The broader indices performed in line with the main indices, which witnessed volatility amid mixed quarterly earnings, continued FII selling, mixed global markets due to uncertain tariff policies by the US President and rate cut by RBI in almost five years.

BSE Smallcap index ended marginally in the green, breaking a 4-week losing streak, while BSE Midcap and Largecap indices ended higher, extending the gains in the second week.

This week, BSE Sensex added 354.23 points or 0.45 percent to finish at 77,860.19, while the Nifty50 index rose 77.8 points or 0.33 percent to close at 23,559.95.

On the sectoral front, BSE FMCG index shed more than 5 percent, BSE Realty Index fell 3.5 percent, BSE Capital Goods index declined 2.4 percent, BSE Power index fell nearly 2 percent. However, BSE Healthcare added 3 percent, BSE Metal index gained nearly 3 percent, BSE Information Technology rose nearly 2 percent.

"This week, equity markets globally and in India absorbed the tariff-related announcement by the US President. Further, the markets also priced in the impact of the Union Budget. Most of the key indices ended the week with flattish to marginal gains. On the sectoral front, the trend remained mixed. BSE FMCG index declined amid profit booking post the Union Budget. BSE Capital Goods and BSE Realty were the other indices that closed the week on a weaker note. Sectoral indices movements tracked the macro headlines and the impact of Q3FY25 results," said Shrikant Chouhan, Head of Equity Research, at Kotak Securities.

"The Q3FY25 earnings season has been broadly in line with our expectations. As expected, the RBI reduced the repo rate by 25 and the focus has shifted to addressing growth concerns, with inflation expected to move toward the 4% mark over the next few months."

"Factors like uncertainties on US President’s trade policies and retaliatory tariffs, a relatively hawkish stance from the Fed and continued capital outflows pose some challenges to the global and domestic equity markets," he added.

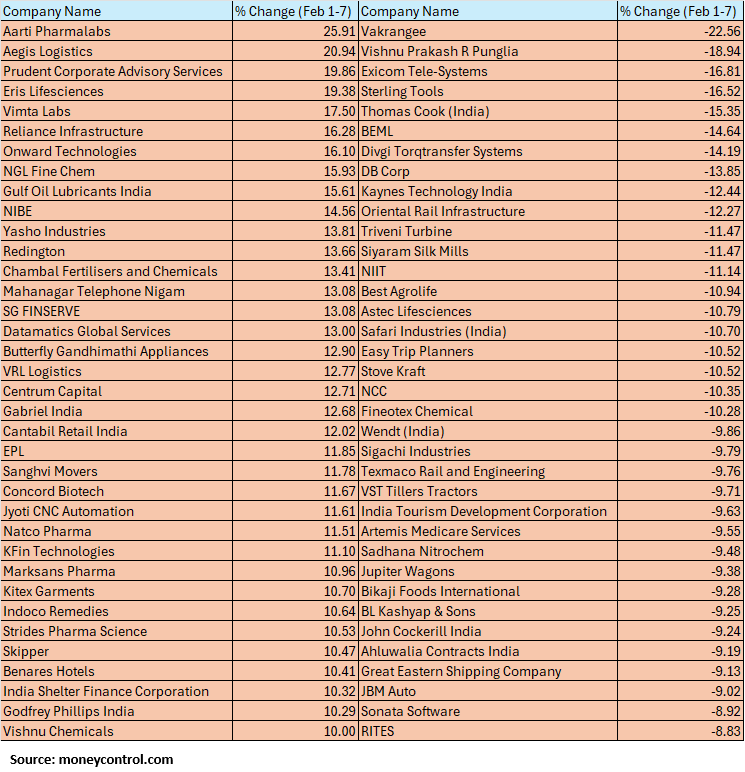

The BSE Small-cap index ended flat. Aarti Pharmalabs, Aegis Logistics, Prudent Corporate Advisory Services, Eris Lifesciences, Vimta Labs, Reliance Infrastructure, Onward Technologies, NGL Fine Chem, Gulf Oil Lubricants India gained between 15-26 percent, while Vakrangee, Vishnu Prakash R Punglia, Exicom Tele-Systems, Sterling Tools, Thomas Cook (India), BEML, Divgi Torqtransfer Systems, DB Corp, Kaynes Technology India, Oriental Rail Infrastructure fell between 12-22 percent.

Going forward, the bullish gap around 23400, followed by the handle low at 23250 (Monday’s low), can serve as crucial support levels. A break below these levels could cause the current up-move to fizzle out, pushing prices back toward 23000 and lower. On the flip side, despite multiple positive triggers, prices struggled at higher levels as markets approached the upper boundary of a Falling Wedge pattern, which we have been tracking for the past few weeks. The lower end of this pattern previously acted as support, while the higher end now serves as a stiff hurdle near the 89 DEMA.

Resistance levels remain at 100-point intervals, with key hurdles at 23800 (Tuesday’s high), 23900 (89 DEMA), 24000 (200 DSMA), and 24250 (previous swing high). A strong buying momentum is needed to surpass these levels; until then, traders should book profits at regular intervals. The market may continue consolidating in the near term within the 23250–23800 range, and a breakout from this zone could reignite momentum.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC SecuritiesThe underlying short-term trend of Nifty is weak with high volatility. The market is now placed at the support of 23500-23400 levels and a sustainable upside bounce from the support could pull Nifty towards 23800 levels again in the near term. However, any breakdown of the support could negate the bullish bet and is likely to bring sharp weakness.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.