The Dow Theory or the Dow Jones Theory is a concept or a trading approach that was postulated by Charles Dow. The theory forms an important framework on which technical analysis is carried out in the financial markets today.

Dow believed that the stock market as a whole was a reliable measure of overall business conditions within the economy and that by analysing the overall markets: one could accurately gauge those conditions and identify the direction of major market trends and the likely direction of individual stocks.

The Six Principles of the Dow TheoryThe Dow Theory has six principles which when put together gives a complete picture for the markets.

1. The markets discount everythingAbove statement states the obvious fact that everything there is to know about the markets is already reflected on the stock price. Based on this first principle, the price always reflects everything there is to know including expectations on the outcome of any future event such as interest rates decision or a stock’s earnings etc.

Everything including news, facts, data, emotions, and expectations are discounted in price. Everyone (including the fundamental analyst) ponders over each piece of information to make only one decision: to buy or to sell. This single decision affects price and volume.

Based on this principle, the only information excluded is that which is unknowable, such as a massive earthquake& natural calamities.

2. The markets have three trendsDow postulated that the market trends can be classified into three trends.

1. Primary Trend

2. Secondary Trend

3. Minor Trend

Figure 1 – '3 Trends of Bull Market' Example of NIFTY

Figure 1 – '3 Trends of Bull Market' Example of NIFTY

Looking at above chart, Nifty is in primary uptrend and secondary trend is counter against the primary trend indicated by red arrow. At the same time minor trend is shown with blue arrows, which is usually called as noise too.

Charles Dow defined an uptrend as one which has a consistent rising peaks and troughs while a downtrend is determined by falling or lower peaks and troughs.

Each of the three trends is also determined by their timeline. The primary trend usually lasts for more than year, while a secondary trend can be from a few weeks to a few months and finally the minor trend lasts for a few weeks, which are largely noise.These are daily fluctuations in the market.

Between the three trends, Dow notes that it is important to know what the primary trend is as it tends to impact the secondary and minor trends.

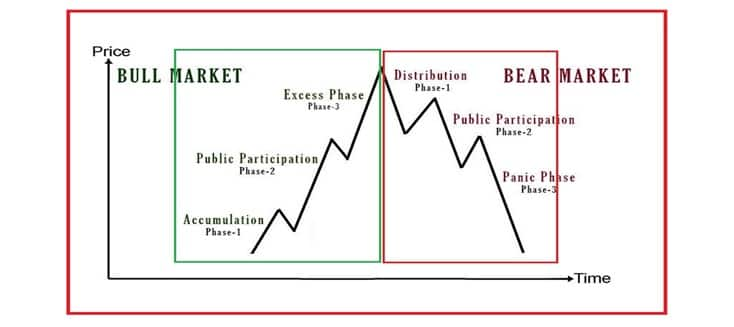

3. The market trends have three phasesDow Theory suggests the markets are made up of three distinct phases, which are self repeating.

Phases of primary trend in bull market

1. Phase1 - Accumulation

2. Phase 2 - Big Move

3. Phase 3 – Excess

Phases of primary trend in bear market

1. Phase 1 - Distribution

2. Phase 2 - Big Move

3. Phase 3 – Despair/Panic

Figure 2 – 3 Phases of Bull Market & Bear Market

Figure 2 – 3 Phases of Bull Market & Bear Market

Figure 3 – ‘3 Phases of BullMarket’ Example of SBI

Figure 3 – ‘3 Phases of BullMarket’ Example of SBI

It is important to note that no two market cycles are the same. For example in the Indian context the bull market of 2003–04 is way different from the bull market of 2013-15. Sometimes the market moves from the accumulation to the distribution phase over a prolonged multi-year period.

On the other hand, the same move from the accumulation to the distribution can happen over a few months. The market participant needs to tune himself to the idea of evaluating markets in the context of different phases, as this sets a stage for developing a view on the market.

4.Indices must confirm each otherIn order for a trend to be established, Dow postulated, indices or market averages must confirm each other. Dow used the two US indices, the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA), however for Indian market; we consider the most important 2 indices Nifty and Bank Nifty.

Thus, the Dow Theory notes that both major benchmark indices must confirm to each other when forming new highs or lows, although they don’t necessarily have to move in a lock step fashion.

We cannot confirm a trend based on just one index. For example the market is said to be bullish only if CNX Nifty, CNX Bank Nifty, etc. all move in the same upward direction which is indicated by red trend line in above chart. It would not be possible to classify markets as bullish, just by the action of CNX Nifty alone.

Charles Dow's indices principle is often said to have formed the basis for convergence and divergence in technical analysis. This is a common phenomenon which is used to capture turning points in prices when the price of a security does not confirm to an oscillator or another index which is shown with white lines & explains about occurrence of divergence around turning point.

5. Volume Must Confirm the TrendThe volumes must confirm along with price. The trend should be supported by volume. In an uptrend the volume must increase as the price rises and should reduce as the price falls.

Figure 5 – Infosys Price & Volume chart

Figure 5 – Infosys Price & Volume chart

The reason for this is that the uptrend shows strength when volume increases because traders are more willing to buy a stock in the belief that the upward momentum will continue. And on the other side, in a downtrend, volume must increase when the price falls and decrease when the price rises.

6. A trend is said to be continuous until a reversal is confirmedAccording to this principle, Dow states that trend is actually one continuous movement and that unless there is some external force acted upon, the trend will not change. If the market is rising, it will more likely continue to rise. If the market is falling, it will more likely continue to fall. If the market is not going anywhere, it will more likely continue to stay within a range.

Conclusion• The markets discount everything, news, results, rumors and all future events.

• Primary trend is interrupted by a secondary reaction which lasts on average of three weeks to a few months.

• A primary trend will pass through three phases, according to the Dow Theory. In a bull market, these are the accumulation phase, the public participation (or big move) phase and the excess phase. In a bear market, they are called the distribution phase, the public participation phase and the panic (or despair) phase.

• Trends persist until a clear reversal occurs, so ‘The trend is your friend’.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.