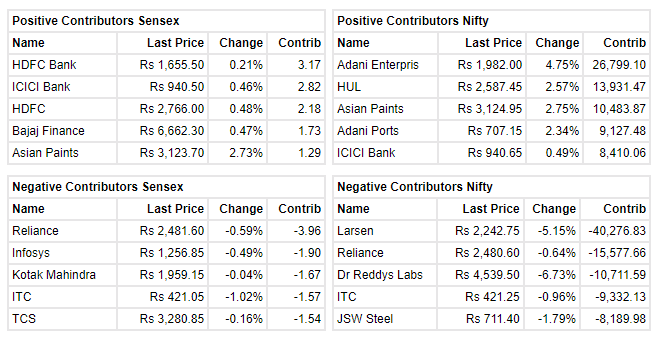

Weak Asian cues dampened the sentiment as local markets remained subdued throughout the trading session before finally edging marginally lower amid selling in metal and capital goods stocks. Investors are probably in a wait-and-watch mode after a sharp spike in recent sessions. Technically, the short term uptrend formation is still positive and the index is consistently forming a higher bottom formation which is also supportive for the bulls. We are of the view that as long as the index is trading above 18200, the uptrend formation Is likely to continue. Above which, the index could move up till 18400-18475. On the flip side, below 18200, the market could slip till 18125-18100.