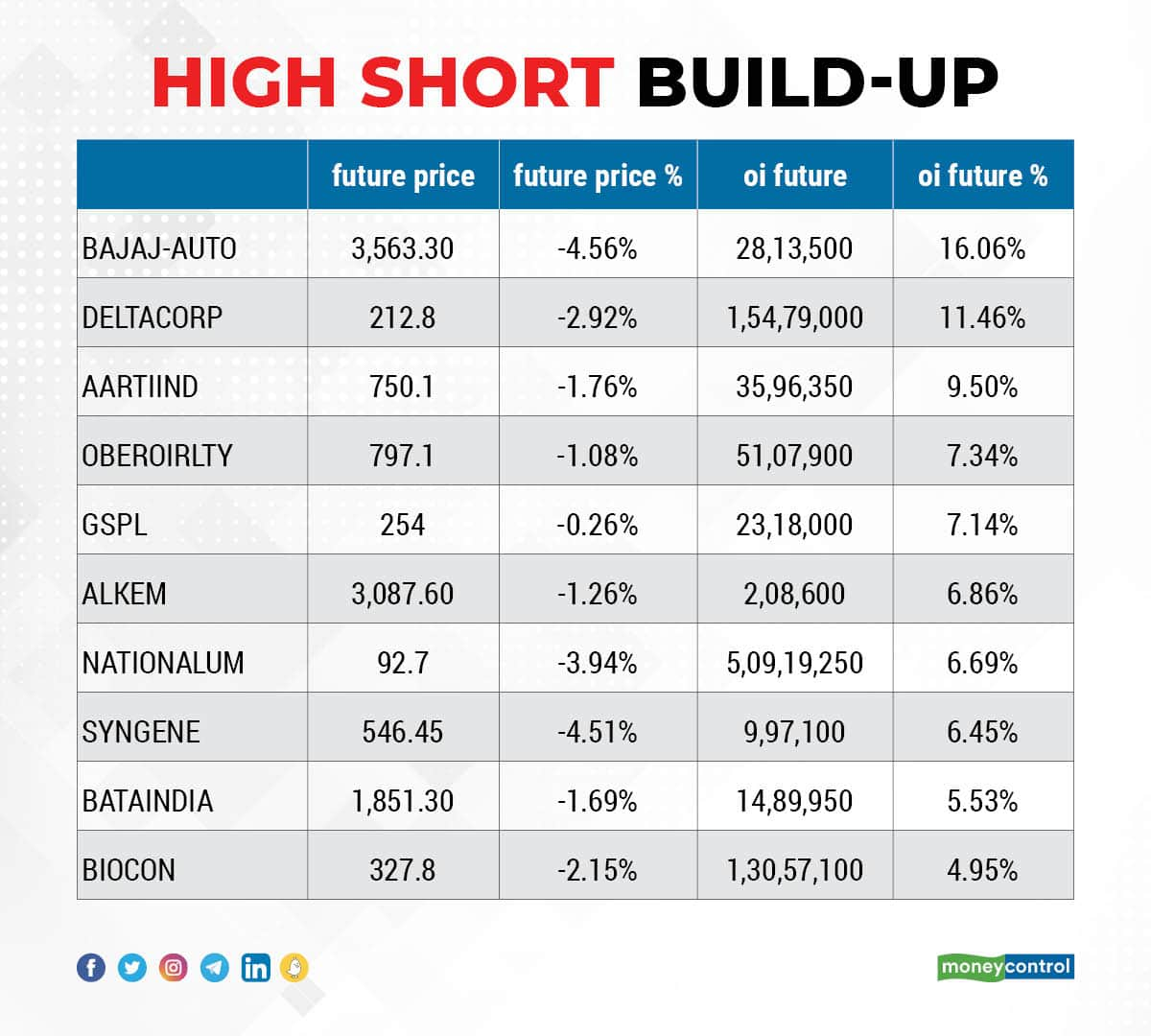

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Bajaj Auto, Delta Corp, Aarti Industries, Oberoi Realty, and Gujarat State Petronet, in which a short build-up was seen.

