The broader indices remain under pressure throughout the week, losing between 3-5 percent and perform in line with the main indices, which posted biggest weekly fall in more than 2 years on global sell-off post Fed meet outcome.

This week, BSE Sensex tumbled 4,091.53 points or 4.98 percent to close at 78,041.59, while the Nifty50 index plunged 1,180.8 points or 4.76 percent to finish at 23,587.50.

All the sectoral indices ended in the red with BSE Power and Metal indices shed nearly 7 percent each, BSE Capital Goods index was down 6 percent, BSE Telecom index slipped 5.7 percent.

During the week, Foreign Institutional Investors (FIIs) sold equities worth Rs 15,828.11 crore, while Domestic Institutional Investors (DII) bought equities worth Rs 11,873.92 crore.

"In the last week, the benchmark indices corrected sharply, with the Nifty ending 4.7 percent lower, while the Sensex was down by 4100 points. Among sectors, Metal and Bank Nifty indices corrected sharply, shed over 5 percent. During the week, the market slipped below the 20-day and 50-day Simple Moving Averages (SMA), and post-breakdown, selling pressure intensified," said Amol Athawale, VP-Technical Research, Kotak Securities:

"Technically, the weekly charts have formed a long bearish candle, and after a long time, the Nifty closed below the 200-day SMA, which is largely negative. We believe that as long as the Nifty remains below the 200-day SMA or 23800/78300, weak sentiment is likely to continue. Below this level, the market could slip to 23400-23200/77500-77000."

"On the other hand, if it rises above 23800/78300, the pullback formation is likely to continue up to 24000/80000. Further upside may also occur, potentially lifting the market up to 24200/80600," he added.

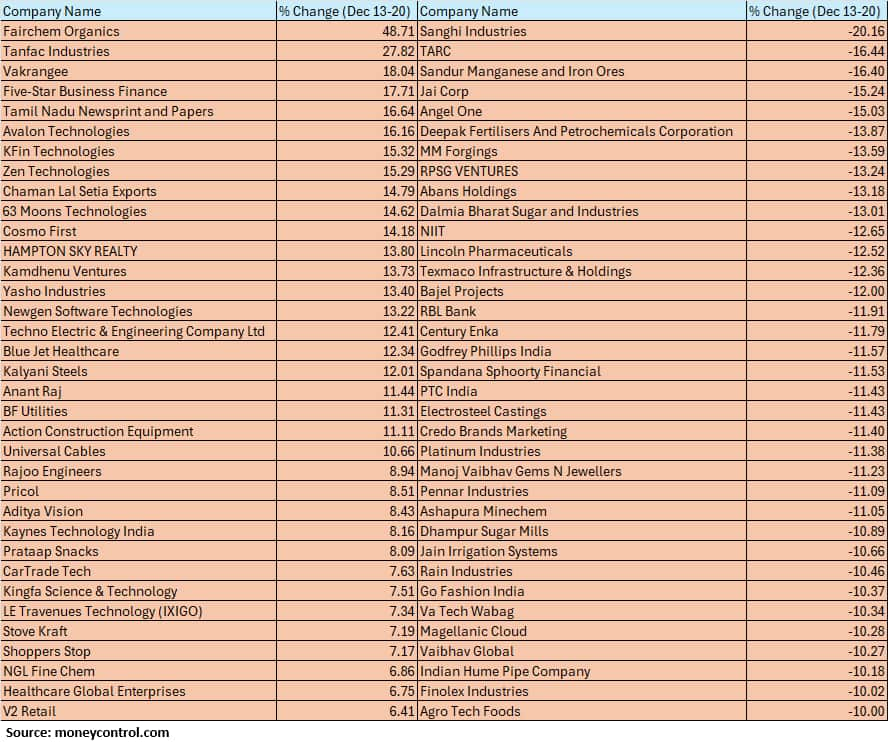

The BSE Small-cap index was down 3 percent. Sanghi Industries, TARC, Sandur Manganese and Iron Ores, Jai Corp, Angel One, Deepak Fertilisers And Petrochemicals Corporation, MM Forgings, RPSG Ventures, Abans Holdings, Dalmia Bharat Sugar and Industries, NIIT, Lincoln Pharmaceuticals, Texmaco Infrastructure & Holdings, Bajel Projects fell between 12-20 percent.

On the other hand, Fairchem Organics, Tanfac Industries, Vakrangee, Five-Star Business Finance, Tamil Nadu Newsprint and Papers, Avalon Technologies, KFin Technologies, Zen Technologies, Chaman Lal Setia Exports, 63 Moons Technologies and Cosmo First rose between 14-48 percent.

From a technical standpoint, as Nifty slipped below the pivotal zone of 200 SMA, the next potential support could be seen around the recent swing low around 23200-23100, while a decisive breach is likely to open further downside towards 22800 in the near period. The formation of a strong Bearish candle on the weekly chart certainly showcases a turnaround move, with bounces to be seen as opportunities to exit longs.

As far as resistance is concerned, 23800-24000 is likely to be seen as an intermediate hurdle, followed by 24150-24300, coinciding with the bearish gap and the cluster of EMAs on the daily charts for the upcoming truncated week.

The weak global cues initiated the downward move, but the follow-up sell-off showcases the bears' eagerness to color the market red ahead of Christmas. The advance declines have strongly turned to favor Bears, and it is advisable to avoid trying to catch the falling knife with anticipation of bottom-fishing. Considering the recent developments, it is advised to approach markets with proper risk management and refrain from taking complacent bets for the time being.

Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment InterrmediatesTechnically, Nifty initially found support near the 200-Days Simple Moving Average (200-DSMA) but owing to strong selling pressure, the index broke the support and formed a large red candle, indicating further weakness. The 200-DSMA is located near 23,830, which will serve as an immediate barrier for the index.

On the downside, major support for the index is located near its previous swing low, which was around 23,260. As long as the index remains below 23,830, weakness will persist, suggesting a sell-on-bounce strategy.

Siddhartha Khemka, Head - Research, Wealth Management, Motilal Oswal Financial ServicesOn Monday, markets will likely react to the US personal consumption expenditures (PCE) data for November, a key indicator for the Fed's future actions. Looking ahead, Indian markets are expected to remain subdued and will closely follow global cues amidst a volatile environment. With the festive season approaching and global markets closed for 2-3 days, including a domestic holiday on December 25, market activity is expected to be low next week.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.