The market had a strong run with the benchmark index Nifty50 closing above the 12,100 mark on November 5, amid anticipation of the Democratic Party's victory in the US election and hope of further supportive measures from the Federal Reserve.

The BSE Sensex jumped 724.02 points or 1.78 percent to close at 41,340.16, while the Nifty50 surged 211.80 points or 1.78 percent to 12,120.30 and formed a bullish candle on the daily charts.

"Technically, this pattern could mean an uptrend continuation and the unfilled opening upside gap could be considered as a bullish breakaway gap. This is a positive indication and more upside could be in store in the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"We observe a sustainable upside breakout of the hurdle of previous swing highs around 11,950-12,025 levels, which was coincided with a down-sloping minor trend line. This also indicates an upside breakout of the recent broader range movement of the market," he said.

The next important resistances are placed at 12,250 and 12,430 levels, which could offer key resistance for the market on the higher side, he says.

All sectoral indices, barring realty, closed in the green. The broader markets and overall market breadth remained strong. The Nifty Midcap and Smallcap indices gained over 1.7 percent each, while about 2.5 shares gained for every share falling on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 12,054.9, followed by 11,989.5. If the index moves up, the key resistance levels to watch out for are 12,158.4 and 12,196.5.

Nifty Bank

The Bank Nifty rallied further by 541.50 points or 2.10 percent to close at 26,313.10 on November 5. The important pivot level, which will act as crucial support for the index, is placed at 26,083.73, followed by 25,854.37. On the upside, key resistance levels are placed at 26,458.83 and 26,604.57.

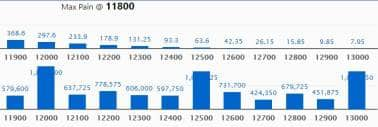

Call option data

Maximum Call open interest of 18.15 lakh contracts was seen at 12,000 strike, which will remain a crucial level in the November series.

This is followed by 13,000 strike, which holds 16.06 lakh contracts, and 12,500 strike, which has accumulated 16.02 lakh contracts.

Call writing was seen at 12,900 strike, which added 2.39 lakh contracts, followed by 12,400 strike which added 1.52 lakh contracts and 12,700 strike which added 1.32 lakh contracts.

Call unwinding was seen at 11,800 strike, which shed 1.13 lakh contracts, followed by 11,600 strike which shed 66,150 contracts and 11,900 strike which shed 64,050 contracts.

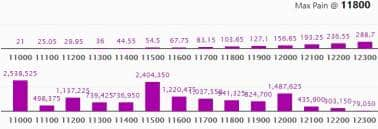

Put option data

Maximum Put open interest of 25.38 lakh contracts was seen at 11,000 strike, which will act as crucial support in the November series.

This is followed by 11,500 strike, which holds 24.04 lakh contracts, and 12,000 strike, which has accumulated 14.87 lakh contracts.

Put writing was seen at 12,000 strike, which added 5.92 lakh contracts, followed by 12,100 strike, which added 3.56 lakh contracts and 12,200 strike which added 2.4 lakh contracts.

Put unwinding was witnessed at 11,100 strike, which shed 5.18 lakh contracts, followed by 11,600 strike which shed 2.6 lakh contracts and 11,400 strike, which shed 18,600 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

80 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

One stock saw long unwinding

Based on the open interest future percentage, here is a stock in which long unwinding was seen.![]()

6 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are six stocks in which short build-up was seen.

52 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

![]()

(For more bulk deals, click here)

Results on November 6

ITC, Cipla, Ashok Leyland, Bank of India, Union Bank of India, Vedanta, Bharat Electronics, BEML, BHEL, Bosch, Voltas, 8K Miles Software, Aditya Birla Fashion, Alkem Laboratories, Allcargo Logistics, Astral Poly Technik, Balkrishna Industries, Central Bank of India, CESC, Chemcon Speciality Chemicals, CreditAccess Grameen, Dilip Buildcon, Glenmark Pharmaceuticals, India Cements, Indian Overseas Bank, Jammu & Kashmir Bank, Dr Lal PathLabs, Lemon Tree Hotels, Manappuram Finance, MRF, Quick Heal Technologies, REC, SAIL, Sonata Software, Tata Consumer Products and Westlife Development among 219 companies will declare their quarterly earnings on November 6.

Stocks in the news

Berger Paints: The company reported a higher consolidated profit at Rs 221 crore in Q2FY21 against Rs 194.7 crore, revenue rose to Rs 1,742.6 crore from Rs 1,598.6 crore YoY.

Reliance Industries: Public Investment Fund (PIF) invested Rs 9,555 crore in Reliance Retail Ventures.

Dalmia Bharat: The company reported a higher consolidated profit at Rs 232 crore in Q2FY21 against Rs 36 crore, revenue increased to Rs 2,410 crore from Rs 2,236 crore YoY.

Adani Power: The company reported a higher consolidated profit at Rs 2,228 crore in Q2FY21 against Rs 3.9 crore, revenue jumped to Rs 7,749.2 crore from Rs 5,915.7 crore YoY.

Chambal Fertilisers: The company reported a higher consolidated profit at Rs 436.7 crore in Q2FY21 from Rs 380.8 crore, revenue increased to Rs 3,986.9 crore from Rs 3,550.1 crore YoY.

Birla Corporation: The company reported a higher consolidated profit at Rs 166.6 crore in Q2FY21 against Rs 88.3 crore, revenue increased to Rs 1,654.2 crore from Rs 1,626.9 crore YoY.

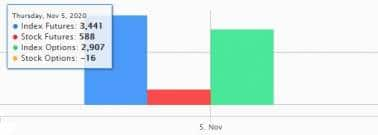

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 5,368.31 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,208.18 crore in the Indian equity market on November 5, as per provisional data available on the NSE.

Stock under F&O ban on NSE

One stock - SAIL - is under the F&O ban for November 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!