The stock market started April series on a positive note on March 29, after a stellar run in the month during which benchmark indices rallied more than 7 percent.

The 30-share BSE Sensex gained 127.19 points to close at 38,672.91 while Nifty50 rose 53.90 points to 11,623.90 and formed pin bar candle on daily charts.

For the week, the Nifty50 rallied 1.4 percent, forming bullish candle on weekly charts and is 2 percent away from its record high of 11,760 touched in August 2018.

"Nifty is forming higher high and higher low formation continuously from last six weeks whereas long body bullish candlestick pattern signifies the continuation of the uptrend. At the same time, the index has formed white Marubozu candlestick pattern on monthly timeframe suggesting bullish tone in coming sessions," Shabbir Kayyumi, Head of Technical & Derivative Research at Narnolia Financial Advisors told Moneycontrol.

He said index trading above 11,640 will accelerate the upmove taking it higher towards the target of cup and handle pattern formed on a lower time frame which comes to 11,740.

Also, as long as Nifty sustains above bullish unfilled gap formed around 11,445-11,455, one can trade with buy on dip strategy, he advised.

Nagaraj Shetti, Technical Research Analyst at HDFC Securities said having placed at key overhead resistance of 11,650-11,750, there is a possibility of intermittent downward correction for the next one or two weeks, which is unlikely to damage the uptrend status of the market.

The broader markets outpaced frontline indices during the previous week as Nifty Midcap index climbed 2.9 percent. Among sectors, Nifty Bank rallied 2.8 percent, followed by Nifty Energy and Metal that gained 2 percent each.

Key support and resistance level for Nifty

The Nifty closed at 11,623.90 on March 29. According to the Pivot charts, the key support level is placed at 11,585.97, followed by 11,548.03. If the index starts moving upward, key resistance levels to watch out are 11,646.07 and 11,668.23.

Nifty Bank

The Nifty Bank index closed at 30,426.80, up 6.25 points on March 29. The important Pivot level, which will act as crucial support for the index, is placed at 30,275.41, followed by 30,124.0. On the upside, key resistance levels are placed at 30,538.71, followed by 30,650.6.

Call options data

Maximum Call open interest (OI) of 22.67 lakh contracts was seen at the 12,000 strike price. This will act as a crucial resistance level for the April series.

This was followed by 11,600 strike price, which now holds 12.92 lakh contracts in open interest, and 11,800, which has accumulated 12.19 lakh contracts in open interest.

Significant Call writing was seen at the 12,000 strike price, which added 2.24 lakh contracts, followed by 11,700 strike that added 1.88 lakh contracts and 12,100 strike that added 1.69 lakh contracts.

Call unwinding was seen at the strike price of 11,500 that shed 0.57 lakh contracts, followed by 11,400 strike that shed 0.46 lakh contracts.

Put options data

Maximum Put open interest of 21.33 lakh contracts was seen at 11,500 strike price. This will act as a crucial support level for April series.

This was followed by 11,200 strike price, which now holds 14.07 lakh contracts in open interest, and 11,300 strike price, which has now accumulated 12.77 lakh contracts in open interest.

Put writing was seen at the strike price of 11,500, which added 4.61 lakh contracts, followed by 11,100 strike that added 3.18 lakh contracts and 11,600 strike that added 2.95 lakh contracts.

Put unwinding was seen at the strike price of 11,400, which shed 1.43 lakh contracts.

FII & DII data

Foreign Institutional Investors (FIIs) sold shares worth Rs 86.21 crore while Domestic Institutional Investors (DIIs) bought Rs 1,724.39 crore worth of shares in the Indian equity market on March 29, as per provisional data available on the NSE.

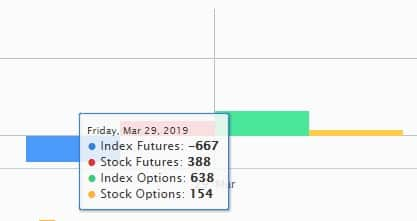

Fund flow picture

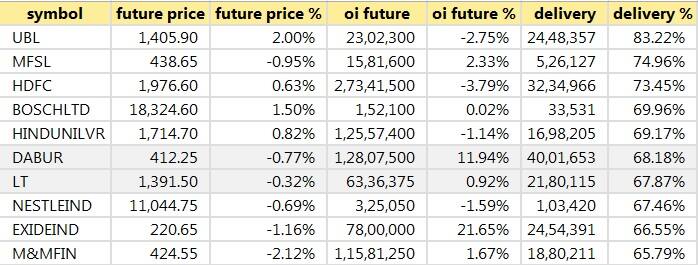

Stocks with a high delivery percentage

High delivery percentage suggests investors are accepting the delivery of the stock, which means that investors are bullish on it.