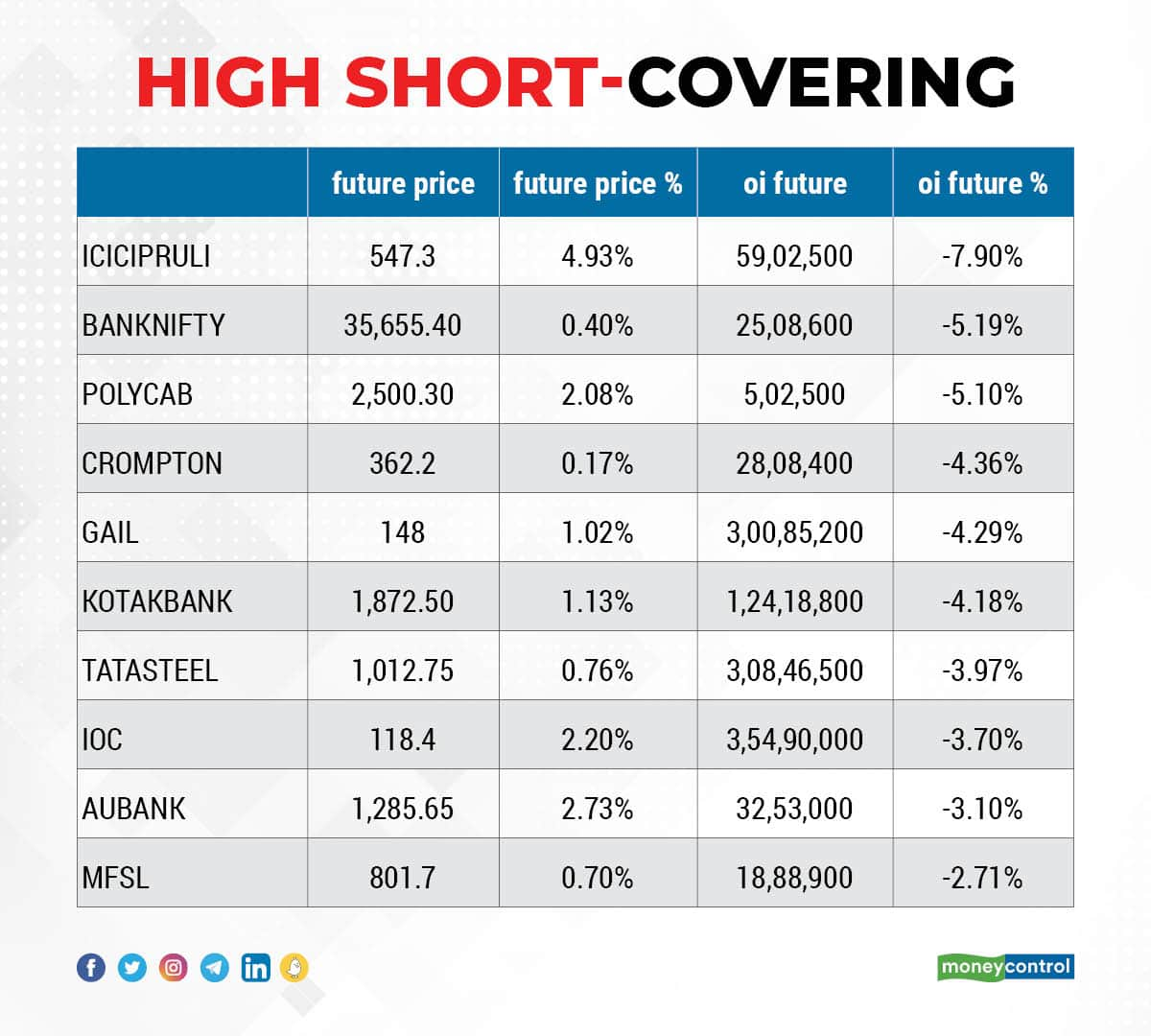

33 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including ICICI Prudential Life Insurance, Bank Nifty, Polycab India, Crompton Greaves Consumer Electricals, and GAIL India, in which short-covering was seen.

