The market fell further on expiry of October derivative contracts as traders worried about global growth concerns due to rising coronavirus cases in Europe and the United States.

The Sensex declined 172.61 points to close at 39,749.85, falling for second consecutive session, on October 29. The Nifty fell 58.8 points to 11,670.80 and formed a small bullish candle which resembles an inverted hammer kind of pattern on the daily charts.

"A small positive candle was formed on October 29 with an upper shadow, which indicates a broader range movement with a negative bias in the market. The upper shadow signals a sell on rise opportunity for the day," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"This above said pattern could not be considered as a downside breakout of the range and one may expect chances of an upside bounce in coming sessions, above 11,700 levels. The anticipated upside bounce could confirm a false downside breakout of the range and leave room for further upside in the near term. A decisive decline below 11,600 levels is expected to negate our bullish bias and result in further weakness in the market," Shetti said.

The overall market breadth continued to be negative. The midcap and smallcap indices closed the day 0.43 percent and 0.92 percent lower, respectively, while all sectoral indices, barring IT, closed in the red.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,603.47, followed by 11,536.13. If the index moves up, the key resistance levels to watch out for are 11,741.17 and 11,811.53.

Nifty Bank

The Bank Nifty fell 140.50 points to close at 24,092 on October 29. The important pivot level, which will act as crucial support for the index, is placed at 23,829.7, followed by 23,567.4. On the upside, key resistance levels are placed at 24,346.7 and 24,601.4.

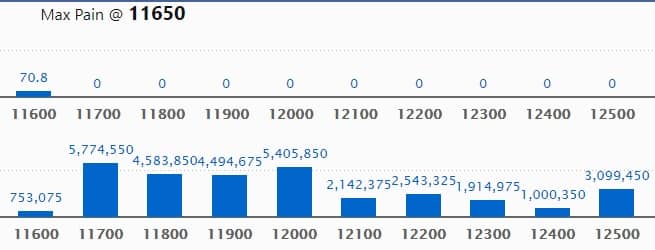

Call option data

Maximum Call OI of 57.74 lakh contracts was seen at 11,700 strike, which will act as crucial resistance in the November series.

This is followed by 12,000, which holds 54.05 lakh contracts, and 11,800 strikes, which has accumulated 45.83 lakh contracts.

Call writing was seen at 11,700, which added 40.18 lakh contracts, followed by 11,800, which added 5.87 lakh contracts, and 11,600 strikes, which added 2.09 lakh contracts.

Call unwinding was seen at 12,000, which shed 11.53 lakh contracts, followed by 12,500, which shed 8.9 lakh contracts, and 12,100 strikes, which shed 7.15 lakh contracts.

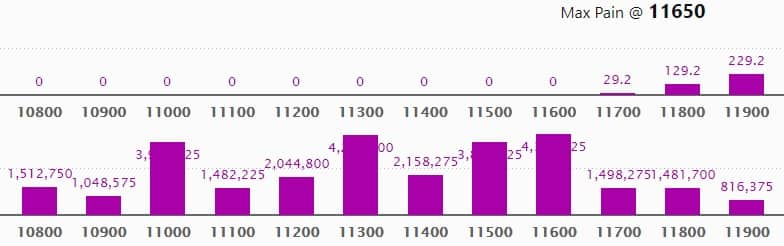

Put option data

Maximum Put OI of 43.41 lakh contracts was seen at 11,600, which will act as crucial support in the November series.

This is followed by 11,300, which holds 42.71 lakh contracts, and 11,000 strikes, which has accumulated 39.17 lakh contracts.

Put writing was seen at 11,300, which added 19.25 lakh contracts, followed by 11,600, which added 14.10 lakh contracts, and 11,100 strikes, which added 3.25 lakh contracts.

Put unwinding was witnessed at 11,700, which shed 17.46 lakh contracts, followed by 11,800, which shed 9.25 lakh contracts, and 11,900 strikes, which shed 5.56 lakh contracts.

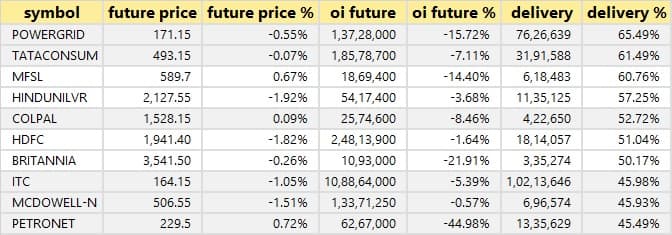

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

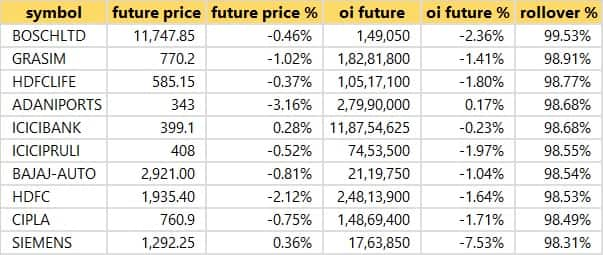

Rollovers

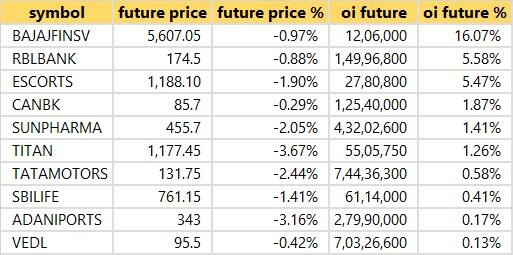

5 stocks saw long build-up

Based on OI future percentage, here are the five stocks in which long build-up was seen.

