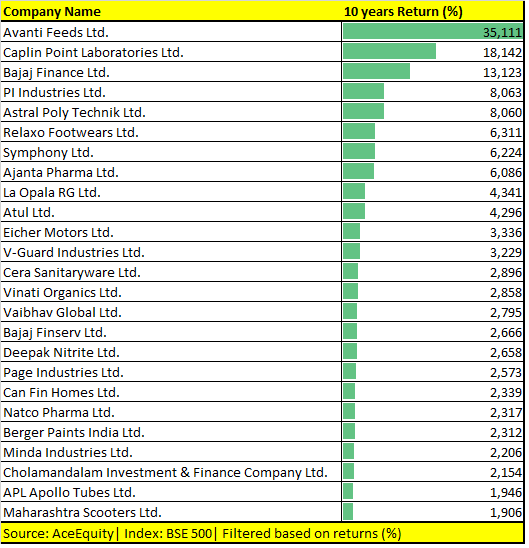

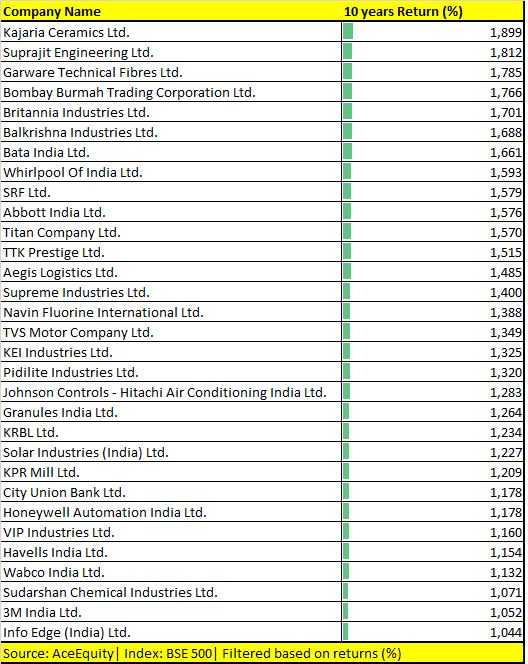

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.” That's a word of wisdom from Warren Buffett. Moneycontrol charted the data for past 10 years for the stocks in the S&P BSE 500 index. More than 50 stocks in the index gave more than 1000 percent, returns while 169 out of 500 rose 100-900 percent in the same period, according to data from AceEquity. On the other hand, only 0.16 percent, or 80 stocks, out of 500 gave negative returns in the last 10 years. So if you are invested in the stocks that have growth potential and a unique business model which could sustain for a decade, multibagger returns can’t be ruled out. As many as 56 stocks from the S&P BSE 500 index gave 1000-35000 percent returns in the last 10 years. The names include

Info Edge,

3M India,

Page Industries, Berger Paints, Eicher Motors, Atul, Ajanta Pharma, Astral Poly, Bajaj Finance, Caplin Point and Avanti Feeds.

Note: The above list contains stocks that are part of the BSE500 index in 2020. It makes sense for investors to hold onto stocks for more than 10 years for long-term wealth creation, but can the same stocks be considered for the next 10 years? Expert View The first and foremost thing which investors have to understand that things change in a decade, and what worked 10 years back might not be even relevant now; hence, portfolio churning is important. Investors should re-balance their portfolio after 10 years and book profits in stocks which have already rallied or the business model is not sustainable. “In the last 10 years, lot of changes have happened in the economy with the service sector now accounting for more than 60% of the GDP. The composition of Indices has undergone a major change in the last 10 years. There has been a shift from old economy to new economy stocks and sectors,” Rusmik Oza, Sr. VP (Head of Fundamental Research-PCG), Kotak Securities told Moneycontrol. “Many non-cyclical sectors and stocks who have the businesses in the B-2-C model can continue to be wealth generators in the next 10 years. Many of the new age growing businesses will have more listed stocks in the next few years and could be the future wealth generators: he said. Businesses like insurance, asset management, retail, healthcare, small finance banks, specialty chemicals, fintech, CRAMs, eCommerce could be wealth-generating sectors in the coming years.

10-years is a long time and the dynamics of wealth creation also change with time. In the last 2 years, the focus of analysts has shifted to the corporate governance aspect of the business amid IL&FS defaults, as well as DHFL. The most important aspect which investors should consider while picking stocks for the long term is the management quality as well as the governance aspect of the business, suggest experts. “Many winners of the last decade still have a lot of potential left and they may continue to perform well in the coming decade too. We see huge potential for many companies in the decade ahead as the benefit of major structural reforms in the last few years is yet to play out on the bigger scale,” Asutosh Mishra, Head of Institutional Research, Ashika Stock Broking told Moneycontrol. “Identifying the winner for the next decade is almost by the same old method, which we are following till now. Some of these are opportunities available to the companies, capabilities of the management team to monetize these into revenue and profit, any specific business moat enjoyed by the company and quality of the promoter and management team,” he said. Additionally, an investor needs to analyse carefully any probable disruption in the business segment in which the company is operating, and transparency in overall business operations are some more important factors which one should analyze. Index Performance: One of the easiest way to pick winners is to bet on index stocks. The last 10 years data suggest that 70 percent of the stocks in the S&P BSE Sensex rose more than 100-13,000 percent in the last 10 years. Stocks which more than doubled investors wealth include names like Bajaj Finance which shot by whopping 13,000 percent, followed by Titan Company (up 1570 percent) and IndusInd Bank which rallied nearly 1,000 percent. Only 3 out of 30 or 10 percent stocks failed to deliver and gave negative returns that include names like NTPC, ONGC, and Tata Steel. “Most of those stocks that have eroded wealth are either having corporate governance issues or are facing structural issues. And, we would recommend avoiding them. The existing investors may also consider getting rid of them in case of any technical bounce,” Ajit Mishra, VP Research, Religare Broking told Moneycontrol. Experts are of the view that index stocks could turn out to be sure short winners, but instead of opting to invest in individual stocks one could also look at Exchange Traded Funds which are more cost-effective. “Index stocks are the apple of FIIs’ eyes. Foreign flows frequently propel these stocks to heights and given sticky nature of FII flows, buying momentum in these names can be long-lasting,” Rajesh Cheruvu, Chief Investment Officer, Validus Wealth told Moneycontrol. “For instance, the recent increase in India’s weight in the MSCI EM Index has spelled out a rally that we have seen in these scrips. One cost-effective way of playing index stocks would be via ETFs which offers exposure to majority of these winners that have been preliminarily screened for investment hygiene by the index manufacturer,” he said. The only problem with index stocks be it Sensex or Nifty or other sectoral indices is that there is constant reshuffle; hence, it might become difficult for investors to do active management of the portfolio. “Indices like Nifty undergo active reshuffling every six months. The share of old economy stocks in Nifty has been consistently going down and the share of service-oriented companies has been going up. Today the top 15 stocks in Nifty-50 account for two-thirds of its market capitalization,” says Oza of Kotak Securities. “Out of these top fifteen companies, twelve are from BFSI, Technology and Consumer-facing sectors. The bottom 15 stocks in the Nifty-50 are mostly from the old economy and account for just ~8% of the Index market capitalization,” he said. Oza further added that investors who don’t have a deep understanding of individual companies should go for Mutual Funds ETFs of Nifty-50 whose performance will mimic that of the Index. Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!