Tata Communications Ltd shares exhibit a bullish engulfing pattern on the technical charts, accompanied by futures long additions, indicating upside potential.

According to Avani Bhatt, Vice President of Derivative Research at JM Financial: "After the recent correction in mid-June from 1926 to 1820, Tata Communications has undergone a 9-day consolidation, taking support from the 50-day EMA on the daily charts. The stock has now closed above the highs of the last two weeks and is well poised to extend the uptrend."

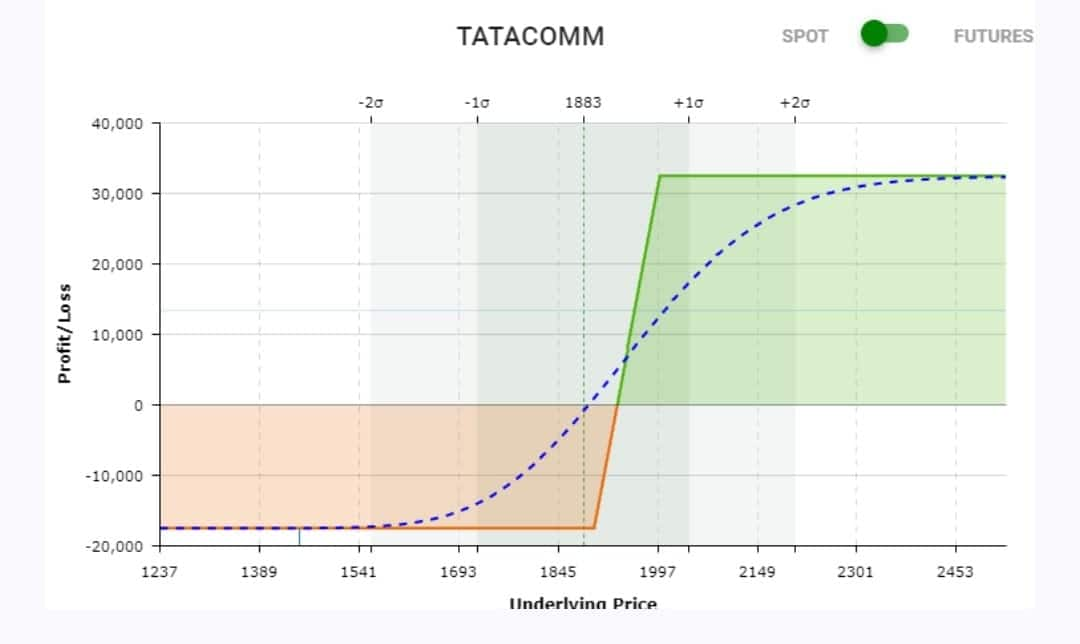

Bhatt recommends a bull call spread strategy to capture the upside potential.

Trade Details: Tata Communications Bull Call Spread

Target Profit: Rs. 16,000

Target Price: Rs 2000/2050

Stop Loss: Rs 1830

"A bullish engulfing pattern has formed on the weekly and daily time frames. July futures witnessed a long addition of nearly 3 percent," said Bhatt.

Bhatt also notes that the options data is positive. Strong open interest (OI) additions at the 1900 PE indicate early signs of a support base formation near the 1900 mark, suggesting a likely move towards targets of Rs 2000-2050 in a short span of time.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.