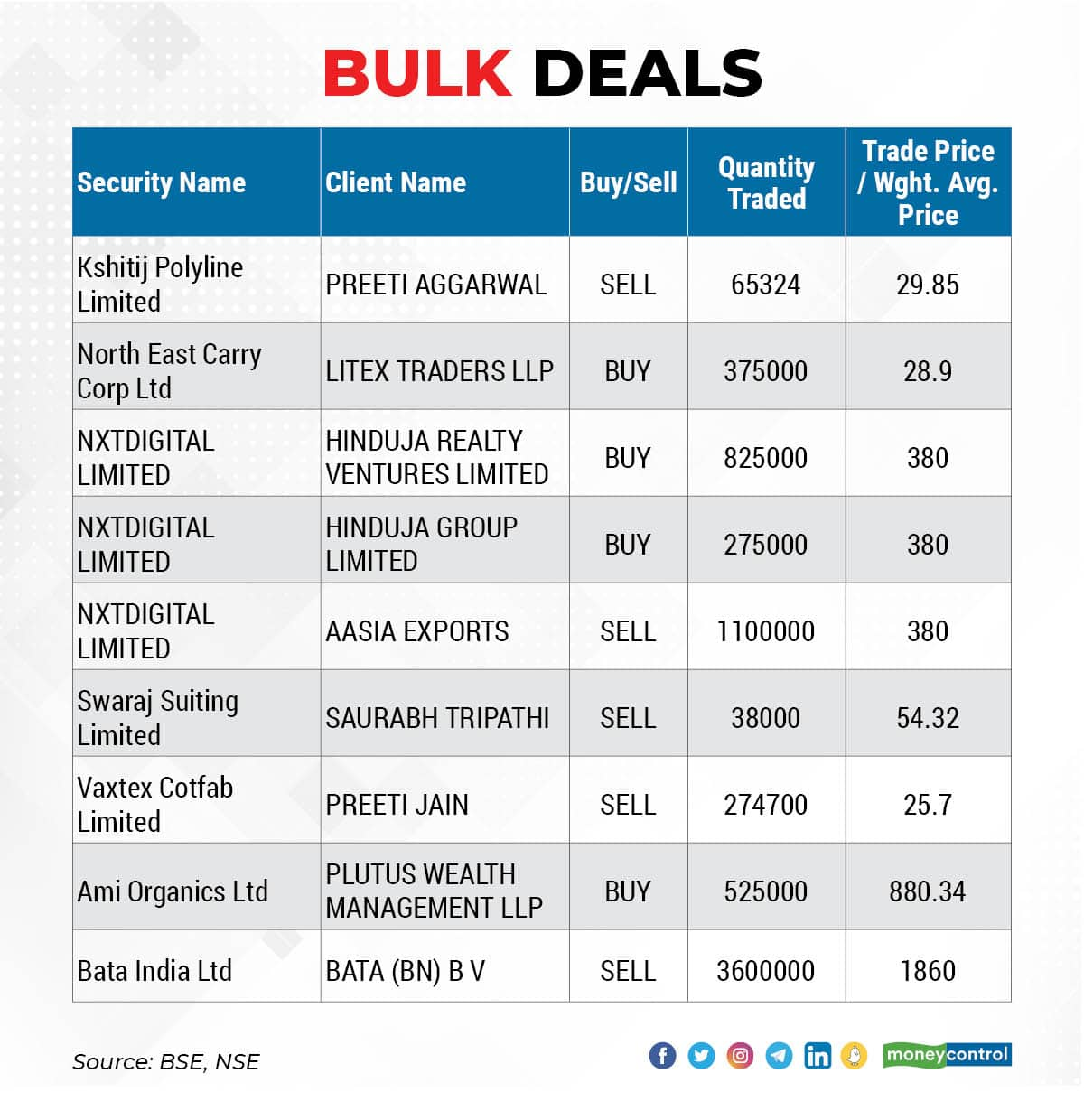

Nxtdigital: Hinduja Realty Ventures acquired additional 8.25 lakh shares in the company via open market transactions and Hinduja Group also bought additional 2.75 lakh shares, whereas Aasia Exports sold 11 lakh shares in the company. These transcations have taken place at an average price of Rs 380 per share.

