The Nifty which started on a bullish note reclaimed its crucial resistance level of 10,700 in the opening tick Wednesday and built momentum to rally above 10,750 but closed marginally below its resistance level of 10,770.

The index is now trading above most of its crucial short-term moving averages. It formed a bullish candle on the daily candlestick charts and is now trading above 5, 13, and 50-EMA

After closing above the 50-EMA, now the real challenge for bulls is to cross the interim top placed around 10,850 levels, experts said, adding the further short covering then may push Nifty towards 11,000 levels.

"Inline with the expectation, Nifty50 rallied for the second day in a row as the initial dip was bought before signing off the session with a bullish candle formation," Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.com.

He said in this process bulls appears to have strengthened their position as Nifty50 changed its recent behaviour of forming bull and a bear candle in alternate sessions suggesting near-term strength.

“If bulls manage to conquer this top then the current upswing shall initially get extended up to 11,000 kinds of levels as a close above 10,810 will also result in a downward sloping trend line breakout which is in progress from the highs of 11,171,” he said.

India VIX fell down up by 2.62 percent at 12.65 levels. Lower volatility indicates limited downside and decline is being bought in the market.

We have collated the top 15 data points to help you spot profitable trades:Key support and resistance level for Nifty:

The Nifty closed at 10,769.90 on Wednesday. According to Pivot charts, the key support level is placed at 10,706.07, followed by 10,642.23. If the index starts moving upwards, key resistance levels to watch out are 10,805.47 and 10,841.03.

Nifty Bank:

The Nifty Bank index closed at 26,433.95, up 229 points. The important Pivot level, which will act as crucial support for the index, is placed at 26,217.70, followed by 26,001.50. On the upside, key resistance levels are placed at 26,565.30, followed by 26,696.70.

Call Options Data

Maximum call open interest (OI) of 36.73 lakh contracts was at the 11,000 strike price. This will act as a crucial resistance level for July series.

This was followed by the 10,800 strike price, which now holds 28.80 lakh contracts in open interest, and 10,700, which has accumulated 25.78 lakh contracts in open interest.

Call writing was seen at the strike price of 10,900, which added 1.02 lakh contracts, followed by 11,100, which added 83,400 contracts and 11,300, which added 1.85 lakh contracts.

Call unwinding was seen at the strike price of 10,700, which shed 1.6 lakh contracts, followed by 10,600, which shed 94,125 contracts.

Put Options data

Maximum put open interest of 51.75 lakh contracts was seen at the 10,600 strike price. This will act as a crucial resistance level for July series.

This was followed by the 10,500 strike price, which now holds 36.45 lakh contracts in open interest, and the 10,200 strike price, which has now accumulated 34.01 lakh contracts in open interest.

Put Writing was seen at the strike price of 10,700, which added 4.2 lakh contracts, followed by 10,800, which added 2.8 lakh contracts and 10,500, which added 2.2 lakh contracts.

Put Unwinding was seen at 11,000, which shed over 1.75 lakh contracts, followed by 10,900, which shed 20,925 contracts.

FII & DII data

Foreign institutional investors (FIIs) sold shares worth Rs 284.58 crore, while domestic institutional investors bought shares worth Rs 611.01 crore in the Indian equity market, as per provisional data available on the NSE.

Fund Flow Picture:

Stocks with high delivery percentage:

High delivery percentage suggests that investors are accepting delivery of the stock, which means that investors are bullish on it.

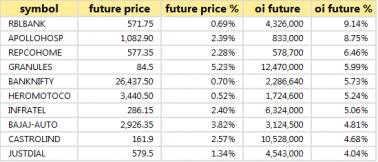

56 stocks saw long buildup

39 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

38 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

38 stocks saw long unwinding

Bulk Deals

C & C Constructions: Manbhupinder Singh Atwal bought 2,45,000 shares at Rs 37.99 per share

Suumaya Lifestyle: Newedge Vinimay Private Limited bought 1,52,000 shares at Rs 18.30 per share

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

Va Tech Wabag: Meeting is scheduled to be held on July 9, 2018, to consider and approve the fund raising proposal.

Future Lifestyle: The Board of Directors has approved the proposal to invest an amount up to GBP 15.3 millions (approximately Rs 140 crore) in one or more tranches by way of acquiring of or subscribing to the equity shares of Koovs plc, subject to receipt of necessary approvals, as applicable.

Stocks in news

Unichem Labs: Company gets USFDA nod for asthma drug

Muthoot Finance: Company eyes disbursal of Rs 300 crore personal loans

ICICI Bank: Bank aims to grow home loan book to Rs 2 trillion by FY20

JP Associates: Supreme Court asks to deposit at least Rs 650 cr for refund of principal amount to home buyers

Yes Bank: Bank receives SEBI approval to launch mutual fund business

Biocon: Receives EU GMP Certification For Its Sterile Drug Product Mfg Facility In Bangalore

Essar Oil: UK revenues rise 10.2 percent in FY18

Future Lifestyle to acquire up to 29.9% of Koovs

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.