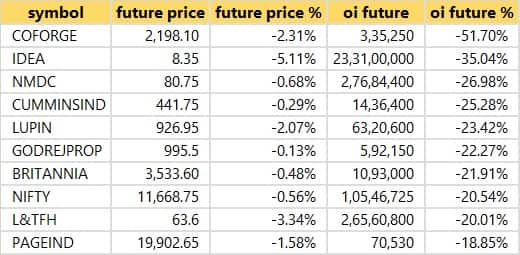

85 stocks saw long unwinding

Based on OI future percentage, here are the top 10 stocks in which long unwinding was seen.

11 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on OI future percentage, here are top 10 stocks in which short build-up was seen.

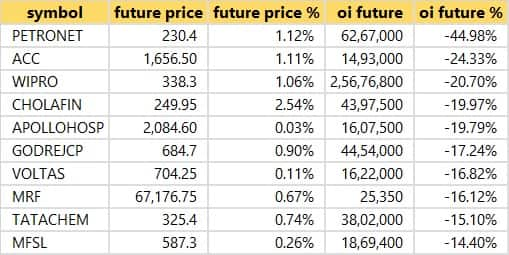

36 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on OI future percentage, here are top 10 stocks in which short-covering was seen.

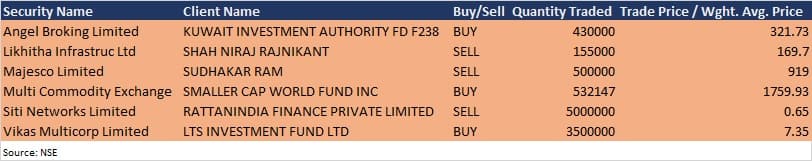

Bulk deals (For more bulk deals, click here)

(For more bulk deals, click here)

Results on October 30

Reliance Industries, IndusInd Bank, Indian Oil Corporation, DLF, LT Foods, Deepak Nitrite, Dhanuka Agritech, Dixon Technologies (India), Edelweiss Financial Services, Emkay Global Financial Services, IFB Industries, Intellect Design Arena, Jindal Steel & Power, Jindal Stainless, Just Dial, Mahindra Lifespace Developers, Mahindra Logistics, Max Financial Services, Motilal Oswal Financial Services, NIIT, Nucleus Software Exports, Quess Corp, RPG Life Sciences, Sundaram-Clayton, UPL, Vakrangee and Zee Media Corporation among 80 companies will declare their quarterly earnings on October 30.

Stocks in the news

Vodafone Idea reported a consolidated loss of Rs 7,218.2 crore in Q2 FY21 against a loss of Rs 25,460 crore. Revenue rose to Rs 10,791.2 crore from Rs 10,659.3 crore QoQ.

TVS Motor Company reported a lower standalone profit of Rs 196.2 crore in Q2 FY21 compared to Rs 255 crore. Revenue rose to Rs 4,605.5 crore from Rs 4,347.8 crore YoY.

HPCL will consider a share buyback on November 4.

Canara Bank reported higher profit at Rs 444.1 crore in Q2 FY21 against Rs 364.9 crore. Net interest income jumped to Rs 6,296 crore from Rs 3,129 crore YoY.

Welspun Corp reported lower consolidated profit at Rs 153.8 crore in Q2 FY21 compared to Rs 161.1 crore. Revenue fell to Rs 1,157.66 crore from Rs 2,262.95 crore YoY.

InterGlobe Aviation (IndiGo) reported a loss of Rs 1,194.8 crore in Q2 FY21 against a loss of Rs 1,062 crore. Revenue dropped to Rs 2,740.9 crore from Rs 8,105 crore YoY.

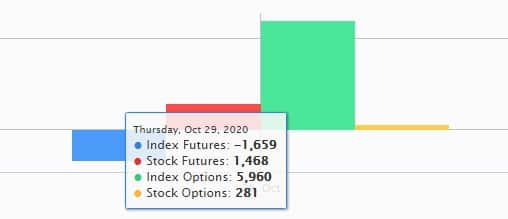

Fund flow

FII and DII dataForeign institutional investors (FIIs) and domestic institutional investors (DIIs) net sold shares worth Rs 420.95 crore and Rs 253.41 crore, respectively, in the Indian equity market on October 29, as per provisional data available on the NSE.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!