Analysts are an optimistic bunch. They project hefty earnings per share (EPS) growth for the benchmark Nifty 50 every financial year, only to eat their words soon after.

Since FY12, Nifty earnings estimates have been revised downwards, notes Ambit Capital in a recent report. “Analysis indicates that in any financial year, EPS estimates have, on average, been revised downwards by 16 percent over the last two years, and by 8 percent on average over the last one year,” it said.

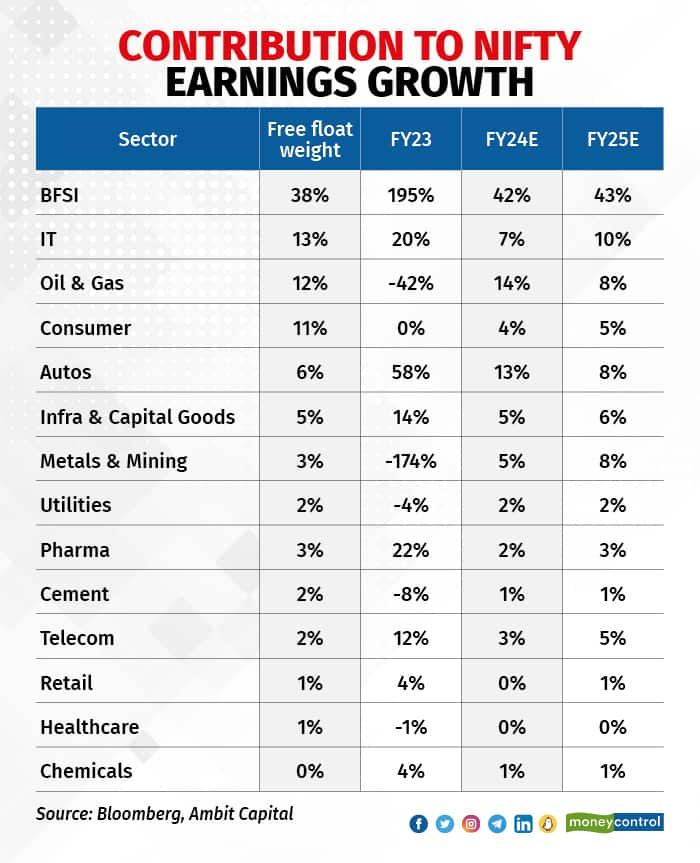

And even if the headline estimates were met, the earnings breadth remained poor. Some sectors, such as financials in FY23, powered the earnings story while sectors like consumer and utilities failed to deliver.

FY24 will be no different, believes Ambit Capital. In fact, more pain might be in store in FY24. Here’s a sector-wise analysis of the same.

Banking, financial services and insurance (BFSI)Buoyed by repo rate hikes, banks saw a significant jump in net interest margins (NIMs) in the year gone by. The banking, financial services, and insurance (BFSI) sector contributed 195 percent to Nifty’s EPS growth ― from Rs 730 in FY22 to Rs 842 in FY23.

According to Ambit Capital, the earnings trajectory will likely change in FY24 with BFSI's contribution to incremental earnings growth tapering to 43 percent. “Loan growth will moderate to 12-14 percent from 15-16 percent as credit growth in corporate stays muted and deposit growth stays anchored at 10 percent,” it said.

Valuation-wise, the firm’s pecking order is Axis Bank, SBI, ICICI Bank, HDFC Bank, and Kotak Bank.

Last year, price hikes helped boost the topline of fast-moving consumer goods (FMCG) companies. Now, as inflation recedes, these companies have to start taking price cuts to help get back volumes.

But balancing the price-volume equation will be tricky, believe analysts. That’s because rural consumers will first prioritise deleveraging themselves, then invest in income-generating assets and eventually shift from unbranded to branded products.

“It would take some time for FMCG companies to revert to normalised volume growth of mid to high single digits,” according to Ambit Capital’s analysts. They have ‘Buy’ ratings only on Britannia and Godrej Consumer in this space.

Check Out: Should you bet on sectors with highest earnings growth? Moneycontrol AlphaITThe second-largest weightage in the index is for Information Technology (IT) services, which have finally started to show cracks. In Q4, all tier-1 IT companies sounded off sluggish growth in BFSI, hi-tech, and telecom segments that make for the big clients.

Top-4 IT EBIT margin could decline 170 basis points (bps) to 20.6 percent over FY22-25E due to backfilling, deal transition, and travel costs, as per the report. Currently, Nifty IT trades at a 13 percent premium to Nifty versus a historical average of 9 percent, which makes the Street even more bearish on the sector.

Oil & gasAfter dragging Nifty earnings by 42 percent in FY23, the oil and gas sector might turn the corner in FY24 on the back of China’s reopening and normalisation of the global energy market.

Ambit Capital expects oil and gas consumption to rise by 5 percent and 9 percent respectively in FY24. The increase in volumes will be accompanied by an improvement in gross marketing margins for oil marketing companies (OMCs) as crude prices trade lower. OMCs’ overall gross marketing margin is expected to be Rs 3.9 per litre in FY24.

AutosAfter a year of strong volume rebound and margin expansion, this sector is set to see moderate numbers. This will be on the back of an elevated base, continued weakness in rural demand, a reversal in the tractor cycle after years of an upswing since FY20, and the introduction of stringent safety regulations like seatbelt reminders, airbags, etc., according to analysts.

Thus, Ambit Capital has ‘Sell’ ratings on Maruti Suzuki and Mahindra & Mahindra.

In conclusionAs these heavyweights on the index stare at an uncertain future, Ambit Capital's FY24 EPS estimate stands at Rs 940 while the consensus estimate is higher at Rs 991.

(Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.