The broader indices underperform the main indices and end flat in the holiday-shortened week ended on December 27. This week, BSE Sensex added 657.48 points or 0.84 percent to end at 78,699.07, while the Nifty50 index rose 225.9 points or 0.95 percent to end at 23,813.40.

Among sectors, Nifty Auto and Pharma indices rose more than 2 percent each, the Nifty FMCG index added 1.5 percent, while Nifty Bank and Realty gained 1 percent each. On the other hand, the Nifty Media index shed nearly 2 percent and the Nifty Metal index declined 1 percent.

Foreign Institutional Investors (FIIs) extended their selling during the week, as they sold equities worth Rs 6,322.88 crore, while Domestic Institutional Investors (DII)provided support to the Indian market as they bought equities worth Rs 10,927.73 crore.

For the month till now, FIIs sold equities worth Rs 10,444.10 crore, while DIIs purchased equities worth Rs 27,474.14 crore.

"In the last week, the benchmark indices witnessed lacklustre activity, with the Nifty ending 1 percent higher while the Sensex gained 650 points. During the week, the market experienced non-directional activity. On the downside, it found support near 23650/78100, while profit booking occurred near the 200-day Simple Moving Average (SMA) or 23860/78800," said Amol Athawale, VP- Technical Research, Kotak Securities.

"Technically, a small inside body candle appeared on the weekly charts, and the non-directional activity on the daily and intraday charts indicates indecisiveness between the bulls and the bears," he added.

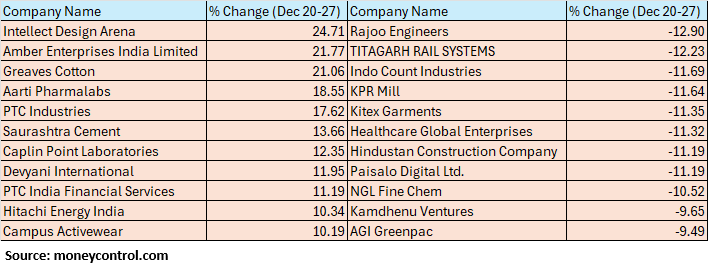

The BSE Small-cap index ended flat. Intellect Design Arena, Amber Enterprises India, Greaves Cotton, Aarti Pharmalabs, PTC Industries, Saurashtra Cement, Caplin Point Laboratories, Devyani International, PTC India Financial Services, Hitachi Energy India, Campus Activewear, Triveni Engineering and Industries added between 10-24 percent.

On the other hand, Rajoo Engineers, Titagarh Rail Systems, Indo Count Industries, KPR Mill, Kitex Garments, Healthcare Global Enterprises, Hindustan Construction Company, Paisalo Digital, NGL Fine Chem lost between 10-13 percent.

The short-term trend of Nifty is slightly positive with range bound action. The market could encounter strong overhead resistance around 24000-24200 levels by next week and any rise up to the hurdles could be a sell-on-rise opportunity. Immediate support is at 23650.

Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment InterrmediatesTechnically, Nifty managed to cross the 200-Days Simple Moving Average (200-DSMA) on the daily chart but failed to sustain above it, forming a doji candle. On the weekly chart, the index has formed an inside bar candlestick pattern, indicating strong demand near 23,500-23,540 zone.

The 200-DSMA is placed around 23,860, which will act as an immediate hurdle for Nifty. A sustainable move above this level could drive the index towards 24,000–24,100.

On the downside, 23,500 remains a key support. In the immediate term, Nifty is expected to consolidate between 23,500 and 23,900, with a breakout on either side defining its next move

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.