84 Stocks saw a long buildup

51 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

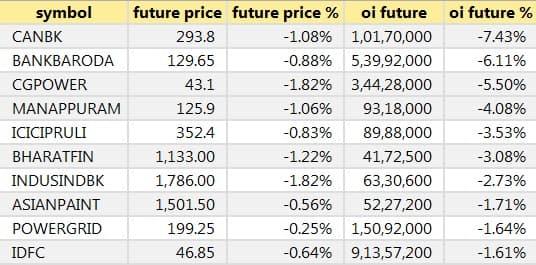

39 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

21 stocks saw long unwinding

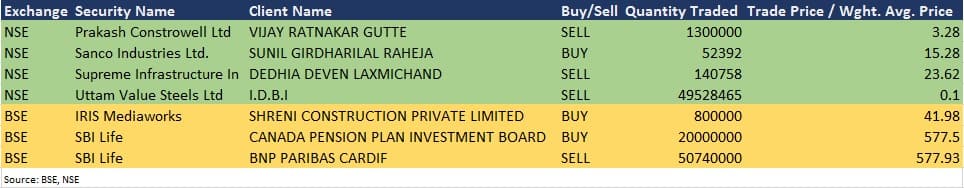

Bulk deals on March 29

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

Dishman Carbogen Amcis: Management meet and plant visit at company's Bavla plant with certain institutional investors and analysts has been scheduled on April 1.

Atul Ltd: Board to consider FY19 results & Dividend on April 26.

Astral Poly Technik: Company's officials will meet KGI Funds, Fuh Hwa Securities, Eastspring Investments, Cathay Securities, Yuanta Securities and Taishin Securities on April 1 and 2.

Kalpataru Power Transmission: Company's officials will meet ICICI Prudential Life Insurance on April 1.

PI Industries: Company will announce its Standalone and Consolidated audited financial results for the financial year ended March 31, 2019 and recommend final dividend, if any on April 17.

Stocks in news

Auto sales: Maruti Suzuki, Ashok Leyland, Escorts, Eicher Motors, etc in focus.

Dr Reddy's Labs: German drug regulator cleared Duvvada formulations unit.

Grasim Industries: Company acquired Soktas India for Rs 135 crore.

MCX India: Board approved the appointment of PS Reddy as MD & CEO of the company.

Vadilal Industries: Company said the agenda to re-appoint Rajesh Gandhi and Devanshu Gandhi as Managing Directors of the company was not passed unanimously. It was further resolved to appoint a professional Managing Director/Chief Executive Officer/Manager for the company. Rajesh Gandhi and Devanshu Gandhi will continue to work for the company as a director of the company without any remuneration.

Lyka Labs: Company entered into One Time Settlement agreement with the Bank of Maharashtra and arranged to make an upfront payment of Rs 11 crore as settlement amount and Rs 6.49 lakh as processing fees to the bank.

Sadbhav Infrastructure Project: Company acquired further 6 percent (3,000) equity shares of subsidiary Maharashtra Border Check Post Network Limited (MBCPNL), held by SREI.

Container Corporation of India: First distribution logistics centre at Ennore, Chennai was inaugurated on March 30.

Dynamic Industries: Company has disinvested/sold its entire investment in equity shares of its wholly owned subsidiary in Neo Farbe Private Limited.

Scanpoint Geomatics: Company in consortium with Team Computers Private Limited (lead bidder) received a contract for setting up of enterprise Geoportal for National Atlas and Thematic Mapping Organisation (NATMO), Kolkata. The aggregate value of project for SGL is Rs 2.08 crore.

The company received a contract of enterprise and City GIS Solution for Agra Smart City through Master System Integrator (MSI) - Bharat Electronics and Lookman Electroplast Industries Limited, and for Lucknow Smart City through MSI Fluent Grid Limited and Bharat Electronics. The aggregate value of the said projects for SGL is Rs 9.33 crore.

Navkar Corporation: Board approved appointment of Captain Dinesh Gautama as whole time director of the company with immediate effect. Dinesh Gautama is also serving as Chief Executive Officer.

Sayaji Industries: Board has authorised Priyam B Mehta, Varun P Mehta and Vishal P Mehta individually and jointly to enter into a Joint Venture Agreement with Societe Developpement Produits Afrique - SDPA, France, the holding company of Alland and Robert for manufacturing of gum arabic/ gum acacia, gum ghatti and gum blends. The joint venture will be a 50:50.

Rico Auto Industries: Company alongwith its step down subsidiary, Rasa Autocom Limited has completed the acquisition of 2,11,20,000 equity shares of Magna Rico Powertrain Private Limited from Magna Powertrain GMBH at the rate of Rs 4.05 per share for a total consideration of Rs 8.56 crore.

Jindal Drilling: Company has acquired an offshore jack up drilling rig from Discovery Drilling Pte Ltd, Singapore, a joint venture of the company. The rig would be soon deployed under contract with Oil and Natural Gas Corporation (ONGC) already awarded to the company.

Wockhardt: India Ratings revised company's short-term ratings to IND A3 from IND A3+ & long-term loan facilities to IND BBB-.

Three stocks under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For April 1, Adani Power, IDBI Bank and Reliance Power are present in this list.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.