The Nifty IT sector has witnessed significant long buildup in this series, with large-cap stocks showing a strong reversal in momentum. To capture this momentum, Jay Thakkar, Head of Quantitative and Derivative Research at ICICI Securities, recommends taking a bull call spread in Mphasis Ltd.

As of 9:27 am on July 19, shares of Mphasis Ltd were trading at Rs 2,887.20, up by Rs 53.95 or 1.90%.

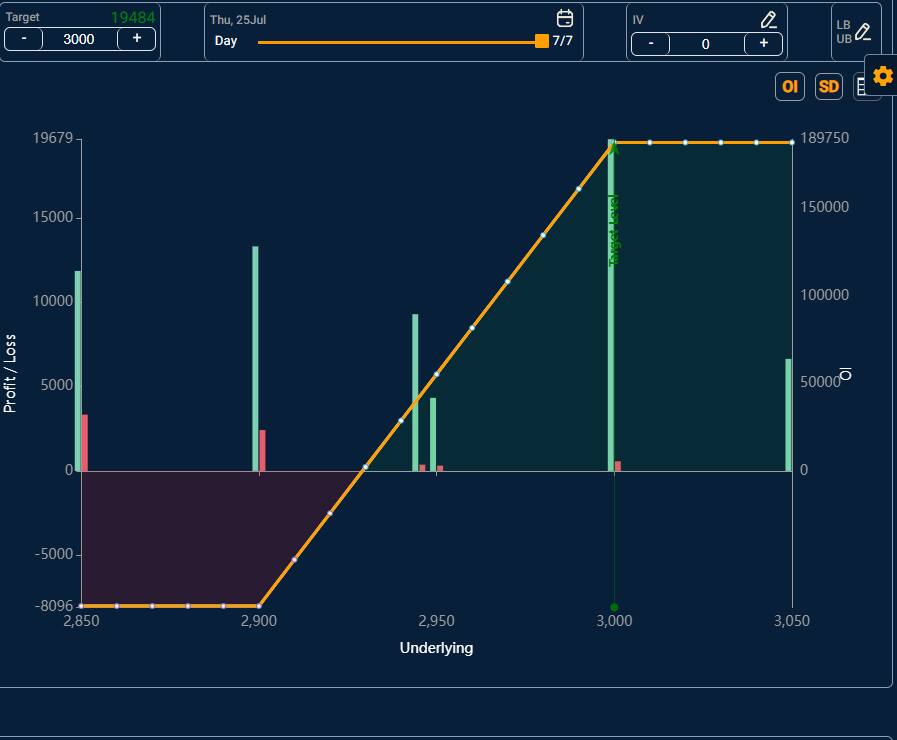

Strategy Recommended by Thakkar: Bull Call Spread in Mphasis LtdStrategyBuy 1 lot of 2900 CE at Rs 48.85Sell 1 lot of 3000 CE at Rs 19.70Total Outflow: 29.15 points, which is the maximum loss if the stock closes below 2900 levels

Maximum Profit: 70.85 points at or above 3000 levels

"Since the cost or outflow is 29.15 points, the breakeven point is 2929.15. The strategy will be profitable at any level between 2929.15 and 3000 and above," said Thakkar.

Thakkar notes that the Nifty IT Index has surpassed its all-time high levels of 39,446, entering a new bullish zone. The momentum indicator MACD has turned to buy mode across all timeframes, from monthly to daily charts. "Now, on the lower side, 39,000 is a very crucial support level. As long as these levels are held, the overall trend will be positive for the sector," said Thakkar.

"For Mphasis, above the 2850 level, the stock doesn’t face significant resistance until the 3000 level. Hence, a bull call spread with strikes at 2900 and 3000 is recommended, offering a risk-to-reward ratio of more than 1:2," he added.

On the derivatives front, Thakkar highlights that the stock is trading well above its max pain and modified max pain levels of 2645 and 2720, respectively. These levels will act as crucial support going forward, whereas there is no major hurdle before the 3000 level. "The PCR is at 1.04, having risen above 1, which is neutral to bullish in the short term. There are strong put additions at lower levels, and significant call unwinding from 2800 to 2900 strikes indicates further short covering in the stock, helping it inch towards the 3000 level," he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisionsDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.