Ami Organics: Plutus Wealth Management LLP bought 5.25 lakh shares in the company via open market transactions at an average price of Rs 880.34 per share.

Bata India: Promoter Bata (BN) B V offloaded 36 lakh equity shares in the company via open market transactions at an average price of Rs 1,860 per share.

(For more bulk deals, click here)

Investors Meetings on June 2

UltraTech Cement: The company's officials will meet Oaktree Capital Management.

Prince Pipes and Fittings: The company's officials will attend B&K Securities Annual Investor Conference - Trinity India 2022.

Fine Organic Industries: The company's officials will attend B&K Securities Annual Investor Conference - Trinity India 2022.

TTK Prestige: The company's officials will attend B&K Securities Annual Investor Conference - Trinity India 2022.

Allcargo Logistics: The company's officials will attend B&K Securities Annual Investor Conference - Trinity India 2022.

NIIT: The company's officials will attend B&K Securities Annual Investor Conference - Trinity India 2022.

Arvind Fashions: The company's officials will attend B&K Securities Annual Investor Conference - Trinity India 2022.

Zee Entertainment Enterprises: The company's officials will attend B&K Securities Annual Investor Conference - Trinity India 2022.

IRCTC: The company's officials will meet Sumitomo Mitsui DS Asset Management, Hongkong.

Axiscades Technologies: The company's officials will meet investors.

Stocks in News

Delta Corp: Subsidiary Delta Pleasure Cruise Company has commenced management of operations of the casino at the hotel "The Zuri White Sands Goa, Resort and Casino", situated at Pedda Varca Salcete, Goa. With the commencement of operations of this casino by DPCCPL (subsidiary), the company and its subsidiaries now operate five casinos in Goa.

Butterfly Gandhimathi Appliances: CRISIL has upgraded its long term rating on the company to 'AA' from 'A-', and short term rating to 'A1+' from 'A2+'.

Eicher Motors: The company sold 63,643 units of Royal Enfield in May 2022, registering a growth of 133 percent compared to 27,294 units sold in same month last year. In year-ago month, several states had imposed lockdowns to control the spread of Covid virus. Eicher exported 10,118 units in May 2022, up by 40 percent over 7,221 units sold in corresponding month last year.

Mold-Tek Packaging: Ashish R Kacholia & PAC (Himalaya Finance and Investment Company) sold 2.25 percent equity stake in the company via open market transactions on May 31. With this, their shareholding in the company stands reduced to 4.55 percent, down from 6.8 percent earlier.

Knowledge Marine & Engineering Works: The company has received a contract from Dredging Corporation of India, for 'capital dredging at Mangrol Fishing Harbour Phase III Part B', for a tenure of 12 months. The project cost is Rs 67.85 crore.

Mishtann Foods: Mishtann Foods has seen good response for Mishtann Pink Rock Salt and has bagged orders from major retail stores for 1700 metric tonnes. The supply of these orders will commence from July 2022.

Reliance Industries: Reliance Brands and Plastic Legno SPA have signed a joint venture through which Reliance Brands will acquire a 40 percent stake in Plastic Legno SPA's toy manufacturing business in India. Plastic Legno SPA is owned by the Sunino group that boasts of more than 25 years of toy production experience in Europe. This investment by Reliance Brands will bring in vertical integration for Reliance Brands' toy business and help diversify the supply chain with a long-term strategic interest in building toy manufacturing in India.

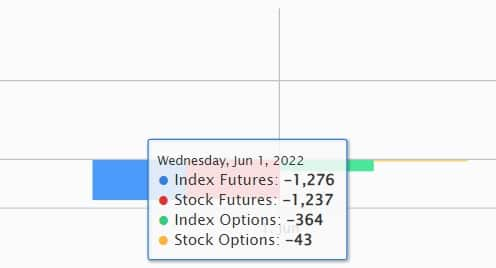

Fund Flow

Foreign institutional investors (FIIs) have net sold Rs 1,930.16 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 984.11 crore worth of shares on June 1, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not put any stock under its F&O ban segment for June 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!